There is no way 48% of Americans have more than $250k in individual bank accounts. There's no reason to worry about deposits covered by the FDIC insurance. And even for uninsured deposits the risk of loss is low- the FDIC generally seeks to have the purchasing bank cover all deposits. Even when that doesn't happen, it generally is a minor haircut.

For investment accounts, SIPC insurance is even higher, and more importantly these accounts are segregated.

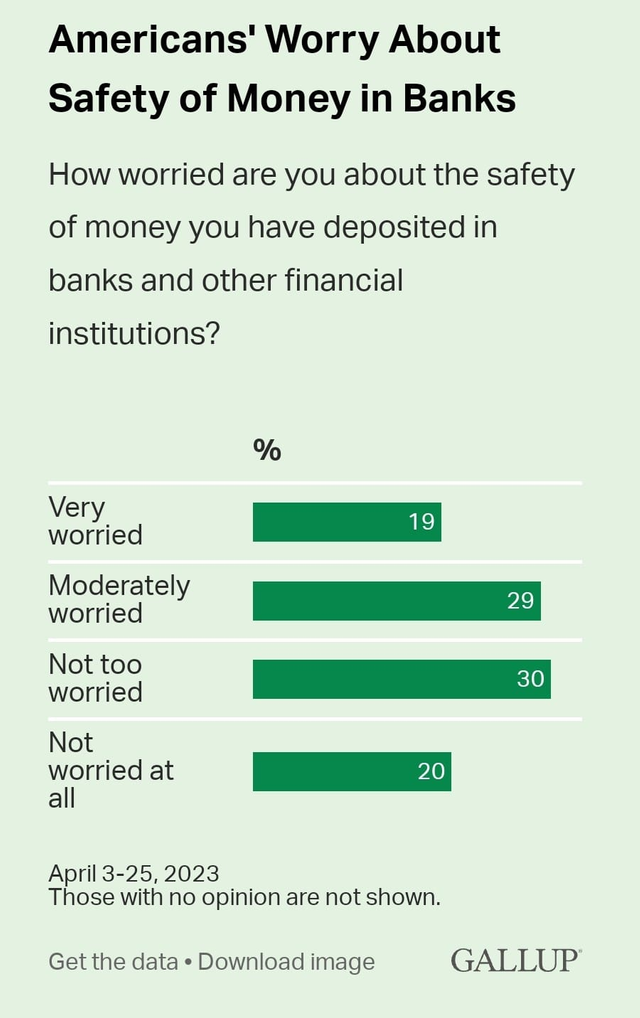

Lower income people are more worried about their money in the bank. Likewise Republicans. I have to imagine their news consumption is fueling their concerns.

The coverage is by bank and by ownership category at each bank too, so one can have more than $250k coverage.