More than half of AI-integrated investment teams (56%) report that AI analysis informs rather than determines final investment decisions. A fifth of these teams (20%) report that AI proposes investment decisions, which investment teams can override.

At sector level, managers’ views on the opportunity set differ widely, demonstrating both the structural nature of AI’s impact and the broad dispersion of opportunity for AI-driven alpha generation across asset classes, according to Potential of AI in Investment Report.

A quarter of managers (25%) report using AI to support investment decision-making, broadening inputs to investment risk-management frameworks (21%), and portfolio construction and rebalancing (18%).

In relation to rebalancing, one manager reported the development of a random forest factor-timing model, which adjusts investment strategies based on value and growth factors.

For a minority (10%) - likely to correspond with quantitative or systematic managers and/or strategies - AI executes decisions based on models that are periodically evaluated by investment teams.

Nearly three-quarters of managers (72%) currently using AI expect the integration of gen AI to improve their investment decision-making processes, whereas a fifth (19%) expect it to improve their processes significantly.

Value creation opportunities brought about by AI

Liquidity is also a consideration, as AI can identify liquid assets for efficient buying and selling. However, in illiquid markets like real estate, AI may have limited value-creation potential in the short term, according to Generative AI Insurance Market Trends.

At the asset-class level, managers' expectations around the potential impacts of AI on value creation vary widely.

Among those already using AI, there is a clear consensus on the opportunity set in equities, with 61% of managers seeing very significant or significant prospects for value creation, according to Artificial Intelligence Integration in Investment report.

This is followed by hedge funds at 53% and digital assets at 45%. Additionally, nearly half of managers (47%) see a significant or very significant prospective value-creation opportunity in fixed income.

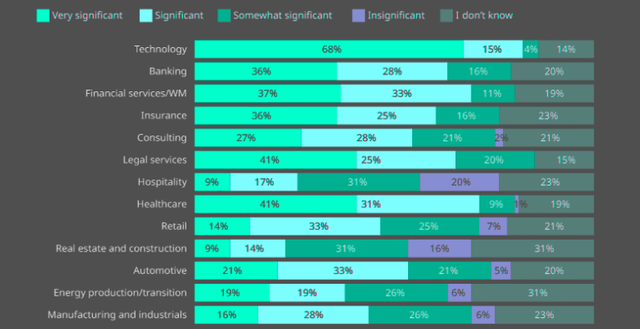

AI-driven opportunities for value creation at the sector level

Managers see significant or very significant value-creation opportunities through the integration of AI across a range of sectors/business lines, but the perceived opportunity in different industries differs significantly, indicating the potential for alpha generation.

Among those already using AI, the technology sector naturally emerges as the most prominent opportunity, viewed as significant or very significant by 83% of managers.

Healthcare (72%); financial services and wealth management (70%); legal services (66%); banking (64%); and insurance (61%) are the next-most-cited significant or very significant areas of opportunity for value creation.

Big picture, the application of AI across investment processes in public and private market contexts looks very different. So far, the use of AI investment processes and broader applications of gen AI are yet to become truly impactful in the private markets space.

From an underlying investment perspective, managers across the venture arena are inherently focused on innovation, be it new software, products or applications.

How significant do companies perceive the value creation opportunities brought about by AI to be in the following business lines?

From an AI-analysis perspective, managers have screen-scraped LinkedIn and other platform sources for many years - to aggregate and sift data on prior companies, and schools, thereby elevating more interesting companies and entrepreneurial talent to speak. These approaches are not generative AI applications, but LLMs.

Managers' integration of AI has ramped up over the past year, but for many, AI integration has been a more-than-three-year journey.

ML, NLP and gen AI are the priority areas for operational investment, though investment in predictive AI also plays out strongly in our findings. Productivity is the name of the game for many managers, but the jury is still out on AI's commercial impacts on both AUM and revenues. On a five-year view, managers expect AI to have a limited impact on headcount, though firms do intend to hire more specific skillsets during this period.