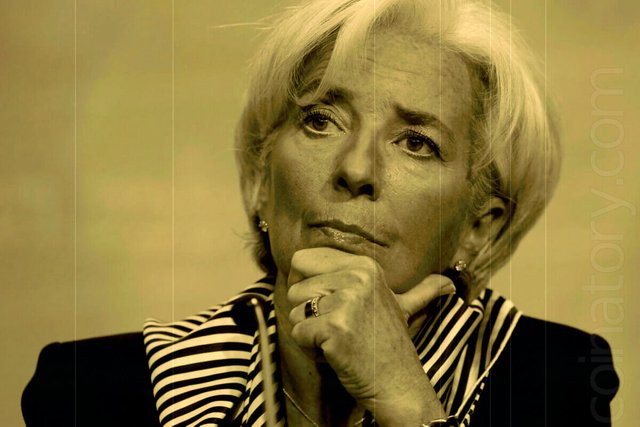

The head of the International Monetary Fund, Christine Lagarde, said that the world is on the verge of another financial crisis. According to her, a source of increased risk is the rapid development of financial technologies, such as digital currencies, and this fact reminds us that the constant evolution of the financial system requires vigilance and vigilance from regulators.

Speaking on the annual conference of the IMF, the head of the fund said that "the global economy is facing serious challenges that threaten with the second Great Depression." In particular, according to her, the organization is concerned about the concentration of banks, the growth of lending by shadow banks in China and the policy of non-intervention with respect to insurance companies and funds managing trillions of dollars in assets.

According to Lagarde, the world national debt, including the public sector and private business, reached a historic high of $ 182 trillion, which is a 60% increase since the 2008 global economic crisis. Governments and companies in developing countries are vulnerable to an increase in the interest rate of the US Federal Reserve, which can trigger a financial drain. Recent crises in Argentina and in Turkey can spread to other developing countries.

In the second chapter of the IMF document with the lengthy title “Global Financial Stability Report. Regulatory Reform 10 Years after the Global Financial Crisis: Looking Back, Looking Forward”, the authors advise regulators to remain attentive to the risks that come from financial technology and cybercrime. They write:

Despite its potential benefits, our knowledge of its potential risks and how they might play out is still developing. Increased cybersecurity risks pose challenges for financial institutions, financial infrastructure, and supervisors. These developments should act as a reminder that the financial system is permanently evolving, and regulators and supervisors must remain vigilant to this evolution and ready to act if needed.Note that Christine Lagarde is optimistic about cryptocurrency. In a personal blog, the head of the IMF wrote that digital currencies "can play a role in how people save money, invest and pay bills." Lagard remarks:

In developing economies, such advances can help secure property rights, increase market confidence and promote investment.Unlike libertarians such as Roger Ver and John McAfee, Christine Lagarde advocates the role of central banks in managing currencies and the financial system. She writes:

If privately issued crypto-assets remain risky and unstable, there may be demand for central banks to provide digital forms of money

Posted from my blog with SteemPress : https://coinatory.com/2018/10/05/head-of-the-imf-the-rapid-development-of-cryptocurrency-a-threat-to-the-financial-system/