Pal pondered the impact of the crisis and the Fed's response on the venture capital industry. Investors are in a bad condition, with a variety of reasons such as demographics, debt, and geopolitical difficulties causing widespread fear and confusion.

The answer is straightforward: interest rates are exceptionally high, and the yield curve has inverted. As a result, banks are unable to produce profits, and in attempt to compensate, they are generating a false yield curve by offering extremely low interest rates on deposits rather than the standard 4 or 5%. This method, however, is problematic because every deposit received by the bank is eventually returned to the government through treasury bonds or money market funds. As a result, depositors are withdrawing funds, forcing the bank to limit lending in the government bond market, resulting in significant losses. The Fed's strategy of bringing everyone together and simply covering up the difficulties with deposits and lending is a waste of time. Interest rates should be slashed by 200-300 basis points as quickly as feasible to stop the bleeding.

Smaller banks, on the other hand, would face significant challenges in getting commercial real estate loans off their balance sheets. Some of this property may have to be completely demolished. Smaller banks are also concerned about their balance sheets, and the scenario is reminiscent of the savings and loan crisis of the 1990s. While there is no full-fledged financial crisis at the present, the banking industry is under enormous strain, and the only solution is to implement lower interest rates and greater quantitative easing, both of which have already begun in some form. The Federal Reserve's balance sheet is expanding, as is the money supply.

During its next meeting, the Federal Reserve is projected to raise interest rates by 25 basis points, signifying the end of the hiking cycle. The Fed's next move, which is expected within two months, will almost certainly be a 100 basis point emergency rate cut. As a result, yields must fall quickly, and interest rates must be cut by two or three hundred basis points in a relatively short period of time, maybe by late July or September.

The banking problem cannot be solved by simply lending money to huge banks and moving it to other people's balance sheets. This method appears dubious and is unlikely to be successful. The crisis will most certainly evolve in the expected fashion, with everyone worrying about these banks' stability due to deposit flight or their balance sheets. The Federal Reserve will eventually need to implement quantitative easing to give support. When we observe the next drop in bank stocks and bond agreements, particularly the 10-year closing at its lows, it will be suitable to buy bonds. Furthermore, I have a controversial and positive outlook on stocks, arguing that debasing the currency improves share prices. As a result, I am very optimistic about bitcoin, bonds, and, in particular, technology stocks.

The current economic scenario resembles the 1990 recession, which was marked by credit contraction and culminated in the failure of bond deals and commercial real estate. Because of the overhang in some areas of the economy, this recession will cause a sharp drop followed by a delayed recovery. They claim that certain commercial properties will never be sold and must be bulldozed. Many people are not returning to work, which is causing losses for firms that rent office space, which must be absorbed by the pension system. Small banks are the principal commercial real estate lenders, hence there is a link between the two. Yet, it is strange that insurance companies have not yet been affected, signalling that there may be a bond market problem that would eventually harm them.

Everyone is focused on supply restrictions right now, but people frequently underestimate the importance of demand. One of the world's greatest commodity hedge fund managers, Dwight Anderson, believes oil is undervalued owing to a structural supply story. Yet, demand for oil declines during a recession as industrial activity slows and extra stockpiles accumulate. This drop in demand has an effect on Asian manufacturing output. Lower demand for oil and commodities has resulted in deflation, with all commodity prices falling year on year. There is no evidence that inflation will be a chronic worry, and the idea that inflation is a threat is unfounded and will most likely be dismissed in the next months.

We are on the verge of a recession, as forward-looking indicators have predicted for some time. My prediction is that we will hit bottom in the current or next quarter and then start to recover. Yet, the recovery is expected to be slow, with GDP hovering near trend levels, and to be a difficult and tumultuous process.

Source:

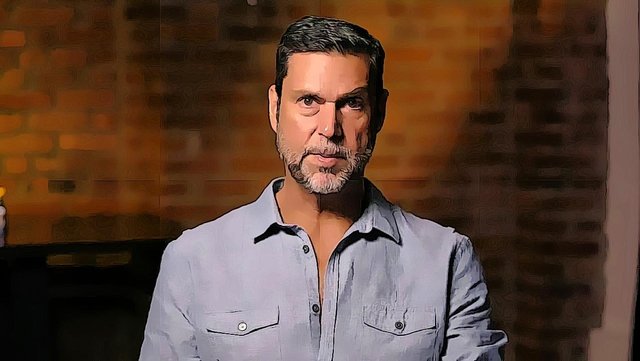

Money Talks, 19 March 2023, "Everyone Will Be Wiped Out In 30 Days..." | Raoul Pal",