Image From: pixabay.com (Simon)

It is a common school of thought in the cryptocurrency space, that Bitcoin (BTC) may become the digital store of value. A personal, digital bank of sorts, that the user can control without any third parties. Due to its high price and demand, it makes sense as a vehicle to store or transfer large amounts of money or value. But due to its’ volatility, BTC can often be a risky investment/store of value. When referring to store of value, people may need something more stable in value.

Bitcoin Enhanced (BE) looks to solve this problem. In short, BE follows the BTC price during price increase. But, in contrast, BE makes future forecasts, based on statistical data, to bet against the BTC price during BTC price decline. This, in turn, causes the BE price to increase, as the BTC price decreases.

“The purpose of Bitcoin Enhanced is to track the price of Bitcoin while improving its value through accurate forecasts of periods of falling prices” (Bitcoin Enhanced Whitepaper, p. 1).

Image From: pixabay.com (janjf93)

Say for example the BTC price moves from $8,000 USD to $9,000 USD. The BE price would also be $9,000 USD. Then say the BTC price Proceeds to move from $9,000 USD to $7,000 USD. If the BE forecast for BTC was correct, the BE price would move from $9,000 USD to $11,000 USD, thus, gaining value during BTC’s price decline.

This price action would be due to forecasts made in advance by Bitcoin Enhanced. Bitcoin Enhanced should have a 60% success rate based on the data the forecasts are based upon. If the BE projection is wrong, then BE will lose value comparative to BTC. In theory, a 60% success rate should be more than enough to ensure successful consistent profit.

This could be revolutionary with regards to a stable store of value for cryptocurrency. If people store their value in BE coins, then they will likely be able to have confidence that their value should remain stable, if not even gain significant value.

Bitcoin Enhanced Details:

Bitcoin Enhanced is modeled after BTC in its total supply of 21,000,000 coins, and its decentralized nature (no traditional ICO).

If people see value in BTC and its ecosystem, then BE and its’ relationship to BTC should be very logical and useful.

BE Forecasts:

Image From: pixabay.com (3dman_eu)

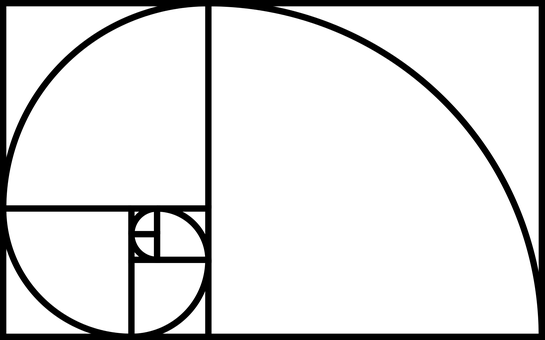

The use of technical analysis in cryptocurrency and traditional markets has been seen to be highly effective. With that being said, there is a level which is of particular significance to most technical analysis (TA) traders. 1.618 or Phi, also known as “the Golden Ratio”, is a level that seems to attract price action. Elliot Wave TA traders often look for the 0.618% range for pullbacks, with regards to Fibonacci Retracement, as for some reason, it can be argued that price action likes to move to this level on charts.

The 1.618 number can be argued to be of significance in an array of areas, even aside from investing and trading. Justin Kuepper of investopedia.com states that “If you divide the female bees by the male bees in any given hive, you will get 1.618. Sunflowers, which have opposing spirals of seeds, have a 1.618 ratio between diameters of each rotation. This same ratio can be seen in relationships between different components throughout nature” (investopedia.com, Kuepper).

Image From: pixabay.com (NDV)

The effectiveness of the BE coin “rests on its ability to make accurate forecasts of when Bitcoin prices will fall. These forecasts are made through the use of the Golden Ratio of 1:1.618, also called Phi, found in all living systems. From the proportions of an animal to the growth of a plant, Phi is the expression of how systems develop” (Bitcoin Enhanced Whitepaper, p. 1).

The use of the BE system will look to utilize BTC’s price action to the advantage of the BE price, utilizing the 1.618 level. This would make for a great store of value, that may potentially attract more investors into the cryptocurrency space, due to an investment option/vehicle that is more stable, while also having the potential to yield excellent returns. There will also still obviously be the ability to also send BE coins and hold them off exchanges, in one’s own wallet without third parties. In short, the goal is for BE to have the benefits, function, and investment gains of BTC, while hopefully being a safer, more stable investment at the same time.

More articles about Bitcoin Enhanced details and technology soon to come!

For more information, including the BE white paper, visit bitcoinenhanced.io

Important Notes:

I am part of the Bitcoin Enhanced team and am compensated by Bitcoin Enhanced on a consistent basis, in BE coins.

At the end of the day, readers need to make their own decisions about Bitcoin Enhanced. This article was written about my opinions and my interpretation of data, which can be subjective. In no way am I claiming that I know everything, and therefore, independent research is required by readers. But hopefully I have given a good amount of content to assist in entertaining the public. BE could go nowhere in price or even go down. But it could also do very well. Decide for yourself based on the data and your own personal research. Nothing said, written, etc. is a recommendation to buy or sell anything.

(**Everything written, said, tweeted, etc. is based on my personal opinion, my interpretation of the data/material, and is not financial or investment advice whatsoever. I do not claim to be an expert. Articles may be subject to edit/update at the discretion of the writer)

Sources:

Bitcoin Enhanced Whitepaper

Kuepper, J. (2018, April 25). Fibonacci and the Golden Ratio. Retrieved June 1, 2018, from https://www.investopedia.com/articles/technical/04/033104.asp