The Quest for the Perfect Sample

Most investment advisors will tell you that you should diversify your portfolio. Many statisticians have spent years trying to find the perfect sample size that accurately reflects the population. Some claim that 20 is the "magic number" while others claim 30 or even 50. The problem with this approach is that in searching for the magic number, we tend to forget that these numbers are built on assumptions. Let me explain:

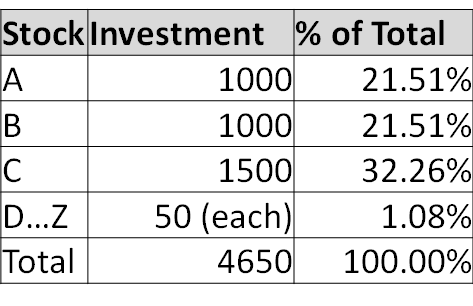

Suppose we have 26 stocks (labeled A-Z). Below represents our holding in each stock. Are we perfectly diversified?

But the magic number is 20...we have 26 stocks!

The magic numbers make certain assumptions. One of them is that you are investing an equal amount in each security. If one stock (stock C) goes bust, almost a third of the portfolio is lost. Does this look like a perfectly diversified portfolio to you?

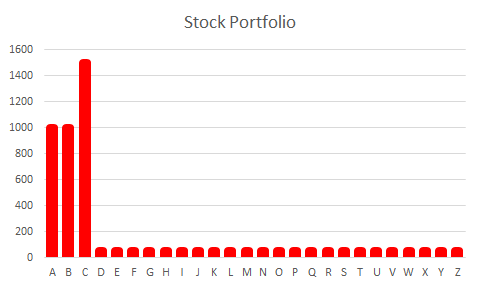

Ok, so we invest an equal amount in each stock and our problem is solved, right?

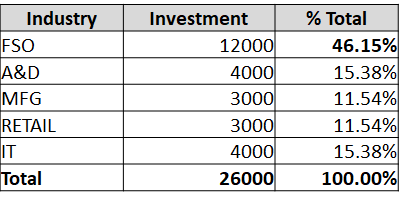

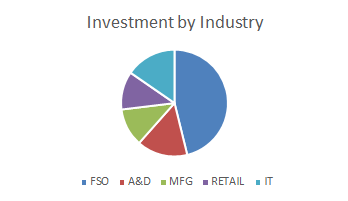

Not quite...let's assume we invest $1,000 in each stock. What happens if we are over-invested in one particular industry?

Even though we invested the same in each stock, if the Financial Services industry falls, we put almost half our portfolio at risk. We're still not diversified.

I see what you're doing here! You won't fool me! We put an equal amount in each stock and then equally distribute by industry and we've solved the problem!

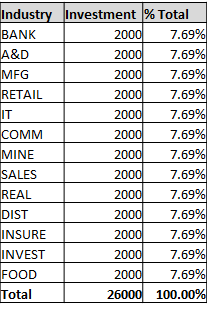

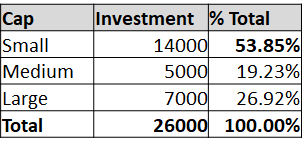

You could say that. However, let's take this example:

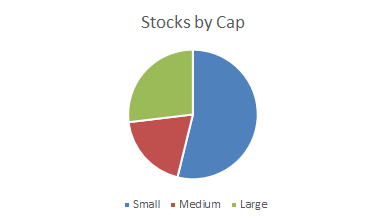

We just invested $2,000 in one stock in thirteen different industries. If we break down our portfolio by cap size (small, medium, large cap stocks), we can see that we are over-invested in small cap stocks. If a market force causes hardship on small cap stocks, our portfolio can take a huge hit.

Ok, I give up, you will find a problem with every solution I come up with...

You're absolutely correct! Next time you look to diversify your assets or try and find the perfect sample size, be cognizant of the fact that these principles make certain assumptions. Anyone that tells you that numbers never lie doesn't fully understand that numbers are meaningless when out of context.

Great advice!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm trying to approach this perfect number, but I'm more around 10 for now. I also like to diversify in material investment, like silver, gold, collection coins. You never know... And gold, for example, is the only thing that never lost value in the history of humanity. So I think it's always good to have some.

For now, I'm mostly invested in gold and in cryptocurrencies, but would you advise me to invest also in some "classic" stocks?

Thanks for the concise article, and the great synthesis. ;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your response @troilo. Yeah, it's good to be invested in some safe assets and some risky assets as well. There's a classic formula if you've ever taken a finance or investing class that Risk=Reward. In order to make big returns, you have to take a lot of risk. I don't think it's the right time at the moment to get into the market since I don't think we've seen the bottom yet (this is just my opinion and in no way financial advice) but one thing I like to do is go for dividend income in at least a portion of my investments. While the capital gains offer tax incentives, the only way you gain money is to reduce your position in an asset. I like to have some passive streams as well that pay me while I hold them. utilities and communications stocks are a relatively safe way to earn some dividend income (again, my opinion and not professional investment advice)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the "not professional investment advice". ;) It's always helpful to get different points of view.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi, I loved your post, thank you very much for sharing the information, I have been following you for a very short time and the truth is that you have read me a lot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for the advice

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your feedback!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

enjoy read this post. that is a good staff.

Great works, I wish you success.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, I appreciate your feedback!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wish you good luck for your investment!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very informative post.

Thanks for shear it.

Happy Steeming.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks! I appreciate your feedback!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Welcome.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@davidllani Thank you for sharing your experience in managing your placements. I found your article very interesting. Best regards

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit