The Binance Smart Chain can be a dangerous place. It offers a reprieve from Ethereum’s fees with transactions costing mere pennies but despite it’s centralized nature it has struggled with new platforms getting hacked, rugpulling, scamming, and many other pitfalls.

In order to continue the journey of learning everything I can about cryptocurrency I have decided to wade through the filth and blog about my journey to outline which services ended up being legit and having value and which ones were a total sham. Today let’s talk about ApeSwap!

Introduction/Disclaimer

The purpose of this article is to document my experiences I have had using ApeSwap. I won’t be giving any investment advice and can’t/am not qualified to tell you what you should do with your crypto or your money. All I can do is tell you what my experience was and if I thought it was worth it for me or not.

You should legitimately, outside of the disclaimers/legal mumbo jumbo, be extraordinarily careful with anything to do with cryptocurrency. Do your research, and consult with experts/professionals if in doubt.

The reason I dived into ApeSwap is that I had been experimenting with PancakeSwap to learn about DeFi and yield farming and had 20-30 CAKE in there when CAKE went from $15-18 to $40. I had meant to buy more CAKE but it had got so expensive that when I heard from some reputable sources about ApeSwap I decided to try doing some DeFi on there!

I have no idea if it’s going to be worth it or not yet but the numbers look promising on paper initially (I’ll share them later).

What is ApeSwap?

ApeSwap is an exchange on the Binance Smart Chain. It lets you, like most things with the Binance Smart Chain, do swaps extremely quickly and cheaply. It also offers the standard set of liquidity pooling/staking that most DeFi services offer letting you stake liquidity pairs like BNB/BUSD for 300-400% APY returns as well as non-pair traditional (and safer) staking for a lower % APY.

Basically, ApeSwap lets you exchange tokens on the Binance Smart Chain for cheap as well as yield farm. The native token of the platform is the BANANA, which probably won’t surprise you. If you have used PancakeSwap before it’s almost an exact clone (at least of the interface) but there are some differences we’ll cover later.

It’s the #12th highest volume Decentralized Exchange (DEX) and will almost certainly be larger by the time you read this article. The BANANA token has gone from about 90 cents to $8.50 at time of writing and has been as high as $11.

Determining Legitimacy

There are a ton of PancakeSwap clones out there that look just like ApeSwap. I experimented with one called JaguarSwap the other day that was offering something ridiculous like 4000% APR and most sections of the site were unfinished/not working. These types of clones are common and notorious for “rugpulling” where a bunch of people are lured in and then the whales take all their liquidity out and leave everyone holding the bag on tokens that drop 90%+ in value when all the liquidity vanishes.

In the words of Vitalik Buterin, “the most important scarce resource is legitimacy”. There’s lots of imitators, and frankly there are really only a handful of serious exchanges/liquidity farms out there worth using. More exchanges are coming all the time, some of them even great, but many of them are scams/rugpulls/etc.

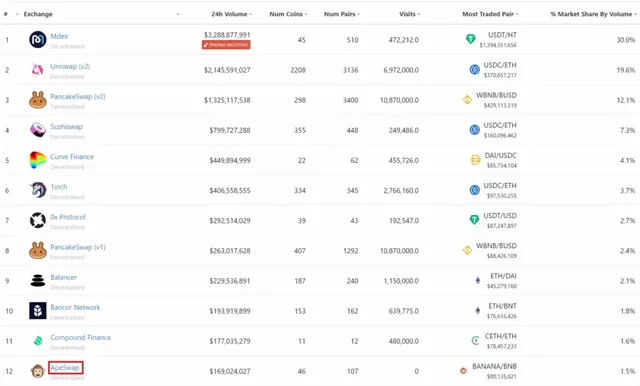

So how can we try to determine legitimacy? The first way is to look at the numbers. How big is the exchange? How much volume is there? Let’s take a look at the CoinGecko DEX chart:

ApeSwap is way up there on the DEX rankings already! It’s already #12 just barely behind Compound in 24 hour volume. We can also see the BANANA/BNB pair on the right has a respectable $80 million dollar 24 hour volume and 1.5% of the entire DEX market share.

This is already a huge exchange to be trading blows with Compound, a well established DeFi platform that has been around for some time. These numbers are impressive and help to establish legitimacy.

The bigger and more established the volumes and rankings are the less likely it is you are going to be dealing with a rugpull or exit scamming. Once exchanges get this big it becomes way more profitable to continue to operate legitimately than try to pull shenanigans since the fee gravy train means the house always wins.

Another thing to note is the number of liquidity pairs. A lot of other PancakeSwap knockoffs have the main “core” liquidity pairs and basically nothing else. ApeSwap has 107 liquidity pairs including for a lot of other yield farming sites like CAKE, NUTS, etc. If you see a liquidity farming site with their token and BNB/BUSD and not much else that is a big red flag. While not nearly as many as PancakeSwap has 107 is a lot of pairs especially compared to other BSC exchanges.

One additional way to determine legitimacy on these PancakeSwap clones is the ICO (initial coin offering) section where people can launch new coins. Are other people actually launching their coin on the platform? ApeSwap has actually launched a few new cryptos on their platform so the answer is yes in this case.

They call it an “Initial Ape Offering” on the platform and there have already been a few. That’s a very good sign of stability. If you see PancakeSwap lookalikes that have a ICO section with nothing in it, under construction, etc. that is another red flag.

Yield Farming

Yield farming on ApeSwap, like most DeFi, offers the highest rates. You combine two tokens together, such as BNB and BANANA, to create a liquidity pair.

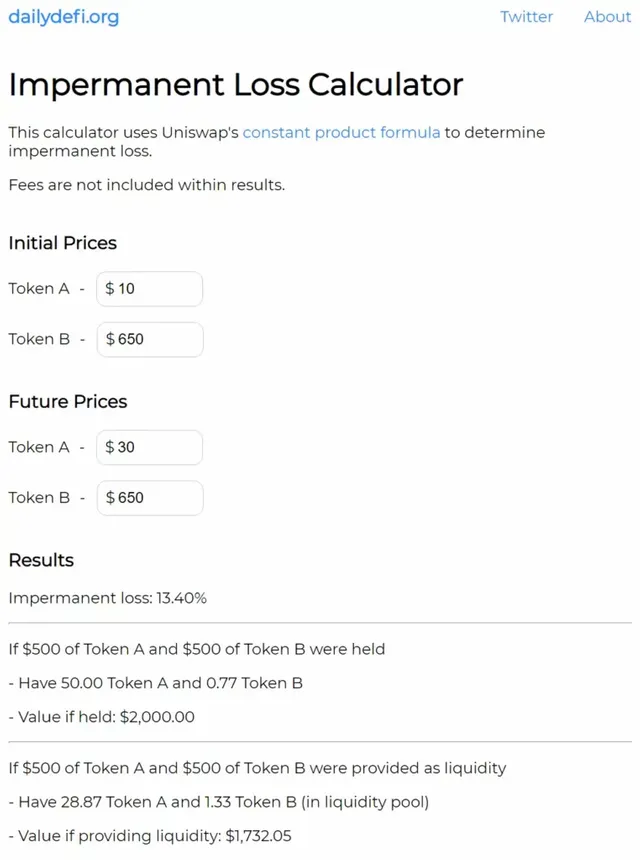

The rates are highest here because you take on the risk of “impermanent loss” with liquidity pairs which means that if the tokens change in value while you have them paired you might not get the same amount of each back unless they’re worth exactly the same as when you “paired” them. This is a difficult concept to wrap your head around but the losses can be as high as 25%.

For an example let’s say you pair BANANA and BNB together in the BANANA/BNB pair when BANANA is $10 each and BNB are $650 each. What if BANANAS rise to $30 each and BNB stays the same? We can plug this into the dailydefi.org Impermanent Loss calculator:

The rates on every DeFi platform I’ve seen way more than make up for the risk of impermanent loss (intentionally) but it’s extremely important to understand how it works before doing this type of yield farming. Use the calculator and do some calculations to understand how this works before farming.

I am currently utilizing the farming and have found it to work well and have not had any problems. If you are trying to earn more bananas this was the fastest way I found on the platform.

Staking Pools

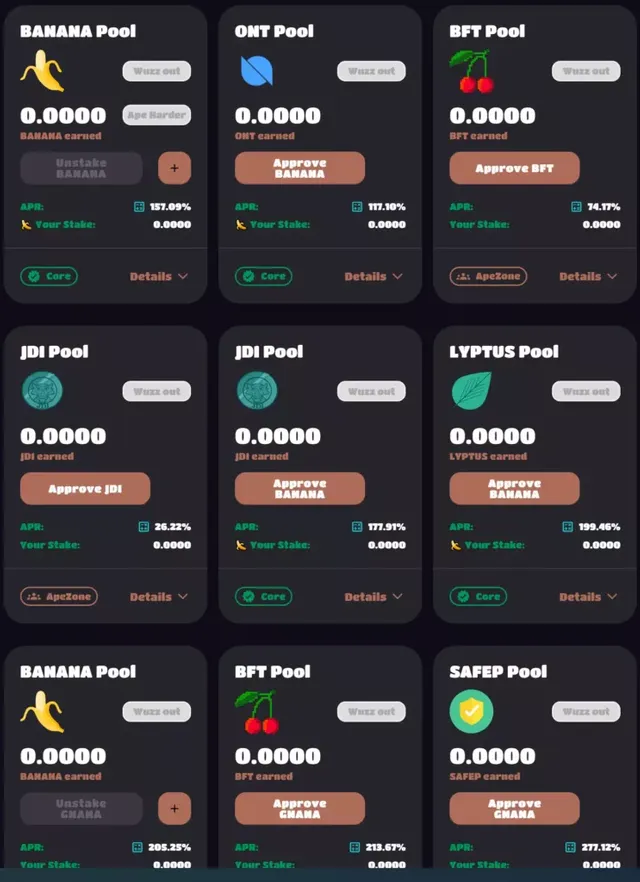

If you don’t want to face the risk of impermanent loss and the complexity of creating liquidity pairs there is a much simpler option available. You can simply stake BANANAs (and a select few other currencies for certain pools) and earn more of them or you can earn other types of currencies as a reward for your BANANA.

Here’s a look at the pools:

You can see the rates are not as high as farming but still quite respectable. It’s very simple with no liquidity pairing or anything. You just click the + and add them and you get the rewards.

I have used the pools but ended up moving everything into farming. They worked great and your balance immediately builds and accumulates just like with farming but I wanted to chase the higher yields.

I may rebalance more later as the rates continue to adjust as more people continue to use the platform and the rates adjust to reflect the market which may make some things look more favorable than they looked when I wrote this article.

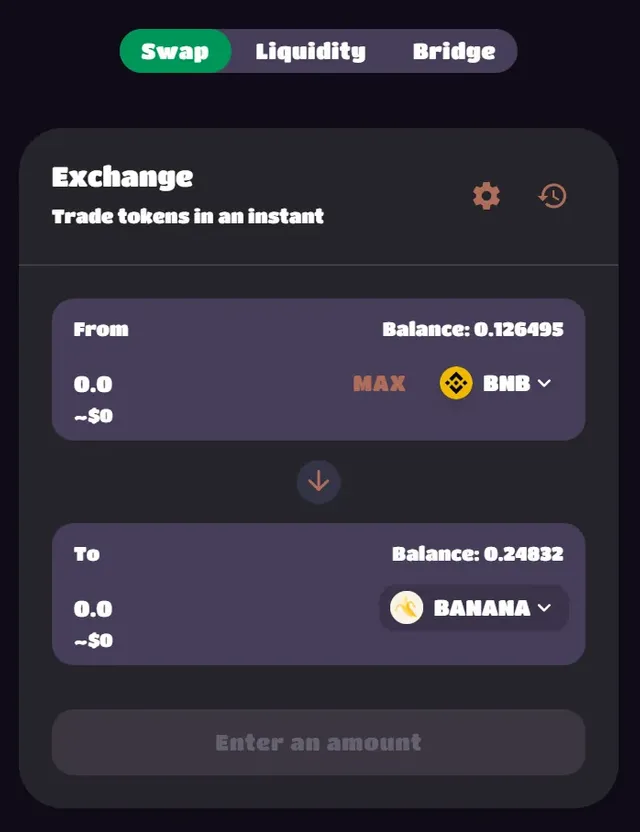

Swapping

Swapping tokens is easy, painless, and cheap. If you’ve ever used any other swapping service it works pretty much exactly the same:

They have a decent number of pairs including a lot of the competitor exchanges like CAKE, NUTS, and more. New pairs are being added all the time as well. Swaps are cheap and fast (< 30 seconds and I want to say like 10-20 cents in fees).

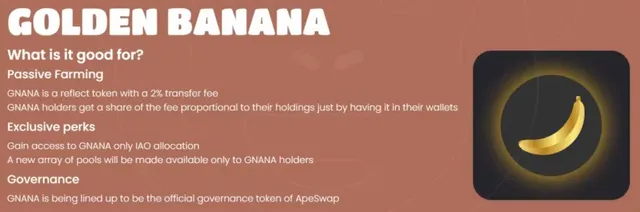

Golden Bananas (GNANA)

This is a really interesting feature that is unique to ApeSwap. Golden bananas are intended to be the governance token for ApeSwap and they have some really interesting properties:

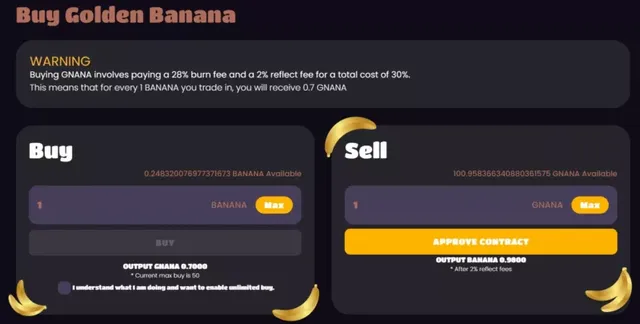

First, to get golden bananas you have to pay a 28% burn fee. You read that correctly, you have to burn 28% of your bananas (and a 2% reflect fee, more on that in a moment) to turn them into golden bananas. This is what it looks like:

This increases the value of the BANANA token by burning them. It also penalizes whales from moving in and out of GNANAs because of the insane 30% loss every time you move into GNANA.

The other awesome thing about GNANA is the 2% reflect fee. What does this mean? That means that when you have GNANA in your wallet (not staked) every time someone does a transaction they pay a 2% reflect fee that goes to all GNANA stakeholders and immediately increases your balance. That’s why my balance has all the extra #s after it. It’s constantly getting 2% fees from all GNANA transactions. I currently have mine unstaked to get the GNANA reflect fees.

You can also stake your GNANA into pools that pay much higher rates than the standard pools. At time of writing the GNANA staking pool for BANANA gave you 205% APR vs. 157% for the standard staking pool.

Eventually as the governance token you will likely be able to use GNANAs to vote on changes to the ApeSwap system like you can with other governance systems in other cryptos and I suspect future perks will continue to be added as well.

Reflect Fee Earnings

I have been running an experiment to see if it’s worth it to leave your GNANA unstaked and earn the 2% reflect fees that are paid out to all GNANA wallet balances (unstaked) for every single GNANA transaction. That means if a heavy hitter buys 1,000,000 GNANA they pay out 2% of that to all GNANA holders. It’s distributed to everyone based on their GNANA balance.

For this experiment I started with about 100 GNANA. Here’s the results so far:

- 12:50am 5/4/21 – 100.83692

- 2:22am 5/4/21 – 100.84059

- 2:40am 5/4/21 – 100.84076

- 2:49am 5/4/21 – 100.84448

- 10:59am 5/4/21 – 100.90658

- 12:23pm 5/4/21 – 100.914823

- 12:48pm 5/4/21 – 100.917236

- 12:56pm 5/4/21 – 100.918348

- 3:12pm 5/4/21 – 100.95683

- 5:46pm 5/4/21 – 100.97162

- 6:07pm 5/4/21 – 100.98609

- 6:40pm 5/4/21 – 100.98848

- 8:08pm 5/4/21 – 100.99374

- 8:29pm 5/4/21 – 100.99448

- 9:10pm 5/4/21 – 100.99519

- 10:28pm 5/4/21 – 101.01053

- 12:06am 5/5/21 – 101.02275

- 12:21am 5/5/21 – 101.02277

- 3:21am 5/5/21 – 101.03115

- 3:47am – 5/5/21 – 101.032747

- 11:40am – 5/5/21 – 101.05644

- 1:40pm – 5/5/21 – 101.06357

- 5:54pm – 5/5/21 – 101.09746

- 7:55pm – 5/5/21 – 101.15425

- 9:28pm – 5/5/21 – 101.16595

- 12:32am – 5/6/21 – 101.17390

- 1:48am – 5/6/21 – 101.17602

The results are pretty interesting. Notice from 2:24am to 2:40am it only went up .0002 that entire time for 18 minutes. There must have been virtually no GNANA activity at this time. I took one last measurement before bed at 2:49 and it had gone up a whole .004 all of the sudden. When I look at my readings during the higher volume periods of the day it’s increasing *much* more quickly on average. This seems like just luck as to whether people are doing big GNANA transactions.

My impression so far is that you’ll probably make more staking your GNANA in the 200%ish BANANA yielding pool right now vs. leaving it in your wallet for the 2% reflect fees but it’s hard to say. There were some pretty big jumps in my balance as I have been tracking it and if the volume continues to increase the 2% reflect fees may easily start passing the BANANA yield.

I’ll keep gathering data!

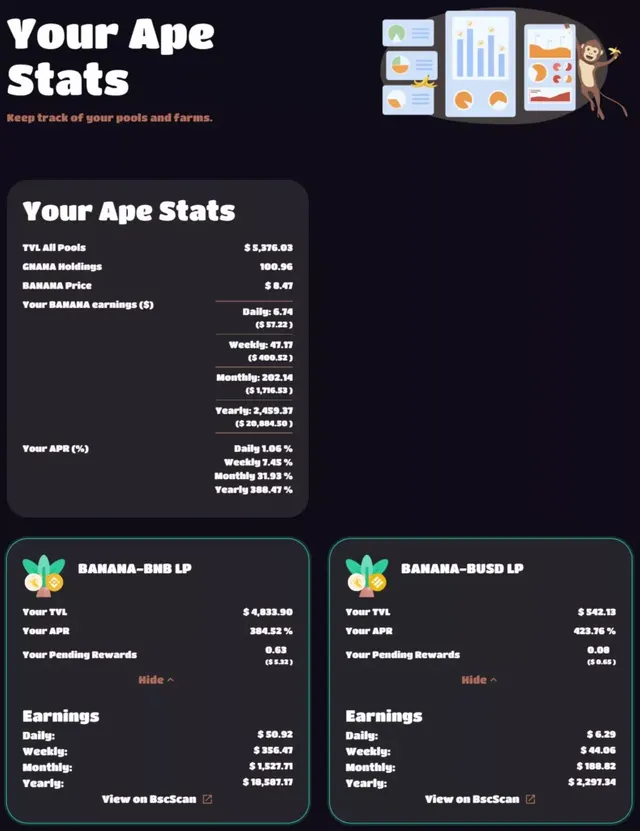

Farming Earnings

The coolest feature ApeSwap is their built in earnings estimates. It has pretty detailed built in calculations for all of your farming/staking pools that break down how much you’ll make per day/week/month/year.

Now, before I show you the numbers, take them with a massive grain of salt. I am. The rates are still quite high and will likely come down quite a bit as more liquidity is established on the exchange. Here we go:

The breakdown into cards for each pool is very nice. ApeSwap actually tells you the difference in earnings you’ll see between a 423% rate like BANANA-BUSD and a 384% rate via this calculator.

Frankly, these earnings are absolutely, wait for it, bananas. Will I still be farming this platform 1 year from now? I don’t know, I kind of doubt it but maybe. But for right now? Yeah, even around $5000 will net you $57 a day right now in the basic BANANA-BNB pool.

That’s absolutely wild performance, but I think the rates will continue to fall and make this less attractive. The further out the timeline the less accurate it likely is. Yesterday it said I was making $29,000/yr but BANANA was over $10 and it is $8.50 right now. At least at time of writing though, it really is making $56 a day in BANANA with about $5300 in liquidity provided. That is outstanding and too good to be true in my opinion but time will tell.

Conclusion

It’s really good so far. Several tokens have already done their initial token offering through ApeSwap and it continues to grow. Yields are great right now but will likely fall as more liquidity comes into the exchange but I’m having a blast doing it at the moment.

As much as I hate to say it, I really have enjoyed working with the Binance Smart Chain despite it’s evil centralized nature. I really am excited for cryptos with cheaper fees than Ethereum that are more decentralized to finally “catch up” and start offering some of these DeFi products on other platforms.

As far as ApeSwap, the web site is fast, works well and has features I love and am annoyed that other platforms don’t have when I use them now (such as the estimated earnings breakdown screen). We will see how their governance token continues to develop (GNANA) and what else they do in the future!

More information

- Website: https://apeswap.finance

- Telegram: https://t.me/ape_swap

- Twitter: https://twitter.com/ape_swap

- Medium: https://ape-swap.medium.com

- Github: https://github.com/ApeSwapFinance

Author : Sinjokubhi

Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=2650089

BSC Address : 0xD713bF8dD102A0274E2043DFb5302fBdAb08Fc0b

#apeswap #banana #bnb #bsc #binancesmartchain #defi #crypto #cryptocurrency