The latest big "thing" in investing is Apple's record setting 1trillion market cap which their stock recently surpassed.

This makes for very good press pieces but I'm not impressed and neither should anyone else be.

This is because, underneath the big impressive numbers, the fundamentals are very very sketchy and I'll be doing a teardown on them in this very article.

Now, first of all, lets start from the bottom - or rather, the top. Here is a chart of Apple's (AAPL) record-breaking bull run.

Now obviously on the face of it this is a very impressive run if you focus purely on the dollar-price performance.

However, if you look at the trade volume indicator highlighted here then you will notice that something else appears to be occuring.

Trade volume is practically drying up.

In fact there is a strong inverse correlation between trade volume and price performance - the opposite of what I would normally expect to see.

This means that hardly anybody is actually trading Apple stocks. So where is the demand that would justify the prices we're seeing?

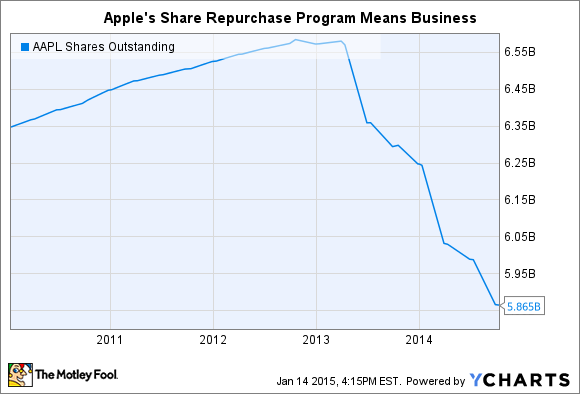

The answer lies in Apple's record-breaking buyback programme.

As we can see here AAPL shares have been repurchased by their parent company in massive quantities since 2013.

Notice how this also seems to correlate to when AAPL trade volume starts to dry up on our price + volume chart?

That's because Apple's share price is being driven primarily by their huge buyback programme which Apple have recently injected over $100billion into.

To clarify, this means that the biggest purchaser of Apple shares... is Apple themselves.

Now lots of people think this is a good thing, but I'm going to take my usual contrarian line and argue against it. Because I believe that this is really just a latter day form of market rigging.

My reasoning for decrying it as market rigging is that ultimately through the buyback program, price becomes detached from any sort of genuine investment sentiment. AAPL does not go up because it creates great stuff which incentivises investors to buy and hold Apple shares... AAPL goes up because Apple buys them... and largely for that reason alone.

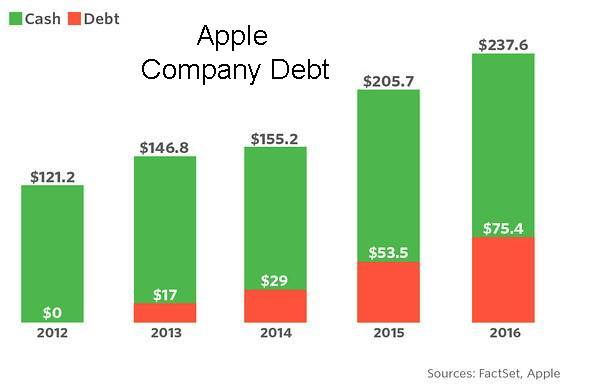

Moreover, we should look at where Apple are actually getting the money for this buyback spree from.

A good percentage of the money allocated to buying back AAPL shares... is actually borrowed from the corporate bond market.

And as we can see Apple's company debt is ballooning.

Apple's company debt has been effectively doubling every year from 2013 - 2016 and has been growing at a rate of between 30-50% ever since - purely to fuel it's massive stock buyback programme.

How is this can possibly be spun as a good thing, in terms of the future of the company, is beyond me. Let alone how this is a boon for stock investors.

No entity can sustain doubling it's debt every couple of years indefinitely.

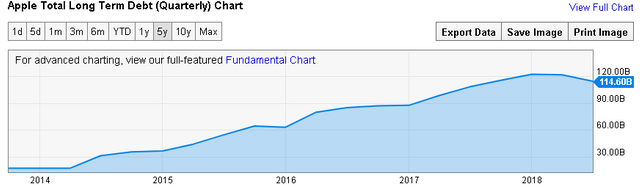

Especially not when we consider how Apple is fuelling it's debt binge - the corporate bond market.

https://www.marketwatch.com/story/apple-issues-7-billion-in-corporate-bonds-2017-05-11

Now consider this, we are in an era of unprecedented low interest rates.

More specifically, we are at the effective end of this era as all central banks seek to raise (I prefer the term "normalise" actually) interest rates.

This will have an enormous impact upon Apple's ability to finance it's very own stock bubble.

Secondly, considering the rate at which Apple's debt pile is growing, then it is reasonable to suggest that sooner or later the credit rating agencies will step in to bring the party to an end. For now, the CRA's have effectively given a "meh" verdict to Apple's policies, but things may change if the trajectory of Apple's debt does not alter.

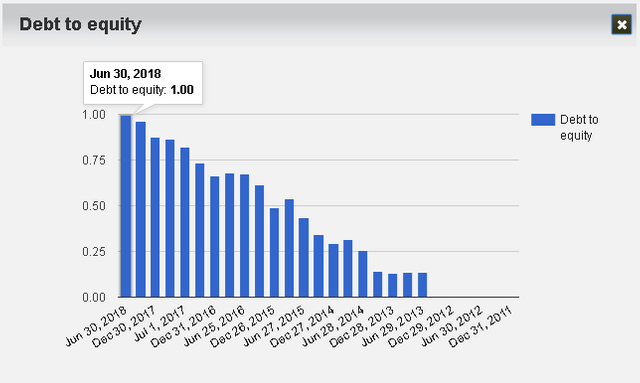

In fact Apple's debt-to-equity ratio reached 1.00 in June of this year.

They are at the tipping point. Half of Apple's financing is now acquired through the corporate bond market. If Apple's trajectory does not alter, then things will only get worse from here.

A well known old-school corporate scam was to basically borrow money and book it as income instead of debt. This was effectively the nature of various frauds perpetrated during the Dotcom boom. I consider Apple's debt-fuelled buyback binge nothing more than a reinvention of this old-school scam. The only difference is that they are booking the debt as stock market valuation and total company valuation. How is this in any way an attractive investment?