WELCOME TO MY POST

Hybrid banknotes use a universally accepted payment method – cash – to deliver the benefits of digital money. Here's how they work.

As central bank digital currencies (CBDC) become reality and the use of cryptocurrencies for payments becomes more mainstream, how do we make sure these new digital monies are available to everyone, everywhere, at all times? To date, the only payment technology that can do this is cash.

The pure physicality of banknotes presents problems in the digital age. International remittances are slow, holding banknotes can be costly and problematic, and cash can impede central bank monetary policy (such as by breaking the zero lower bound in interest rates).

Franklin Noll, PhD, is a recognized authority on the history of money, including banknotes and cryptocurrency. He has extensively written and spoken upon these topics, and he is the president of Noll Historical Consulting.

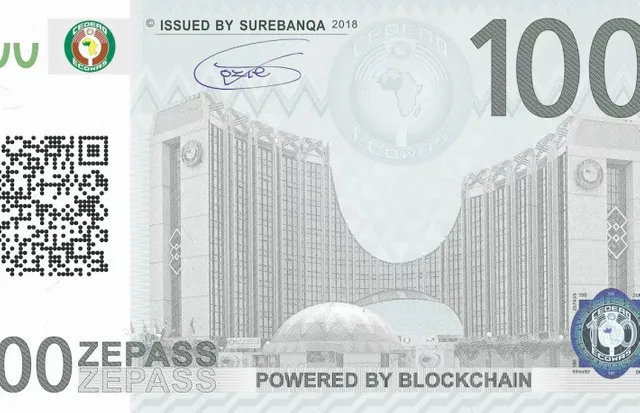

It seems only logical that an ideal payment instrument would combine the advantages of banknotes and digital currencies. A hybrid banknote would use a universally accepted and robust payment technology – cash – to deliver the cutting-edge benefits of digital money. A hybrid banknote – for instance, a bill with a chip embedded – could routinely function as a banknote does currently, but have the ability to access an electronic network to transfer value.

Fulfill pressing needs

A hybrid banknote would act as a transitional device between cash and digital monies such as CBDCs. It would gradually replace current banknotes and exist alongside current smartphone technology until no longer needed.

SOURCE

- LIKE❤️

- COMMENT🖋

- SHARE🔀

> YOU CAN DROP YOUR VALUABLE FEEDBACK IN COMMENT SECTION

#### Thanks a lot for visiting on my post