Michael Hartnett chief investment strategist at Bank of America Merrill Lynch warned in the latest research report that the global market is very similar to the 1998 Asian financial crisis and the emerging market crash may spread to Europe through Europe.

Hartnett said that global stock markets (excluding US technology stocks) have fallen by 6.2% so far this year and at least 809 of the 1150 emerging market stocks he has tracked have fallen into a bear market.

But Hartnett is not worried about stocks but bonds. In particular the US BBB investment grade now has an annualized return of -3.2% the second worst since 1988. Hartnett believes that this is the real "canary in the coal mine."

(Note The canary here is a sign of danger. The canary is very sensitive to gas such as gas. Even if there is a very small amount of gas in the air the canary will stop singing. The workers will bring one each time they go down the well. Only the canary is used as a “gas detection indicator” to evacuate in a dangerous situation.)

Now the canary is still singing (at least the US stocks are still rising) mainly because the aftermath of the global QE effect has not been scattered. As Hartnett said “When the central bank buys you should buy it; when the central bank sells...”.

But even with the strong growth rate of 4% in the US economy the tax cut of 1.5 trillion US dollars and the repurchase of 1 trillion US dollars the return of the market in 2018 is still not high.

The reason behind this is no stranger the global excess liquidity is being reversed. According to Hartnett the global central bank purchased 1.6 trillion US dollars of assets in 2016 2.3 trillion in 2017 and only 0.3 trillion in 2018. By 2019 it will turn into a net sales of 0.2 trillion. From January next year global liquidity will experience negative growth.

It is in this context that the world has begun to appear "rolling bear market" (meaning that different sectors industries or assets have taken turns) Hartnett pointed out that this year bitcoin and other digital currencies are the first falling dominoes.

The current downturn has spread to emerging market currencies such as Turkish Lira Venezuela Bolivar Argentine peso Indian Rupee Brazilian Rial and South African Rand. Even more dangerous is that emerging market risks are being passed to Europe and even the US through exchange rates interest rates and corporate profits.

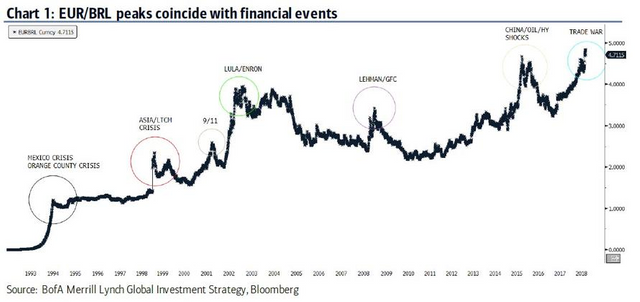

Hartnett once again highlighted his favorite crisis indicator the Brazilian Rial. He believes that the euro has reached a record high against the Brazilian rials which has historically been accompanied by crisis events.

In addition the differentiation of the United States and other markets around the world is also an important signal. This signal has appeared many times in history especially in 1998. Hartnett believes that today's environment is the same as in 1998 in the following five areas

The Fed is in a tight cycle.

The US market is divided with other regions.

The yield curve flattens.

Emerging markets have collapsed.

The leverage quantitative strategy did not perform well.

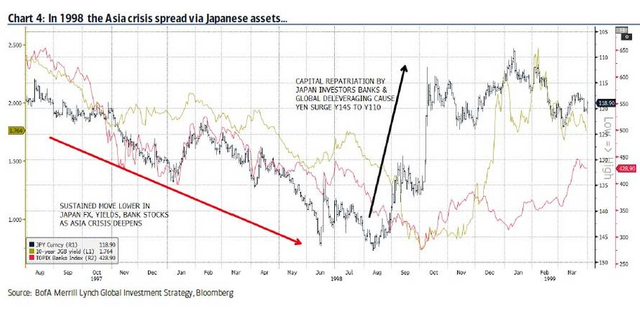

All signals are perfectly matched to 1998 except for the same contagious. In 1998 the crisis in emerging markets spread to Japan through the assets of Japan but this time there seems to be no such indication.

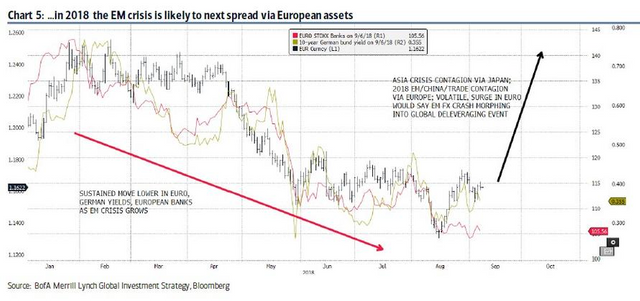

However Hartnett believes that this time Europe may play the role of Japan 20 years ago to promote the spread of the crisis. Today the decline in German overseas orders (down 12% in the past seven months) is a sign of the crisis.

If this inference comes true then the euro will fluctuate sharply this fall which also means that the collapse of emerging markets will turn into a deleveraging storm in the global market.

Hartnett pointed out that European volatility is only the first step in the spread of the crisis and what will happen next is the second step of the debt crisis

Europe's debt-to-GDP ratio is 258% China's 256% emerging markets 194% and US investment-grade bonds have soared from $1.08 trillion in 2008 to $4.93 trillion. We will pay close attention to the spread of credit risk in these over-indebted areas.

Hartnett finally asked four of the eight technology stocks “FAANG BAT” have fallen into the bear market. Will they have survivors when the bubble bursts? Because with the spread of the global crisis investors will eventually lose everything they own and like.