Federal Reserve Bank of St. Louis President/CEO and ‘dovish’ FOMC member James Bullard presented a Recent Developments in U.S. Monetary Policy slideshow this morning at Washington University in St. Louis for breakfast. A news release

from the St. Louis Fed was a ‘just in time’ headline delivery for HFT

Algos to digest at 9:15am EDT, in turn giving markets a bump following

Wednesday’s shellacking. Let’s cut to the chase with a look at

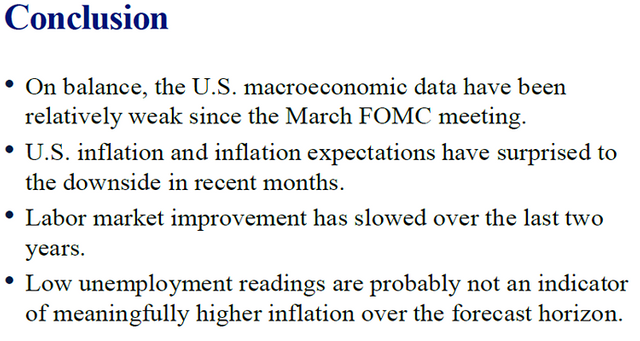

Bullard’s conclusion on Slide #28…

How did he feel about the markets opposite than expected reaction to the March .25% Interest Rates piker?

“This may suggest that the FOMC’s

contemplated policy rate path is overly aggressive relative to actual

incoming data on U.S. macroeconomic performance.”

Oh, the data! That brings to mind those bulls dancing in Yellen’s

china shop where raising interest rates in a deteriorating hard data

environment can be, well, dangerous or a scalpers dream, depending on

what side of boat you’re leaning on…

A few snippets from the ‘alt-media’ following Bullard’s presentation, and MSM from many moons prior…

Adam Button over at @ForexLive…

“About time someone at the Fed acknowledged it”

What about the 4+ Trillion balance sheet over at the Fed?

“Bullard: Fed should shrink balance sheet to gain policy space”

And that means what?

“Sounds good in theory

But the Fed is talking about

shrinking its balance sheet at a glacial pace. They’re not talking about

selling bonds, or even letting expiring bonds run off. They’re talking

about slowing the pace of reinvestment. So instead of buying new bonds

with 100% of the expiring ones, they’re talking about only reinvesting

perhaps 90%. That isn’t going to open up any significant space for

future stimulus.”

ZeroHedge jumped in with the QE4 money quotes…

“Jim Bullard Does It Again – Stocks Spike On Hint Of Future QE”

“BULLARD: FED SHOULD RETAIN OPTION TO DO QE IN FUTURE IF NEEDED”*

Now wait a cotton picking minute. Déjà vu from May 2014?

_ “Bernanke Shocker: “No Rate Normalization During My Lifetime”_

And from Bloomberg in October 2014…

“Bullard Says Fed Should Consider Delay in Ending QE”

I could go on and on with snips from years past. The bottom line

hasn’t budged because any ‘Normalization’ would instantly implode the

financial system. No matter how we slice or dice it, all the data is

bad. It’s the great TaperCaper and the jawboning will continue until we

run out of musical chairs.

TraderStef at Twitter

came for data stayed for data

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit