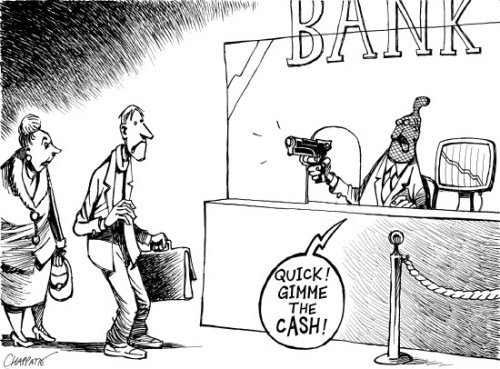

In this article I would like to introduce you to what is known as the bail-in.

What is a bail-in?

A bail-in differs from a bail-out in that instead of a financial institution being saved by external parties they are rescued by making their creditors and depositors take a loss on their holdings. In recent years the bail-out has become a politically difficult idea to sell to the taxpaying public which has made the prospect of a bail-in all the more likely.

How is this possible?

A natural question that arises when the subject of bail-ins is breached is “How is this possible?”. I must admit it doesn’t seem to make a whole lot of sense on the surface but it goes something like this: Once you deposit your money into your checking or savings account that money for all intents and purposes turns into a loan that you just made to the bank and thus the bank now owns that money and can do with it as they see fit (to a certain extent). Essentially your deposit has become unsecured debt for the bank. Think about it like this you have given the bank a credit card with a limit of whatever you have in your account and this can be cashed out at any point by the bank.

When has this happened?

The first bail-in happened after the government of Cyprus decided upon the measure in 2013. We can look at this timeline over at Zero Hedge:

· June 25, 2012: Cyprus formally requests a bailout from the EU.

· November 24, 2012: Cyprus announces it has reached an agreement with the EU the bailout process once Cyprus banks are examined by EU officials (ballpark estimate of capital needed is €17.5 billion).

· February 25, 2013: Democratic Rally candidate Nicos Anastasiades wins Cypriot election defeating his opponent, an anti-austerity Communist.

· March 16 2013: Cyprus announces the terms of its bail-in: a 6.75% confiscation of accounts under €100,000 and 9.9% for accounts larger than €100,000… a bank holiday is announced.

· March 17 2013: emergency session of Parliament to vote on bailout/bail-in is postponed.

· March 18 2013: Bank holiday extended until March 21 2013.

· March 19 2013: Cyprus parliament rejects bail-in bill.

· March 20 2013: Bank holiday extended until March 26 2013.

· March 24 2013: Cash limits of €100 in withdrawals begin for largest banks in Cyprus.

· March 25 2013: Bail-in deal agreed upon. Those depositors with over €100,000 either lose 40% of their money (Bank of Cyprus) or lose 60% (Laiki).

Those with deposits at the Bank of Cyprus lost 40% of their money, traded for shares in the failing bank, and those with deposits at the second largest bank in Cyprus- Laiki Bank lost 60% of their deposits.

Bank Holidays

Another aspect to bail-ins is the bank holiday. This where the government in conjunction with the banks effectively freeze you out of your accounts and disallow you to withdraw your funds from the banks.

FDIC

While it is true that the FDIC insures your deposits up to $250K. It is also true that the Deposit Insurance Fund of the FDIC does not come anywhere close to being able to cover all the deposits in all the banks. It wouldn’t even cover all the deposits in any single major bank which can total a couple of trillion dollars. So with this in mind if a massive financial crisis happens your deposits are at least going to be given a significant haircut straight off the top.

Important things to take away from this

- Once you deposit your money into the bank it becomes their money until you withdraw it.

- You are free to withdraw your money any time you like up until an emergency is declared and a bank holiday is called.

- Once a bank holiday is declared you will lose access to your funds. Once the bank holiday is over you will again have access to whatever is left of your account; post pillaging.

Final Thoughts

Aside from everything contained in this article it is also important to remember that the entire financial structure of the United States and in all likelihood the world is based on the confidence of the consumer. The FDIC exists explicitly to maintain confidence in the system. Any system that requires the confidence of the consumer to be constantly massaged and propped up in order to function properly is not a system that is worth propping up. At a certain point confidence games always come full circle and this is no different. Those that participate and are at the top of the system are also those that will know first when there is a problem. These people are also the same people that will not ever disclose the problem to you as that will erode confidence and perhaps exacerbate the collapse.

As times become less and less certain it becomes more and more important to be vigilant about your hard earned money. The malfeasance of banking institutions can undo what you have worked your whole life for. Keep that in mind.

Additional Reading

Investopedia Definition of Bail-In