Fusing DeFi and CeFi for Advanced Security, Transparency, and Innovation in Banking

The next-generation financial services provider, Bank11, announced today its innovative banking solution, which seamlessly brings together decentralized (DeFi) and centralized financial solutions (CeFi) into a single platform. This pioneering hybrid model, known as Centralized Decentralized Finance (CeDeFi), aims to revolutionize the traditional banking sphere by providing a user-friendly, secure, and transparent financial ecosystem that leverages the best of both DeFi and CeFi worlds.

Bank11's innovative approach to managing user's funds with a combination of decentralization and centralization offers an array of benefits, including greater control over assets, heightened privacy, optimal transparency, and reduced transaction costs. Moreover, Bank11's exclusive use of its private Proof of Stake (PoS) blockchain provides swift and confidential transactions, along with stringent safeguards to secure user funds.

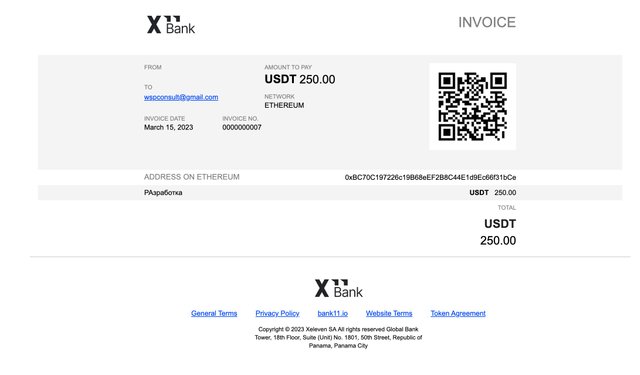

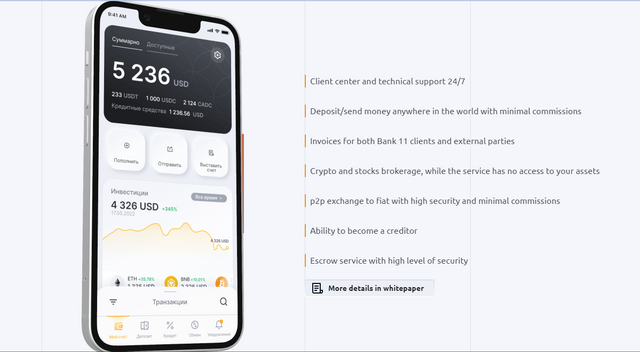

The launch of Bank11 is poised to disrupt the financial industry by providing users with essential banking services such as crypto-backed loans, peer-to-peer lending schemes, and facilitating cryptocurrency transactions. Additionally, unique services include Geocash, a geo-based peer-to-peer exchange, and an escrow service with arbitration support further solidify Bank11's position as the next-gen financial services provider.

Effectively Addressing the Challenges: Looking Deeper into Bank 11 Offerings

In response to the countless challenges eroding customer satisfaction and trust in the banking sector, Bank 11 has devised and executed actionable solutions. These are designed not only to alleviate customary banking woes but also to re-define the banking experience.

The traditional banking system, albeit functional, has often been plagued with complications. Lengthy paperwork, exhaustive compliance, and time-consuming account activation process are just a few among many hindrances that customers face.

Bank 11 aims to shoulder these burdens from the customer, replacing them with convenience and efficiency. With simplified registration processes, minimal documentation, and a customer-centric approach, it's carving a new path in the financial landscape. But, what exactly does Bank 11 bring to the table for its customers?

Experience Digital Transformation with Instant Registration

One of the biggest impediments of the traditional banking system has been its lengthy registration process. Customers often grapple with piles of paperwork and months of untimely processes. Stepping away from this outdated approach, Bank 11 offers instant registration. You no longer need to undergo long waits or incur exorbitant fees. The focus is shifted to swift processes, saving consumers time, money, and stress associated with delays or rejections.

Speeding up Global Transactions with Instant Transfers

Bank 11 also addresses another mammoth issue – delayed transactions in international money transfers. These delays often prove problematic for individuals and businesses alike. Aiming simultaneously for speed and efficiency, Bank 11 ensures that transfers are completed in as little as 30 seconds, drastically reducing the waiting time.

Bucking the Trend of High Rejection Rates through Greater KYC/KYB Compliance

Regions like CIS, Africa, and Asia witness a high account registration failure rate due to convoluted regulations around income or address proof requirements. Bank 11 mitigates this with a thorough yet hassle-free compliance check, simply requiring valid identifying documentation, such as a driver's license or passport. By operating in this transparent manner, Bank 11 manages to offer 0 rejections, building long-lasting relationships with its clientele.

Embracing the Future with Cryptocurrency Support

Often, banks lock horns with digital currencies, and offering support for cryptocurrency has not been a prerogative for almost 99% of them. However, recognizing the rapidly growing crypto industry, Bank 11 acknowledges and supports the usage of these digital assets. Understanding the nuanced requirements of crypto-users, Bank 11 not only supports crypto-acquiring but also integrates browser wallets on websites/stores effortlessly, thus bringing a new dimension to financial transactions.

Rethinking Banking Charges with Low Transaction Fees and No Minimum Deposits

The steep costs associated with banking, including high transaction fees and minimum deposit criteria, often stretch budgets and discourage customers from availing themselves of banking services. Bank 11 feels your pinch and turns it on its head. With lower transaction costs ranging between 1% to only $1 and no prerequisite minimum deposits or service fees, users pay strictly for the transactions made and services utilized.

Ensuring Secure Transactions with Escrow Accompanied by Arbitration

The lack of escrow services in traditional banks often keeps customers on a tightrope. Bank 11 aims to restore the balance with its secure Escrow feature and reinforces it further with Arbitration. By ensuring these transactions are governed by legal agreements secured by smart contracts, Bank 11 lays the foundation for more transparent, lawful, and user-friendly banking operations.

Becoming Immune to Sanctions while Supporting Geo-Cash Services

Operating independently of fiat currency releases Bank 11 from the grips of sanctions that often plague traditional banking. Simultaneously, it introduces a novel Geo-cash service that empowers individuals to exchange their crypto assets for fiat money locally. This innovative approach goes a long way in enhancing customer comfort and convenience regarding transactions.

Invigorating the Lending Experience

Securing loans, especially for non-residents, has always been a daunting process. Bank 11 flips the script by affording users an opportunity to lend their crypto assets to other individuals, thereby opening up a new avenue to generate returns on their holdings.

In essence, Bank 11's proactive and forward-thinking approach is a leap towards a future where banking is no longer a hassle but a convenience that empowers its customers. As we continue to watch the landscape of the banking industry transform, Bank 11 plants its flag as the trailblazer ready to lead the charge towards this brighter future.

Understanding the Mechanism: How Does Bank11 Work?

Bank11 stands out as a stellar example of a hybrid banking system, harmoniously integrating decentralized (DeFi) and centralized financial solutions (CeFi) into one seamless workflow. This CeDeFi approach ensures optimal functionally, maintaining a firm grasp on privacy and user control, while granting the company necessary access to vital customer information for enhanced service. Let's shed some light on how these elements come together to make Bank11 function.

1. Embracing the True Essence of Decentralization

Bank11 operates on a 'protocol-mode' that establishes a foundation firmly rooted in the concept of decentralization. True to this ethos, only the customers have control over their wallets and the funds stored within. This decentralized approach guarantees customers the privacy and exclusivity they need regarding their assets.

2. Enhancing Transparency through Centralized Aspects

While ensuring user control, Bank11 also juxtaposes decentralized processes with centralized ones to create a holistic banking environment. Centralization here entails gathering indispensable customer data, providing crucial insights regarding individual wallets, their ownership, and money stored in them.

3. The Power of Private Blockchain

Bank11 utilizes a unique technology – a Proof of Stake (PoS) blockchain designed for its platform. This mechanism acts as the backbone for swift and confidential transactions, safeguarding user funds with utmost diligence and efficiency. This blend of immediacy and privacy paves the way for secure and seamless transactions.

4. The Driving Force: Transactions and Deposits within the service

At the core of Bank11's operation lies the dual token system, which fuels its liquidity and enables peer-to-peer transactions. As a user, once you commit to engaging with Bank11's financial infrastructure, your funds are safely directed to a multi-signature cold vault smart contract address, after your signature approval. In return, you receive XUSD stablecoin on allocation of your cryptocurrencies to the service's cold vault. This mechanism guarantees privacy and minimal transaction costs stimulating a smooth banking experience.

5. A Balance Struck with CeFi Solutions

Bank11 brings to the table centralized solutions for Know Your Customer (KYC) procedures, redressal of disputes through smart contracts and legal agreements, thereby fortifying its banking paradigm. Each user must bear the responsibility for their operations within the service and with their trading partners. In the event of any fraudulent activity, the guilty party will be held accountable, and any default may lead to legal proceedings.

Bank11's Basic Services:

Bank11 offers a plethora of banking services catered to customers' varied needs. Here are some of the main services provided by Bank11:

- Loan Services Backed by Crypto Assets: Loans secured through your crypto holdings, creating a new avenue for borrowing.

- Peer-to-Peer (P2P) Lending Scheme: A platform facilitating lending transactions directly between individuals or parties, excluding the need for any intermediary, thereby accelerating transactions and cutting costs.

- Crypto-Acquiring: A system to facilitate accepting and processing cryptocurrency transactions.

- Geocash: A unique peer-to-peer exchange facility that allows transactions convenient to the user's geographical location.

- Escrow Services Aided by Arbitration: A safe and secure method for financial transactions where a third-party arbitrator oversees transactions, ensuring fairness and transparency.

In Conclusion

The banking industry needed a fresh perspective and Bank 11 has provided just that - with promising potentials and future-forward solutions. It's more than just a banking platform. It's a financial revolution that aims to put the power back into the hands of the customers. A financial venture where convenience, speed, security, and affordability meet innovation.

As we move towards an increasingly digital future, Bank 11 positions itself as a significant player with its powerful blend of traditional networks and digital solutions. The cornerstone of its success lies in the diversified sources of revenue along with customer-centered services. Bank 11's eco-system is not just an answer to the financial needs of today, but rather a proactive step towards the financial dynamics of tomorrow. It offers more than sheer banking service; it transforms customers into co-investors.

To get more updates on Bank11 and join the community, follow these links:

- WEBSITE: Visit the official Bank11 website to access comprehensive information about the platform and its services.

- TWITTER: Stay up-to-date with the latest announcements and engage with the community on Bank11's Twitter account.

- TELEGRAM: Join the Bank11 Telegram group to connect directly with fellow users and the team members.

- TELEGRAM CHANNEL: Subscribe to the Bank11 Telegram channel for exclusive news and updates from the team.

- PROJECT ROADMAP: Understand Bank11's future plans and milestones by reviewing their project roadmap.

Remember to keep an eye on these platforms for fresh information regarding Bank11, making sure you never miss out on important news and community events.

Author

This post is authored by a user under the forum username: Cobalt Emerald.

You can view my profile on the forum and learn more about their posts and contributions using this Profile Link.

TRON Wallet Address as: TP1ZokD3gSchArdMRz2645QiXAuRkRhsEu.