Introduction of AXL token

Users will be able to make transactions on the AXL platform using the AXL token. For example, in order to participate in an upcoming project through the AXL Launchpad program, users will need to stake AXLs. Fees in AXLs will be requested of projects wishing to be included on our Launchpad website.

Those who hold our tokens will have access to numerous projects launching on our platform as part of the AXL launchpad program. To participate in the IDO pre-sale, all users will be required to own AXL tokens prior to the product launch and at its conclusion. If you're a project owner who wants to advertise your tokens as an IDO, you'll need AXLs to pay the necessary fees. All users who want to take part in the initial dex offering will have to stake as well.

The maximum supply of AXL tokens is 100 billion. The AXL platform will rely on a stable and sustainable tokenomics model that includes burn mechanisms, buyback possibilities, use cases, secondary use cases, a diminishing mint rate, and a smart-contract guided minting process. AXL tokens can be further tailored for each Blockchain they are used on in order to achieve optimal functionality and efficiency.

The AXL token will have the following major features:

Freeze – Freezing AXL tokens prevents them from being accessed or performing certain operations, such as token transfer. The ability to freeze AXL tokens will aid in the preservation of AXL tokenomics, as a set number of tokens will be locked for a period of three years, avoiding AXL token overcirculation.

Burn – In this case, the AXL token will be burned in order to further stabilize and gradually increase the AXL token's valuation. The term "burning" refers to the act of destroying cryptocurrency in order to reduce its total supply. Fees earned from the Dex by repurchase and burn will be used to fund the burn.

Vote – Users can now vote based on the number of AXL tokens in their wallets. This grants them the right and access to vote on various proposals submitted by the AXL team, and votes can be cast more than once or in multiples.

Proposal Creation – If a user has enough AXL tokens in his wallet, there is a feature that allows anyone with enough AXL tokens to make proposals and assist them in participating in certain governance acts or functions.

AXL's characteristics

Interoperability is a feature of the AXL ecosystem.

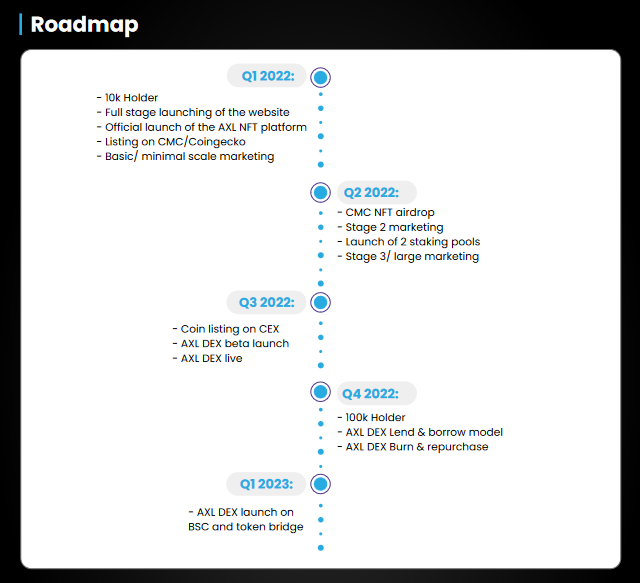

The AXL DEX's strong suit is interoperability. Through the poly network, we will fully support the multi chain smart contract protocol. At the moment, we support the Ethereum chain and the Binance smart chain. Users with crypto assets on these platforms can conduct trades without having to switch from one chain to the other, significantly lowering operational costs. An additional benefit is that if a user believes a particular Blockchain is inefficient, cross chain support allows the individual to easily switch to a different Blockchain that may be faster or have lower transaction fees. Following the completion of staking and the minting of our NFT characters, development of the decentralized exchange will begin in earnest.

Secondary use cases:

AXL tokens will be directly tradable on AXL DEX for other supported tokens, and cross-chain interoperability will allow AXL tokens to be exchanged for AXL tokens on another Blockchain more quickly and cheaply.

Burning, Buybacks, and Burn Mechanisms:

Burning an AXL token would imply the destruction of an AXL token in order to keep the AXL token's value. Buyback and burn programs will help to support the growth and price stability of the token value, making it more appealing to investors. The buyback and burn strategy will also increase liquidity and reduce price volatility. This creates a friendly trading ecosystem, incentivizing long-term growth for the platform and token holders while also helping to stabilize the price of the AXL token. DEX fees and interest earned from the lend & borrow model will be used to purchase and burn AXL/AXLS tokens.

Provisioning for Liquidity

AXL will provide liquidity to market makers. What is the role of a market maker? A market maker is someone who provides assets, in this case cryptocurrency, to a trading platform in order to facilitate trading decentralization. As a form of passive income, a market maker is compensated with fees generated by trades executed on the platform. These assets provided during the specified time period are locked on the platform and cannot be accessed until the specified time period expires. All provided assets are placed in a liquidity pool. As a means of providing liquidity, the provided assets are in the form of token pairs that are locked into smart contracts. The concept of liquidity pools arose from the need to provide circulation, increase liquidity, and prevent token inflation, and is one of the processes required for the establishment of an IDO.

Conclusion

All validated AXL sales are final and non-refundable; you should conduct adequate research into the other risks and costs associated with purchasing, holding, and trading the AXL token. If you live in a region where the purchase and sale of cryptocurrency is prohibited, you may be unable to purchase or hold AXL token or participate in services and programs that require the use of AXL token.

More Details Here:

Website: https://www.axltoken.com/

Twitter: https://twitter.com/axltoken

Telegram Group: https://t.me/Bounties

Instagram: https://www.instagram.com/Axltoken/

Medium: https://axltoken.medium.com/

Author Details:

BCT User Name: cryptohobbs7

BCT Profile Link: https://bitcointalk.org/index.php?action=profile;u=2226573

Telegram User Name: @StapletonBK