Bitcoin Cash split into two chains today, dividing one of crypto's most controversial communities. Bitcoin Cash (BCH) turned into Bitcoin ABC (BCHABC) and Bitcoin SV (BCHSV).

One thing is certain - the last 48 hours have been anything but boring. (To catch up on more of the story's background, check out Crypto Insider's previous BCH fork article.)

BTC Action Related?

Yesterday saw Bitcoin rapidly drop hundreds of dollars, according to real-time data from Blockmodo. One speculation, according to Craig Wright's tweet yesterday, sees Wright and his crew selling some of their Bitcoin stacks to pay for BCHSV mining power.

https://twitter.com/ProfFaustus/status/1062751765601361923

Other explanations for the BTC price drop include natural market movements predicted months ago by individuals like Tone Vays.

https://twitter.com/ToneVays/status/1062861296788365312

BCH Drama

The BCH fork occurred about mid-day today. During which time some traders may have tried to buy BCH right before the fork, and sell right after. This would in theory possibly allow them to receive the forked currencies by holding BCH during the fork.

However, Coinbase (and their Coinbase Pro trading platform) suspended BCH trading shortly before the fork. (This trading pause was announced days in advance, via the Coinbase blog.)

https://twitter.com/coinbase/status/1063099537479340032

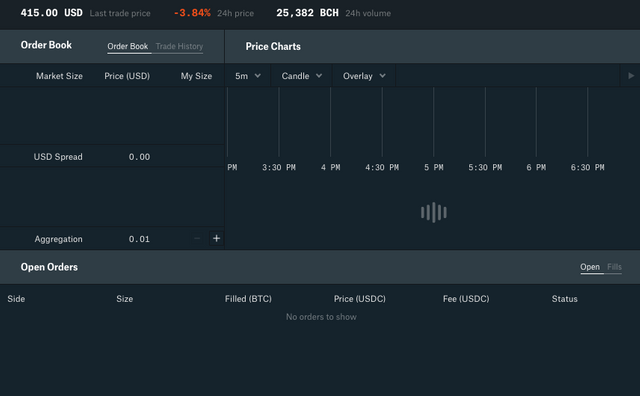

At the time of this writing, roughly 9 hours later, trading on Coinbase Pro was still suspended, with BCH price stagnant at $415.

Image Courtesy: CoinBase Pro

Meanwhile, shortly after the fork, Bitfinex exchange saw prices plummeting, with traders stuck in positions.

Crypto trader @Philakone (on Twitter) explained the situation and the dangerous implications of trading this type of fork scenario.

Philakone goes into detail on lagging Bitfinex pages and a price spread of $60. (This means the bid/buyers had a difference of $60 comparative to the offer/sellers.)

https://twitter.com/PhilakoneCrypto/status/1063112538227990530

At the time of this writing, BCH was priced at about $288 on Bitfinex, with the last price update occurring seven hours ago, according to Coinmarketcap.com. Although combined exchange pricing for BCH is at about $422 on Coinmarketcap.com at the time of this writing.

The BCHABC/BCHSV Mining Battle

So where are the miners gravitating in this BCH chain war? According to a few pictures on Twitter around press time, it appears as though Bitcoin SV is having a hard time. Although it is currently difficult to sift through the noise to know what is really going on out there.

The results of this fork will likely require time to sort out.

https://twitter.com/CryptoHolmesSan/status/1063231261244882944

What Does This All Mean So Far?

All of these associated events indicate crypto markets may not be ready for mainstream volume, attention, and adoption.

The drama from these events likely doesn't look good to institutions and the SEC. This fork occurred at a crucial time, while the SEC is evaluating Bitcoin ETF proposals.

Forbes wrote a relevant article after the SEC denied several Bitcoin ETF proposals in August. The article mentions Georgetown University professor James Angel talking about the Commission's rejections.

He states -“[t]heir rationale is that the exchanges have to show that the underlying market for bitcoin is not subject to fraud and manipulation, and the exchanges have not met their burden of proof. Given the history of fraud, hacks, and manipulation in the bitcoin market, it makes sense”.

Originally posted on Crypto Insider : https://cryptoinsider.com/bch-fork-nov-18-what-a-day/