Forty Seven Bank will be a fully digital innovative branchless financial institution which complies with all EU directives, Basel III, Financial Conduct Authority (FCA), Prudential Regulation Authority (PRA) and Bank of England requirements.

The bank is going to be specialising in digital finance services by fully supporting cryptocurrencies and traditional fiat currencies. Basic cryptocurrency procedures include sale and purchase features, investment and exchange options and crypto-saving and current accounts. Multi-Asset Account will be one of the featured innovative products oered by Forty Seven Bank – it will allow customers to have access to all their accounts in dierent banks and crypto wallets as well as to their investments and savings in cryptocurrency and fiat equivalents via single application. It will be possible to operate with each asset type accordingly by having only one Multi-Asset Account at Forty Seven Bank.

We will oer unique crypto products like bonds, futures and options. Our goal is to invent such market- place and take the leading position in both short and long-term perspectives. Companies will be able to attract finances via product invented by Forty Seven Bank – Cryptobonds. Cryptobonds will be traded on various exchange platforms (mainly at the one developed by Forty Seven Bank).

Who are we ?

Forty Seven is a unique project built to create a modern universal bank both for users of cryptocurrencies and adherents of the traditional monetary system; a bank that will be acknowledged by international financial organisations; a bank that will correspond to all the requirements of regulators.

A team of professionals from the worlds of banking, finance, and IT with expertise and experience in the creation and licensing of payment systems, and building of electronic financial institutions will work to realise the goals of the project.

Our bank will become the biggest structure that corresponds to all the requirements of regulators and the EU Payment Services Directive 2 (PSD2). We will comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies in order to guard against agents of the “grey” market.

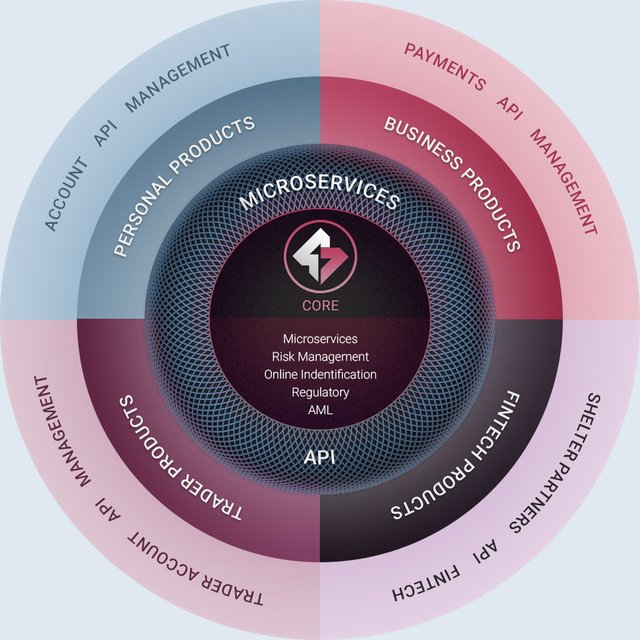

Forty Seven is based on three principles: relevance, convenience, and security. Our specialists use up-to-date technological developments such as blockchain, biometrics, smart contracts, machine learning and many others. If you are interested in the specific details of our establishment and creation of a hitech bank.

Product and services that connect financial worlds

Innovative products for everyone

Multi-currency account. With the help of Forty Seven Bank, people living in European countries can easily open multi-currency accounts with their respective cards tied to it. With the help of this, you can easily manage accounts in European banks using convenient interface of an Internet bank or mobile application. Forty Seven Bank customers will be able to receive and send payments, convert currencies, buy and sell cryptocurrencies. Clients may pay with a card in any service centre, withdraw or transfer funds via ATMs.

An integrated mobile and web-interface to manage accounts opened in any European bank in compliance with the PSD2 directive. On January 13, 2018, PSD2 directive on payment services will enter into force. Its regulations open up new possibilities for the clients. Clients will have access to centralised management of any account opened in person’s name in various EU banks. This solves the problem of bank transfers as well as removes the customer’s need to frequently login into several different financial structures to manage accounts. To use full list of Forty Seven Bank’s services, one needs to enter his European bank account number in the application or on the website and confirm authorised access to it.

Remote identification and authorisation using passport and biometric data. To become a client of Forty Seven, one needs to visit bank’s website or download our application from AppStore. Identification is done online without the need to visit a local bank branch. After a quick procedure, a fully functional account is opened on client’s name and he immediately gets access to modern cryptocurrency services. Client’s payment card is then sent by mail to the address stated in the registration form.

Analytics that helps clients to make right financial decisions by using services of personal manager developed on the basis of machine learning. FortySeven applications with the convenient and easy-to-use interface are ideal for funds management. Based on automatic analysis of monthly expenditures, they can manage personal and family budget guided by hints and advices obtained from a personal assistant.

Cryptocurrency transactions within bank’s application. By using mobile applications, clients will be able to buy and sell any type of digital currency at bank’s internal exchange with low fees and a very negligible waiting time. Conversion in any combination, including ‘cryptocurrency – fiat money’ pair is available. Funds may be transferred to any of the connected accounts or a payment card.

Unique and convenient combination of payment tools. Having a multi-account, clients of Forty Seven Bank will be able to use SWIFT system, credit and debit cards, e-wallets, make secured payments with cryptocurrencies. Clients get access to modern integrated bank service that comprises hi-tech mobile and online-banking, cryptocurrency applications and convenient tool for routine payments, available 24/7 in any part of the world.

Propositions for business

Our products are aimed at targeting small and medium-sized enterprises. These products will allow quick integration of cryptocurrency payments for both online and offline use.

Selection of mechanisms to accept merchant’s payment. Our clients will be able to start accepting money on cryptocurrency accounts, cards, or SWIFT. By using our API, company owners will also be able to transfer them to their company’s account. Ability to accept cryptocurrency payments from buyers in online-stores, on websites, or via mobile applications may be set up using our CMS plugin, SDK or API. The funds transferred will be automatically converted at bank’s internal exchange rate and accredited to organisation’s account in corresponding fiat currency.

Ability to create applications that can manage clients’ accounts and are distributed through Forty Seven Bank’s app store. Representatives of large businesses can develop their own financial tools based on solutions offered by Forty Seven Bank. In compliance with the PSD2 directive, open API provides access to personal mechanisms of account management including making of automatic payments and mass payouts to partners.

Clients’ loyalty management using machine learning. Comprehensive analysis of big data allows predicting clients’ wishes based on their behavioural patterns. Creation and implementation of flexible loyalty programs are done on the verge of rational benefit parameters and implication of clients’ emotional impulses.

Factoring services based on machine learning. Regular collection and analysis of data will allow providing prompt factoring for our clients. Complex AI algorithms will be able to predict the probability of paying out credit taken by a company manager or the need for an organization to receive financial aid.

Escrow-service. Forty Seven Bank provides escrow services by being an intermediate between a buyer and online-platform. We guarantee square deals.

Tools and services for external developers and financial institutions

Forty Seven Bank opens a wide spectrum of possibilities for software developers and partner banks.

Access to API. Open API allows external developer to create modern financial services based on Forty Seven Bank’s infrastructure and internal processes. These applications can both expand the functionality of bank’s products and adjust to needs of other company. Use cases of such applications are limited exclusively to programmers’ vision and preferences of potential clients.

Forty Seven Bank will hold DevDays technological conferences for independent developers and financial institutions. We will invite both experienced developers and new enthusiasts who are interested in use of our bank’s API and creation of new products. We also plan to implement educational programs and courses with priority access For Forty Seven Bank token holders.

We offer the possibility to provide complete set of Forty Seven Bank services under personal brand (white label). With the help of this service, any banking organisation will be able to use our applications and services without the need to modify their existing infrastructure and the need to obtain additional licenses from regulatory organs. All that is going to be done while keeping your own clients and offering them dedicated Forty Seven Bank’s services under personal brand.

Access to bank’s app store as a distribution channel. Forty Seven Bank creates a universal financial app-platform that connects bank’s clients with developers and serves as a user acquisition platform for the latter. We aim to turn this app store into a powerful ecosystem that will grow and develop according to the needs of the market and bank’s customers. This platform will operate on a revenue share basis, meaning that developing popular applications for Forty Seven Bank’s app store might serve as a serious source of income for independent developers.

For More Information :

Website : https://www.fortyseven.io

Whitepaper : https://drive.google.com/file/d/0BzvESRkgX-uDeHc1QjRzbHRBelU/view

Business Model : https://drive.google.com/file/d/0BzvESRkgX-uDbjlsaldCb0F1U0k/view

Ann Thread : https://bitcointalk.org/index.php?topic=2225492

Facebook : https://www.facebook.com/FortySevenBank/

Twitter : https://twitter.com/47foundation

Telegram : https://t.me/thefortyseven

Medium : https://medium.com/@FortySeven47

My Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1273236

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.fortyseven.io/products

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! Providing an excellent opportunity to quickly pay bills, transfer money abroad, as well as make any purchases, the PalmPay payment system has become indispensable for many residents of Africa. The conditions for using the services of this company are very favorable, so many in PalmPay reviews highly rate them and use them with pleasure. It is worth saying that the company is concerned about the reliable protection of its customers’ data, which is why many people trust this payment system.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit