Content

In the encryption ecosystem, miners play a very important role. They publish blocks, store ledgers, and provide low-level support for maintaining the operation of the blockchain. At the same time, they are also roles that are not easily perceived by ordinary users.

The most important reason why miners join crypto ecosystems such as Bitcoin or Ethereum is profit. One benefit is the block reward, and the other benefit is the transaction fee. For now, the core income of miners comes from block rewards. However, with the development of the Ethereum ecosystem, especially since the opening of liquid mining, transaction fees on the Ethereum have been increasing day by day and occupying an increasingly important position.

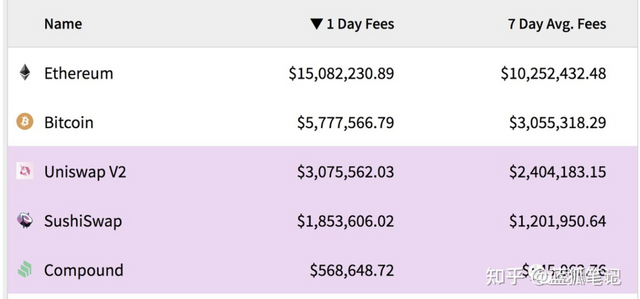

From the figure below, we can see that the current cost of Ethereum is not small. As of the writing of Blue Fox Notes, the cost of that day has reached 15 million US dollars, which is close to 5.5 billion US dollars on an annualized basis, while the current Ethereum rewards are about one day. 11,500 ETH, based on today's price, the daily block reward income is about 15 million US dollars. Taking into account the volatility of fees, the current fee income is not as good as the block reward. Today, the cost of Ethereum is almost close to the cost of the block reward.

(The cost ranking in the encryption field, Ethereum ranks first, from cyptofees)

Although the current block rewards and fee income of Ethereum are very attractive, the competition among miners is also fierce. Are there other opportunities for miners to increase revenue?

With the development of the Ethereum ecosystem, there are more and more opportunities on the chain. These opportunities provide greater opportunities for miners to increase their profits. And Archer DAO can increase revenue for miners.

Archer's "Sweeper" network

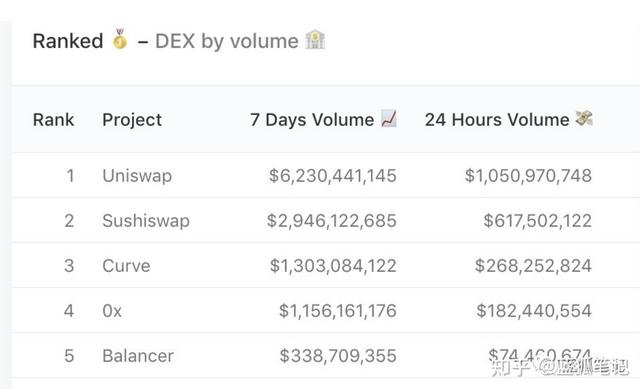

Just mentioned the opportunities on the chain, these opportunities exist in DEX arbitrage trading, loan settlement and other low-risk profit opportunities. As the scale of DEX transactions continues to rise, and the scale of borrowing grows, the opportunities for benefit are also increasing. The trading volume of DEX exceeded 10 billion U.S. dollars in just one week, and it has been rising.

(DEX trading volume ranking, Duneanalytics)

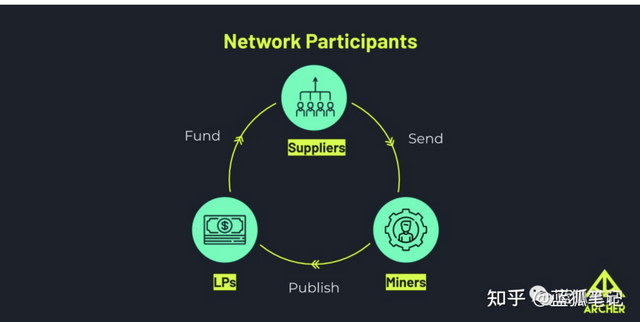

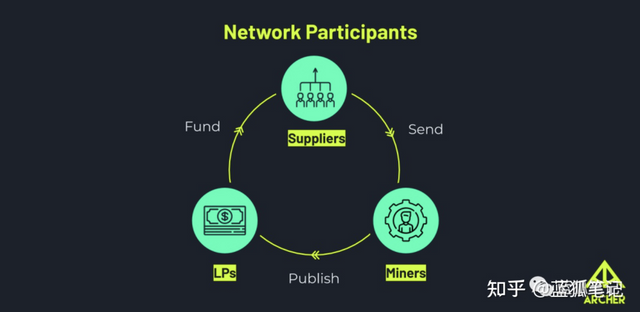

So, how to capture these DEX arbitrage and loan liquidation opportunities? The first question here is: who will discover these opportunities? This involves several roles of Archer DAO: In addition to miners, there are also the role of strategy providers and liquidity providers (LP).

First, the strategic suppliers (suppliers) discover the revenue opportunities on the chain. Suppliers are analysts of opportunities on the chain. They are responsible for discovering and submitting profitable opportunities. The Archer system evaluates these revenue opportunities and sends high-value opportunities to miners, who then package them into blocks and generate revenue.

The income will be shared by the miner and the supplier. As shown below:

(Participant of the Archer Network, Archer DAO)

In this hypothesis, 8eth can be exchanged for 0.112YFI on sushiswap; 0.112YFI can be exchanged for 3,940USDC in cream; and on Uniswap, 3,940USDC can be exchanged for 11.35 ETH. In this arbitrage transaction, a total of 3.35 ETH can be generated, of which 1.675 ETH is distributed to miners and 1.675 ETH is distributed to supplier strategy providers.

From the above cases, we can see that one of the cores of Archer is to turn the role of miners into active participants in the DeFi ecosystem. They participate in DeFi arbitrage activities, not only get block rewards, fee income, but also Obtain higher value in executing transactions. From this point of view, miners have become participants in arbitrage trading and clearing. That is, MEV (Miner Extractable Value) has been increased.

Strategy providers discover opportunities and submit transactions, and miners package these transactions and generate blocks. There is also an important role here, they are liquidity providers. Liquidity providers provide financial support for the realization of the strategy.

Archer's liquidity providers (LP) deposit funds to share arbitrage or liquidation and other benefits. Strategy providers can use these funds for transactions. Because the funds provided by these LPs are pooled together and deposited in multiple tokens, it can make arbitrage and other transactions more efficient. For example, it can reduce the gas cost caused by multiple operations. The existence of multiple token pools can sometimes save the cost of token exchange.

Some people will also say, why not use flash loans, there is basically no cost. However, flash loans have clear requirements for the repayment time of funds, and the funds provided by LP allow longer use time, which can give strategy providers the opportunity to implement more advanced strategies and make transactions more efficient, thereby allowing liquidity, Miners, as well as strategy providers all benefit.

Since DeFi's overall arbitrage and liquidation market space is relatively fixed over a period of time, liquidity also has the problem of diminishing marginal effects. It is not that the more liquidity is better, but the higher the utilization rate, the better. Therefore, subsequent Archer may balance this demand through DAO governance, so as to achieve the best benefit.

Archer's impact on DeFi ecology

Once miners actively participate in arbitrage transactions and clearing transactions, it may bring additional benefits to the DeFi ecosystem. One of them is the more efficient operation of the DeFi system and fewer preemptive transactions.

Since liquidation is more timely and efficient, it can reduce the mortgage rate in markets such as lending; prices between different DEXs are becoming more and more consistent, and tokens have better price discovery; it will also lead to fewer preemptive transactions because of preemptive transactions There are fewer opportunities to submit transactions through private channels.

From this perspective, Archer DAO is not conducive to the current arbitrage robots, which benefit from the first trading of mempool. Archer can unite miners, strategy providers, and liquidity providers to achieve higher returns while also purifying the DeFi environment.

Archer is the DAO organization

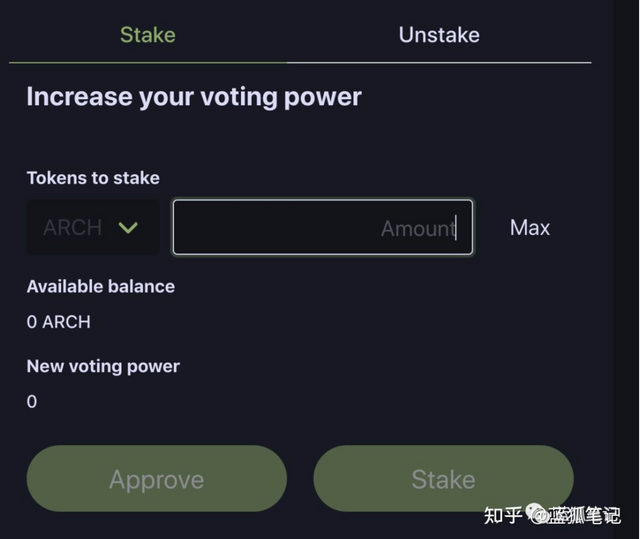

The so-called DAO governance means that Archer does not belong to any single person or organization. It governs through its token ARCH, and users obtain decision-making power over ArcherDAO by pledge ARCH tokens.

(The governance of the Archer network, Archer DAO)

By staking token ARCH, you can vote on the Arhcer network proposal; if you pledge more than 10,000 ARCH tokens, you can enter the private Discord group, and if you pledge more than 20,000 ARCH tokens, you are eligible to propose a new proposal. Judging from the current proposal, Archer DAO has just begun.

ARCH tokens are currently mainly governance tokens and have not yet captured the value of the agreement. It is estimated that with the deepening of DAO governance in the future, this situation may be changed. For example, ARCH can capture a certain percentage of liquidation or arbitrage returns. If it is conducive to the development of the network, the iteration of the token economic mechanism is also possible. Of course, how to develop depends on the decision-making and governance of ARCH token holders.

Archer's cooperation with DeFi ecology

The current DeFi projects that use the Archer system include Sushiswap, Uniswap, Cream, AAVE, Balancer, Compound, mStale, DODO, Curve, Oasis, etc. These DeFi projects use Archer to achieve more timely liquidation, token price discovery, and less Be the first to trade, thereby bringing a better user experience. This is why the DeFi project is willing to cooperate with Archer.

(Collaborator of Archer Network, Archer DAO)

Archer DAO Vs Keeper DAO

Keeper DAO is also DeFi's liquidity network. It also has keeper, which is equivalent to the suppliers on Archer. These keepers use the funds in the pool of liquidity providers to carry out on-chain arbitrage and liquidation to obtain income.

Therefore, in essence, Archer DAO and Keeper DAO are projects on the same track, and they are competing for the proceeds of the clearing and arbitrage market on DeFi. Both are like "scavengers" in nature, and their main goal is to achieve their own high profits, and by the way, provide assistance for the sustainable development of the DeFi system.

However, there are some differences between the two. For example, Archer DAO pulls miners into its network, which is a very clever approach and has advantages in arbitrage and clearing transactions. This means that Archer DAO can not only do what Keeper DAO does, but also has the opportunity to do better. The Keeper DAO uses PGA (Priority Gas Auction) to try to prioritize transactions. In addition, it deposits unused funds provided by liquidity providers in the lending market such as Compound or dydx to obtain more income. This is also smart The practice is worth learning from Archer DAO.

The current market value of Keeper DAO is 10 times that of Archer DAO. Keeper DAO liquidity provider has provided nearly 200 million U.S. dollars in liquidity funds. Due to its early start, Keeper DAO has the leading business. Archer DAO has just started and has potential for growth. How will the two evolve in the future? All this depends on the rhythm and implementation of the two project teams and DAO governance. Some seemingly small differences may show a big gap over time.