In June 2017, the Philippines was shaken by the news of a major system glitch in the Bank of the Philippine Islands (BPI). There were a lot of complaints of unauthorized withdrawals or information that their balance doubled. Some were even shocked that their 10, 000 peso increased to a million or vice versa.

As it created a buzz nationwide, this prompted the BPI president to issue a statement which said that these are only mispostings and that there are no lost or gained money. He added that the ”bank's system picked up the wrong files or transactions when it ran a batch process.” He promised that the issue will be resolved within the day of the issue. Immediately after that, they posted job vacancies for security analysts and jobs with the same description. They may have fired them, we thought.

Fast forward to this day, JC experienced a similar scenario. Only, we could not verify if it’s just a *misposting” or the money really was withdrawn without authorization or the machine where he withdrew the money ate it.

On the midnight of 2018 February 1, after our usual DotA 2 dates, he withdrew 9,400 from a Bank of Commerce ATM because there are no near BPI ATMs. The 9,000 is for my dental surgery which my sister transferred to him because they have the same bank. In the first try, the ATM machine lagged so he canceled the transaction. We initially thought that maybe it lagged because we chose the option where the machine should print a receipt. On the second try, he successfully withdrew without receipt. In the fear that the ATM machine ate money, he checked his remaining balance online.

To our horror, he lost around 6,400. If it’s because of the failed 1st try, the lost money should be 9, 400 not 6,400.

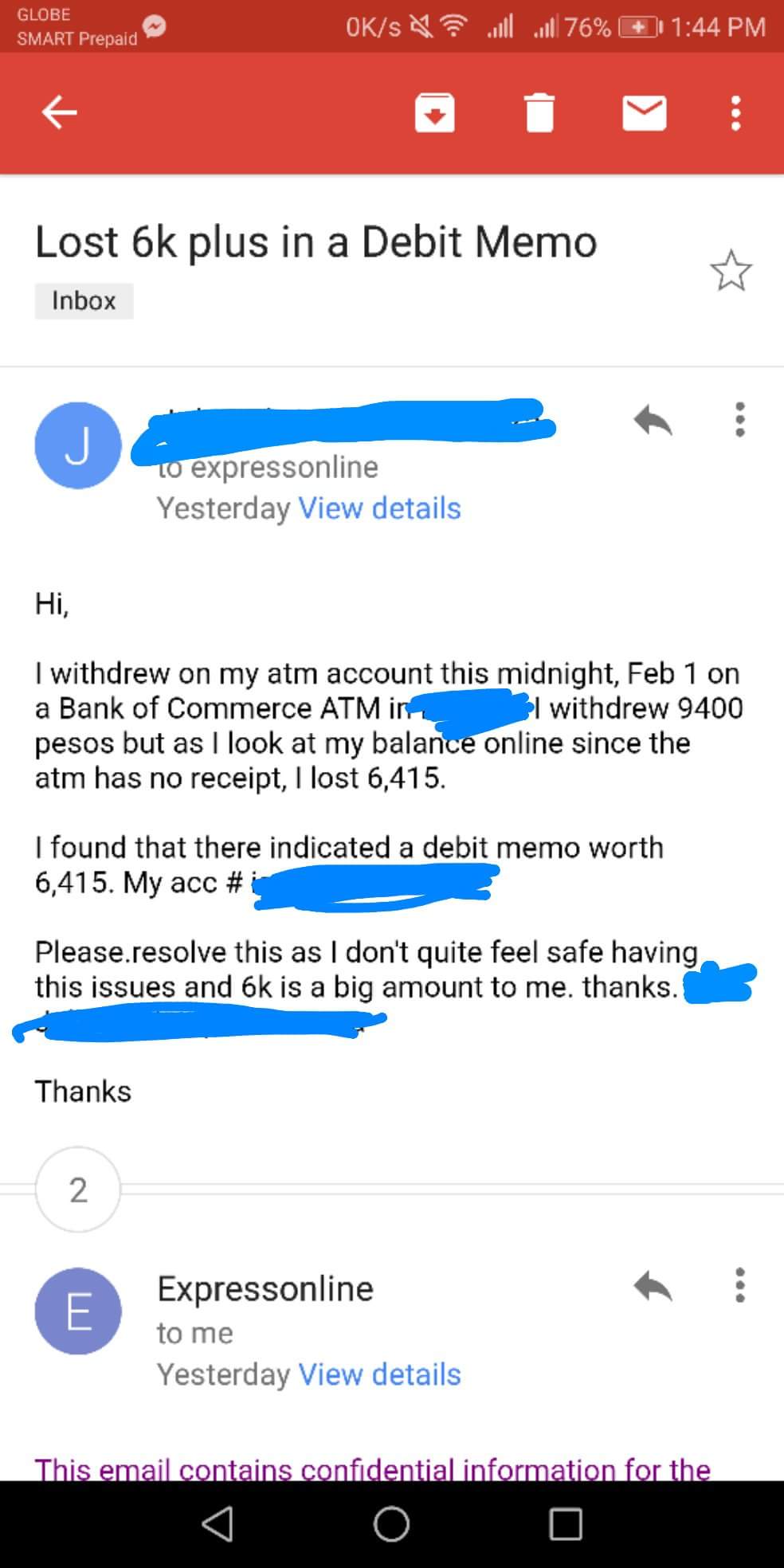

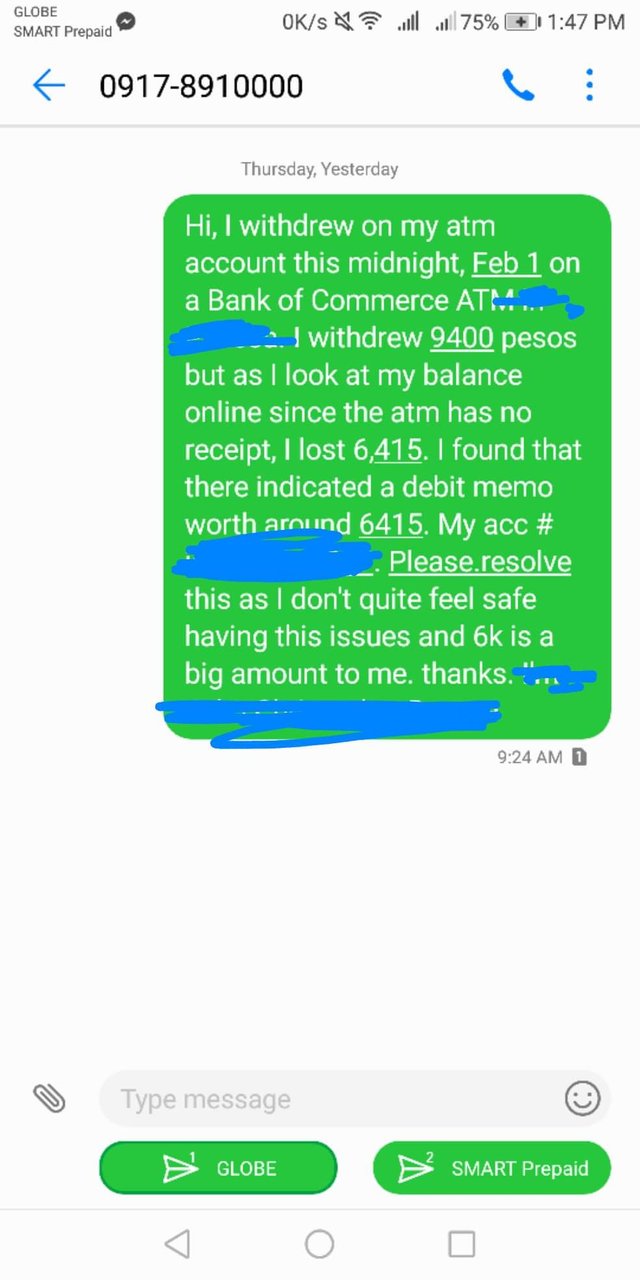

First thing in the morning, I tried to call their hotline but it’s not coming through since all the lines were busy according to the operator. Next, he sent an email and a text to BPI regarding his concern.

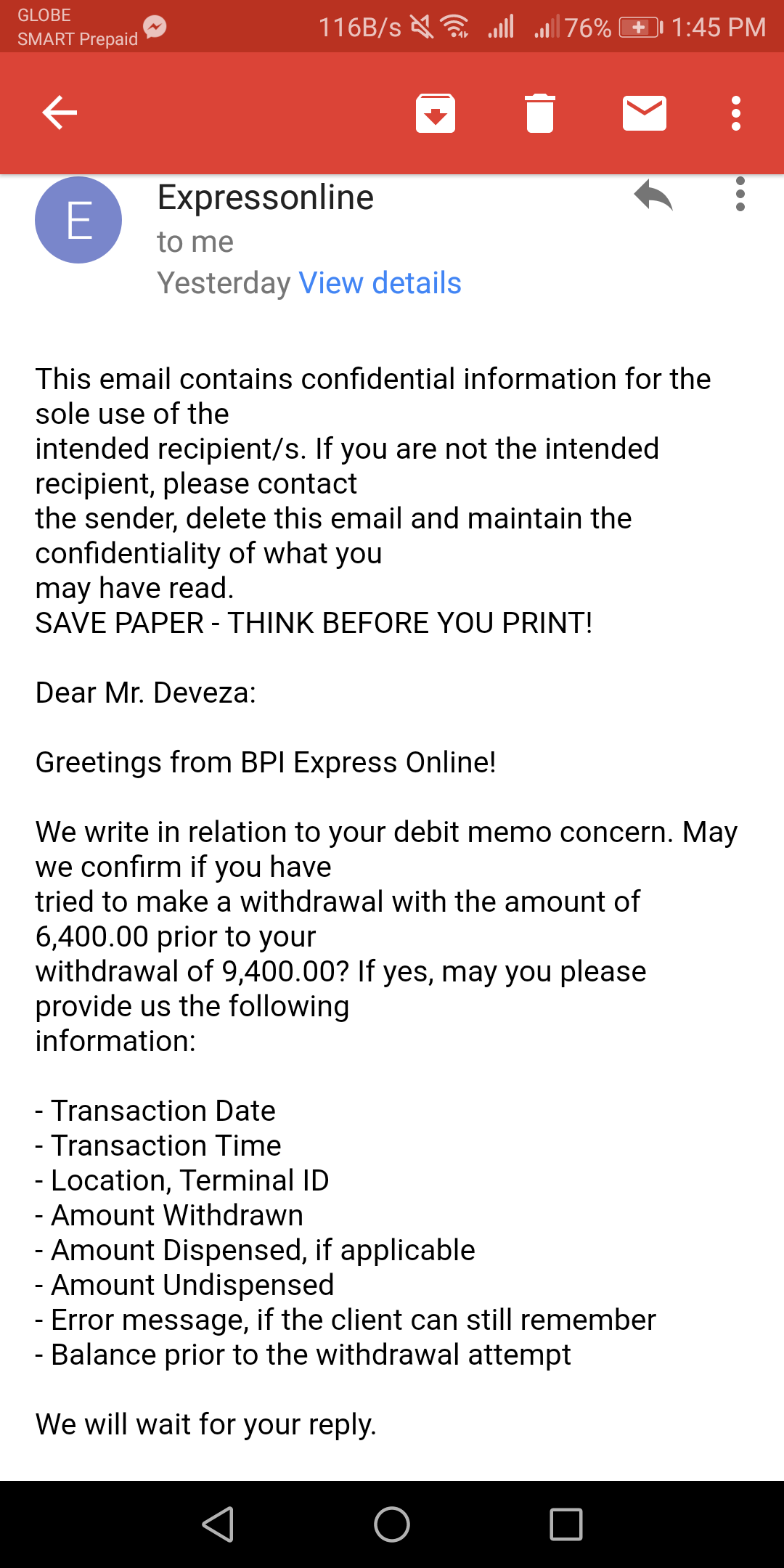

BPI responded to ask further questions such as if he withdrew the specific 6400 amount and to provide the details. See image below:

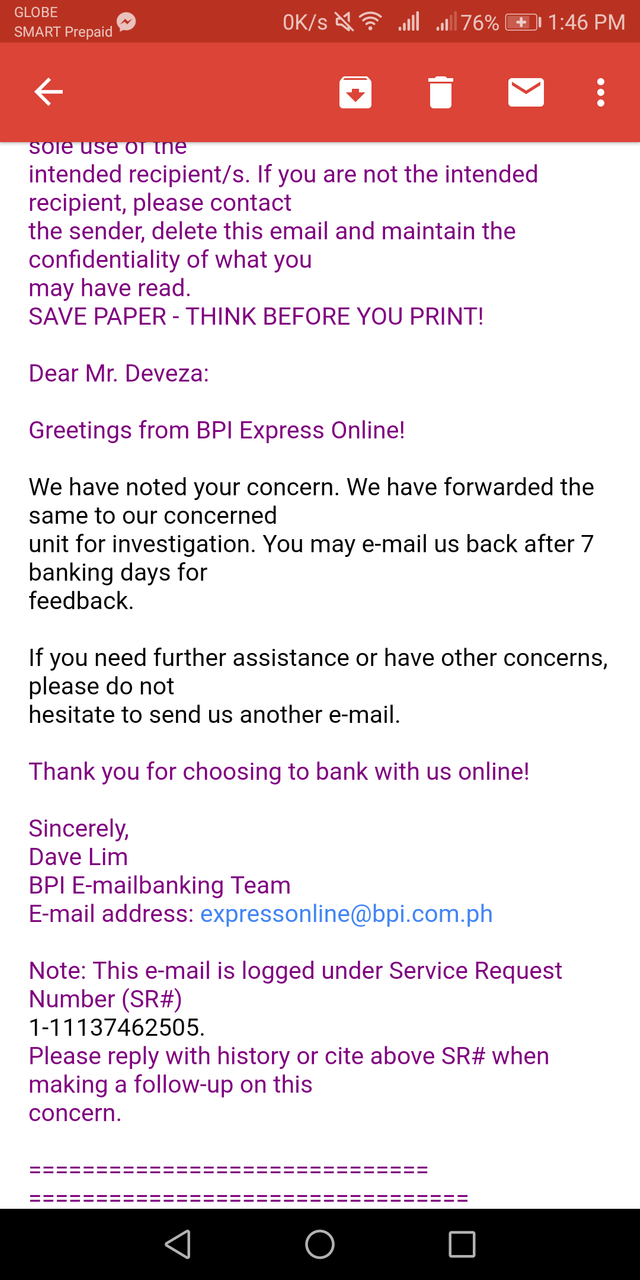

Since he did not withdrew such an amount, he went on to tell the whole story. Then, the email correspondent said that we should email them again after 7 banking days for feedback and that they sent it to their fraud department for checking.

We’re actually ok with that but I could only imagine the restlessness he feels.

On the next day which is today, he visited his bank to report the unauthorized debit. However, the teller said that he should come back after 2 weeks because there should be an investigation. He told me that it felt like the teller is putting the blame on him which I believed added to his stress.

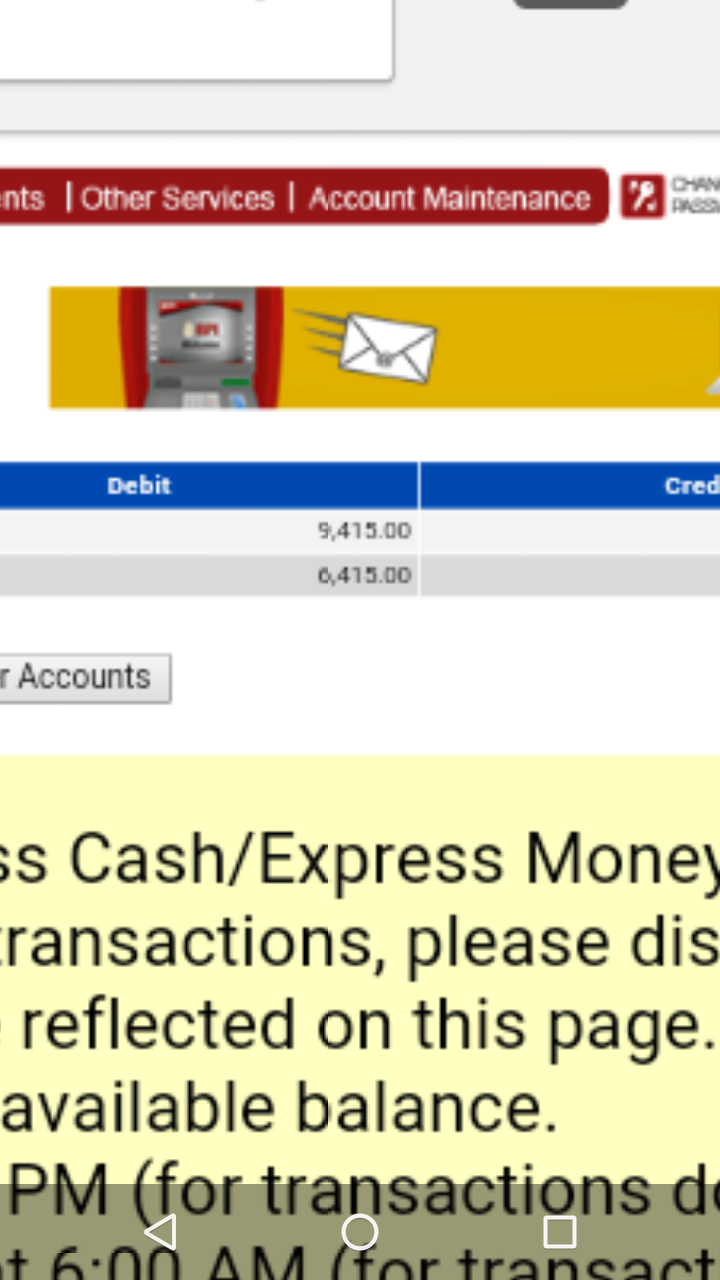

On the same date and time that he withdrew the money, the lost 6,400 or exactly 6,415 was reflected under the debit memo. We googled what debit memo means but it’s still quite vague to us. The first row is the amount he withdrew and the second is the row named debit memo.

Anyway, just today he checked the transaction history and found that the 6,415 that previously reflected in the debit memo is now reflected as a withdrawal last 1 Feb 2016 and it’s just 6,400 as previously reported in the email thread.

I have been having terrible experiences with BPI lately. We already received our 1st salary of the year but it’s in cheque so we needed to encash it. The cheque should be encashed in a BPI branch. We went to BPI UP Town Center but unfortunately they only accept 5 valid IDs (PRC, UMID, Passport, Seaman’s, Driver’s License) for encashment. Anything that’s outside the 5 acceptable IDs whether it’s government-issued or not will not be accepted. Obviously, we don’t have any of the above or we did not bring it at least because we have previous experiences that 2 government-issued IDs will suffice on top of the company ID.

We spent our whole lunch time but to no avail. Sad and down that we can’t really feel our salary yet. Then came one man who is maybe around in his 30s or 40s. He talked to the teller from time to time to ask if he can process his cheque first. He pleaded. He seemed to be a kind man .He was crying as he narrates that he needs the money as soon as possible because his wife will not be attended by the hospital without payment. It broke my heart and added gravity to what I felt. To be fair, we know that maybe that this is the protocol for bank employees that they should prioritize those with the #s for proper order. However, a little compassion may not hurt.

This is not to put the employees in the bad light but a gentle reminder that the money entrusted to the bank and the customer service that the bank promised, are extremely valuable. JC did not celebrate the holidays with his family just to earn more and this kind of scenario is just cruel. These bad experiences may be little to some but it’s definitely huge for others.

it's an ATM glitch that happens all the time to almost anyone. (unless you stumbled on skimming devices, wag naman sana).

btw, I note that the June 2017 BPI glitch had more internal behind-the-scenes-and-conspiracy than what they inform the public.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

yup wag nman sana kasi iba yung amount sa nakain at sa triny iwithdraw.

I think so, too

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit