.jpg)

In a land of blockchain Technology and time of cryptocurrency, the destiny of microfinancing rests on the shoulders of a Decentralized Peer to Peer Microfinance Platform or company. His name..... ASSETSTREAM

Decentralization embraces a variety of concepts which must be carefully examined in particular before determining if projects or programs should support the reorganization of financial, administrative or service delivery systems. Decentralization the transfer of authority and responsibility for public functions from the central administration to subordinate or quasi-independent administrative organizations and/or the private sector is a complex multifaceted concept.

In last year, Rowan Atkinson (aka Mr Bean) starred in Johnny English Returns, an action-comedy that ironically portrayed the problem of centralized control. While the movie's plot was a traditional struggle of good vs evil, its villain's pursuit of power, through a novel tool, showcased a flaw in today's world.

A Decentralized Microfinancing

I believe Microfinance is a term most people have heard before. is a service that allows people, in general, unemployed or low-income individuals to access funds.

an individual or group of people who are interested in starting a business, resources and capital will be need. So what do you do? like most Americans, you head to your bank and inquire about a loan or seek out investors. While you may successfully get a traditional loan, if you are considered low-income, the odds are stacked against you. That's where microfinancing comes in. Microfinancing has been defined as a provider of financial services that is available to low-income earners. This type of loan helps aspiring entrepreneurs generate income, build assets, manage risks and meet their household needs, according to Western Union. Decentralized microfinance running through a blockchain network is the next level of microfinancing to the world entirely.

Microfinance a sustainable means of poverty alleviation leading to lasting, holistic development. Financial tools and training empower entrepreneurs to build businesses, support their families and transform their communities.

THE BELOW LINK VIDEO COVERS THE GLOBAL DECENTRALIZED P2P MICROFINANCE PLATFORM

A New Microfinance

AssetStream is a team with expertise and vast experience within the emerging market. By leveraging on the blockchain network, AssetStream aims to reduce poverty and bring financial inclusion by providing unbanked people with access to financial services. expansion to a full P2P network which will include the local communities having access to personal loans. AssetStream aims to create an extensive micro-financing ecosystem and will raise financial awareness among our clients through consulting services and educational materials. We will be able to bring financially excluded people to the new global economy through blockchain.

Better Quality

Few developments can make microfinance both easy and better, and decentralization of microfinance is one of those few developments.

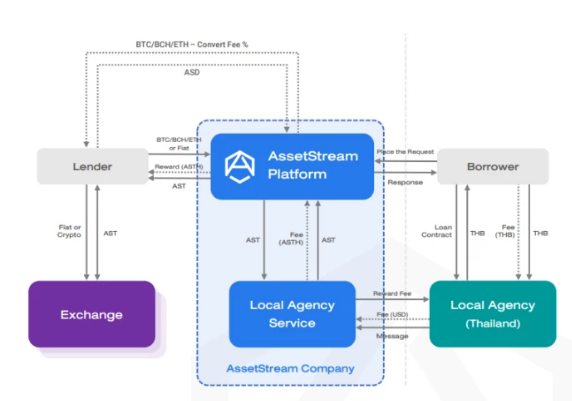

AssetStream will develop the ecosystem that delivers services not only to lenders and borrowers but also to agencies that choose to partner up with us. AssetStream funds will be financed from the purchasing of AST tokens. Within the AssetStream ecosystem, AST will represent a value of 0.01 USD to promote stability. Outside the AssetStream platform, AST prices will be subjected to a fair market value reflected on the secondary exchanges. AssetStream will create their rating criteria and it will be divided into a personal loan and business loan. below is a business modelling of better quality microfinance.

Challenges Faced by Centralized Microfinance

Robust economic growth is not possible without putting in place well focused integrated programs to reduce poverty by empowering the people by increasing their access to the factors of growth, especially loan and credit issues at the micro-level. However, once again, the centralized state of the microfinance market offers troublesome challenges.

Over 1.7 to 2 billion people worldwide do not have a bank account or access to a financial institution in any way. More than 20% of unbanked adults receive wages or government grants in cash, and cash is usually the key payment method in most developing countries. People that belong to this category have no credit history. Even though financial organizations declare that there are fewer unbanked each year, there are still people who remain unbanked preventing them from getting access to basic and daily services such as making payments, access to loans and remittances. A good example would be a foreign worker trying to send money overseas to family or friends. If given better support, providing financial inclusion to more than two billion adults will provide the untapped potential for business profit and economic development.

Collaterals in Banking Sector

Banks nowadays require collateral or prefer to lend cash on cash. Loans requested from

small businesses are usually too small for large financial institutions. There are also

alternatives for securing a loan but the interest rates are too high from eccentric lenders, and traditional p2p lenders will offer a high-interest rate due to private equity. Capital that has a chance to invest in small business credit has been tackled out of the market, and retail investors lack the tools to customize documents to their

risk tolerance. banks have to increase their standards and be cautious about the risk in their portfolio. Small businesses are riskier than their larger counterparts, which makes banks think twice before lending them money. Small businesses usually had more success finding loans at a community bank than at a larger bank, but the number of community banks is decreasing. small business owners are looking for smaller loan amounts, and it doesn’t make sense for banks to provide smaller loans, the cost to underwrite a five hundred thousand loan is essentially the same as for a fifty-thousand loan. Banks earn more interest by focusing on larger loans.

By using blockchain technology for microfinancing, AssetStream will create a layer of trust and security between borrowers and lenders. It is a new standard of the finance business to connect with the individual lender while enabling a new source of finances for small enterprises to fuel global economic growth anywhere.

The Importance of AssetStream Decentralized Microfinance

Lenders will be able to select their loans manually or option for automation for personal loans and be given an option to pick SME loans to participate in. The two options provided to the lenders would be either automatic matching or manual search

Automatic Matching

The lender would set out his requirements, such as the maximum amount he wants to loan out, minimum interest the lender wants to receive, and maximum duration of the loan. the lender can choose the minimum credit rating the borrower needs to have to borrow from the lender. When there is a match of the criteria set by the lender to a specific borrower, the loan will automatically start. The borrower will be able to set up the criteria for his loan by stating the duration of the loan, an interest he is willing to give and the amount he wants to borrow. His credit rating will be listed automatically. The automatic matching feature is currently still under development and will be added in the future.

Manual Search

Borrowers will be able to set up their criteria and list their needs on the AssetStream platform. The lender would be able to look at the criteria listed on the exchange and will pick up the loan of his choice. AssetStream autonomous user interface will enable fast matching, borrowers can tweak their financing request through a point and click or drag and drop. Faster matching will occur when borrowers narrow down their searches based on the availability of parameters and requirements. After a due diligence process, the application will be approved, a smart contract provided to the deal will be generated for the lenders with detailed information, and when the borrower confirms the application, the smart contract gets added into the ledger. Funding will be immediate, as all relevant and required documents are already captured and verified by the proper application team.

Follow this link to register

https://www.assetstream.co/register?ref=Nnzmy

Important Link

website: http://AssetStream.co

bounty thread: https://bitcointalk.org/index.php?topic=5137419.msg50824119#msg50824119

whitepaper: https://www.assetstream.co/AssetStream-Whitepaper.pdf

telegram: https://t.me/AssetStreamBlockchain

facebook: https://web.facebook.com/AssetStream/?_rdc=1&_rdr

Reddit: https://www.reddit.com/r/AssetStreamOfficial/

medium: https://medium.com/@assetstream

Congratulations @clehabs! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit