Numbers show that lop-sided growth continues, with industry continuing to languish, while consumption-based lending remains strong and the services sector is doing well

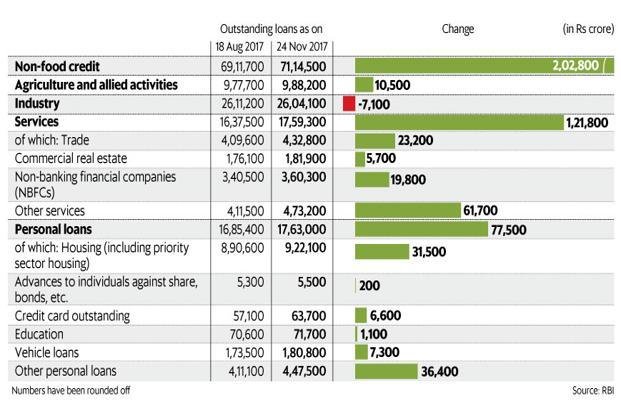

To answer that question, comparing bank credit growth with a year ago would be the wrong thing to do, because a year ago was the time of demonetisation. Instead, the accompanying chart looks at bank credit growth over different sectors over three months or so, between 18 August and 24 November 2017, the latest date for which numbers relating to sectors are available.

The chart shows that non-food credit growth was 2.9% over the three-month period, which isn’t much, but does show a pick-up. Unfortunately, bank credit to industry continued to contract. 60% of the growth in outstanding credit over the period was to the services sector. Another 38% went to personal loans. Growth in housing loans was lower than for “other personal loans”.

The numbers show that lop-sided growth continues, with industry continuing to languish, while consumption-based lending remains strong and the services sector is doing well.

https://steemit.com/steemit/@luzclaritareyes/i-am-new-to-steemit-luz-clarita-reyes-introduce-your-self

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @kumar2013! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.livemint.com/Money/JxmQpzHTdv5TFHFPADLQxN/Is-bank-credit-picking-up.html

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit