Image From: imgur.com (Katarina N.)

Bitcoin has been seen to be the most successful and trusted cryptocurrency, with success beyond anyone’s imagination with regards to application and price action. Many can argue that BTC is still in its infancy with regards to the aforementioned, with much more positivity to come.

That being said, the BTC model has also been seen to be very effective. The total coin supply is low enough that it provides a sense of scarcity and prestige in ownership of BTC. At the same time, the coin supply has been shown to have enough coins to supply sufficient liquidity to a global market.

Image From: imgur.com (Katarina N.)

BTC also did not have an ICO, and touts effective decentralization, having no main governing body or centralized group controlling the majority of coins (possibly due, in part, to not having an ICO). Many people know what an ICO is. But for those that do not, an ICO stands for “Initial Coin Offering” and can be more officially defined as,

“[a]n unregulated means by which funds are raised for a new cryptocurrency venture. An Initial Coin Offering (ICO) is used by startups to bypass the rigorous and regulated capital-raising process required by venture capitalists of banks. In an ICO campaign, a percentage of the cryptocurrency is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, but usually for Bitcoin” (investopedia.com).

ICO’s have been an effective way for cryptocurrency startup projects to raise money in order to build/deliver their product/service/etc, and in return, give investor’s coins or tokens that have use in said ecosystem.

However, over the past several months, ICOs have seen quite a decline in terms of reputation. This can be attributed to numerous fraudulent ICOs, regulations, and ineffective projects. Investors now must be much more skeptical of ICOs, due to the aforementioned, and make sure that they have done their research before getting involved. The ICO market can also often be seen as oversaturated, with many projects that will struggle long term.

Do not be mistaken, ICOs can be effective, and be a great way to conduct business and innovation. However, there are also cases where conducting an ICO is not the most effective route. In the case of Bitcoin Enhanced, an ICO would not be the right route to go for the project.

At this time, Bitcoin Enhanced will not have an ICO, much in the same way that Bitcoin did not have an ICO. BE has an intricate relationship with Bitcoin, with BE price action dependent on the price action of BTC. Therefore, BE will look to be be conducted in a very similar manner to BTC.

Image From: imgur.com (Katarina N.)

There are several reasons for not conducting an ICO in the case of BE. ICOs are often conducted in order to raise funds for projects to build their platform or project. In the case of BE, the goal of the project is not a platform or service. Money need not be raised because there is not anything needed to put it towards. In theory, when people buy BE, they are investing their money into something similar to a store of value such as BTC, but with the potential for more stable returns. BE is looking to be a measure of value/trade, and has its value based on the value of BTC. All the development of BE as a coin is said to be complete, therefore there is no need to raise funds. There is an option to buy BE at a pre launch price. The funds spent on said BE coins will be held in a community wallet for a community fund for the project, pending decision by the community for future donations, costs, etc.

In addition, an ICO may not be best for BE, in that it may lead to instability in price action or price establishment. It is very common in the cryptocurrency space for ICO projects to have dramatic price swings upon launch of the project’s coin/token on exchanges. For example, depending on market conditions, it is not terribly uncommon for a project to increase 5-10x in price, upon initial exchange listing on a well-known exchange.

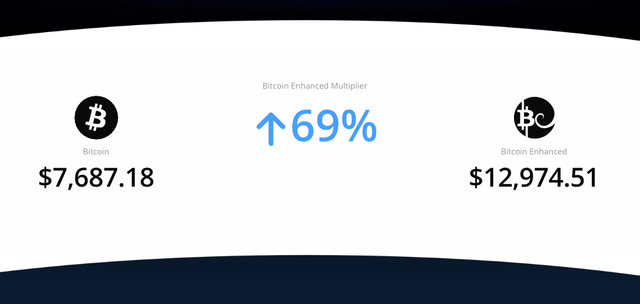

Image From: bitcoinenhanced.io (current BTC vs BE price due to forecasting)

Downside price action is also possible, as some projects may only achieve a fraction of the ICO price upon initial listing on a smaller exchange, due to lack of demand. It is of great importance that the Bitcoin Enhanced price stay relevant to the Bitcoin price. This is because the whole concept of BE is that it tracks the BTC price upon increase, and gains value upon BTC price decline, based on if the BE forecasts for that period are correct. If BE is to become the store of value proposition and option that it aims to be, then the BE price must be based on demand, similar to BTC, as well as based on the BTC price itself.

Another factor that may lead ICOs to have dramatic price swings upon exchange listing, is due to the fact that developers and teams may hold a significant amount of the coins/tokens for that project, and may dump them upon exchange listing. Coin/token lockups are sometimes put into play for ICOs so that it prevents the aforementioned from happening, at least for a specified pertinent period of time. BE aims to be decentralized similar to BTC. Not having an ICO may aid in more evenly distributed coins.

More articles about Bitcoin Enhanced details and technology soon to come!

For more information, including the BE white paper, visit bitcoinenhanced.io

Important Notes:

I am part of the Bitcoin Enhanced team and am compensated by Bitcoin Enhanced on a consistent basis, in BE coins.

At the end of the day, readers need to make their own decisions about Bitcoin Enhanced. This article was written about my opinions and my interpretation of data, which can be subjective. In no way am I claiming that I know everything, and therefore, independent research is required by readers. But hopefully I have given a good amount of content to assist in entertaining the public. BE could go nowhere in price or even go down. But it could also do very well. Decide for yourself based on the data and your own personal research. Nothing said, written, etc. is a recommendation to buy or sell anything.

(**Everything written, said, tweeted, etc. is based on my personal opinion, my interpretation of the data/material, and is not financial or investment advice whatsoever. I do not claim to be an expert. Articles may be subject to edit/update at the discretion of the writer)

Sources:

bitcoinenhanced.io

Bitcoinenhanced Whitepaper

Initial Coin Offering (ICO). (n.d.). Retrieved June 5, 2018, from https://www.investopedia.com/terms/i/initial-coin-offering-ico.asp