The financial world is complex and ever-changing. With so many currencies and assets to choose from, deciding where to invest your money can be difficult. In this blog post, we will look at the differences between currencies, reserve assets, and investments, as well as how they all interact.

Currencies are the foundation of international trade, and they come in a variety of forms. The value of your money can fluctuate wildly depending on a variety of factors, including interest rates, inflation, and global economic conditions, whether you hold dollars, euros, yen, or any other currency. While some currencies are more stable than others, they are all subject to market forces that can cause their values to rise or fall in minutes.

Investing in reserve assets is one way to protect yourself against currency volatility. Central banks and other large financial institutions typically hold reserve assets to protect themselves against economic uncertainty. Because of its intrinsic value and long history as a form of currency, gold has long been a popular reserve asset. Foreign currency reserves, special drawing rights (SDRs), and government bonds are examples of reserve assets.

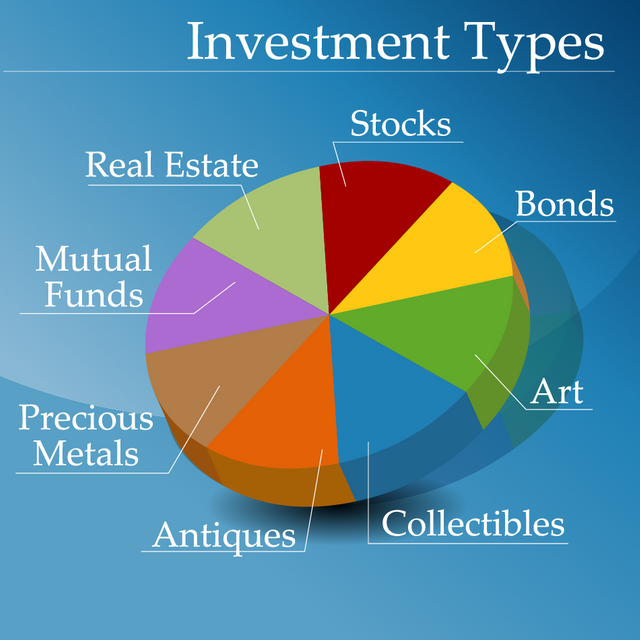

Investing, on the other hand, is a method of accumulating wealth over time. When you invest in stocks, bonds, real estate, or other assets, you are putting your money at risk in the hopes of making a profit. Investment returns can be much higher than currency or reserve asset returns, but they are also subject to greater volatility and risk.

Alternative investments, such as cryptocurrencies like Bitcoin, have grown in popularity in recent years. While Bitcoin and other cryptocurrencies are still in their infancy as investment vehicles, they have a devoted following of investors who believe in their ability to disrupt traditional finance.

The decision between currencies, reserve assets, and investments is influenced by your risk tolerance and investment objectives. Reserve assets may be the way to go if you want stability and security. Investments may be a better fit if you are willing to take on more risk in exchange for higher returns. Additionally, cryptocurrencies such as Bitcoin may be worth considering if you are interested in exploring emerging technologies and alternative investments.

Finally, understanding the distinctions between currencies, reserve assets, and investments is critical for any investor seeking to make informed decisions about where to invest their money. You can create a diversified portfolio that is tailored to your specific investment goals and risk tolerance by weighing the risks and potential rewards of each option.

Source:

Let's Talk Crypto, 2023, "PREPARE! The System Is COLLAPSING | Lawrence Lepard Bitcoin",