To comprehend Bearish Doji Candle completely, one should have the option to comprehend the importance of "Doji" first. The word Doji has a Japanese starting point. It implies that in an exchanging session or trading, the open and shutting cost of a stock has been the equivalent. Because of this, a Doji design resembles a cross wherein the body of the candle is either little or practically nonexistent. The upper and lower shadows of the candle are a lot noticeable giving it the state of a Doji.

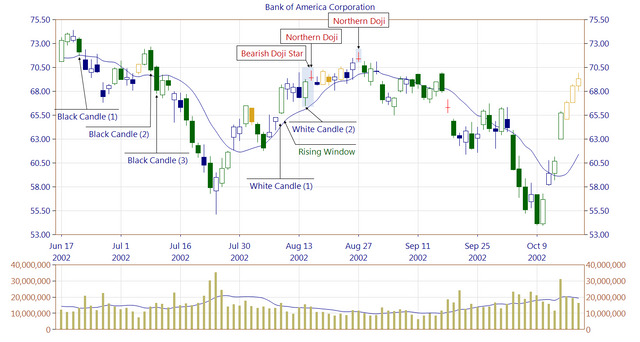

The bearish doji candle a white candle trailed by a short candle, a Highwave, a Spinning Top,or a Doji with a hole in the pattern's way.The primary day reinforces the current rising pattern. The exchanging begins with an upward hole on the following day, however, the exchanging range stays thin and a Doji is framed. The Doji mirrors the vulnerability of the market members and the pattern appears to stop. The third day can affirm the inversion if the offer opens lower and closes close to every day at least.

To ensure the pattern proceeds, an affirmation on the third day is required. The affirmation could emerge out of a dark candle with a descending hole or a lower shutting cost.

Practical Use:

Specialized experts will look for Bearish Doji candle patterns and frequently think of them as selling signals when in the setting of another bearish graph pattern. What's more, examiners will utilize these for timing when to try not to purchase a resource.

Conclusion:

Bearish Doji candle is uncommon to discover yet whenever identified appropriately, one can make a decent measure of cash by wagering as per it. It is commonly observed at the highest point of an upturn when three candles of the successive three days structure this pattern.

The primary candle means a balance between the bulls and the bears.

The primary candle can either be an ordinary green light or a bullish marubozu candle. The subsequent one shows a hole up opening toward the pattern and a little Doji development with it. At long last, the third one affirms the inversion of the bearing of the pattern.

Tristar development is a comparable pattern where all three candles should be Doji. This works like a Bearish Doji candle pattern and signs the inversion of the overarching pattern.

One ought to have a ton of training to distinguish such patterns and start exchanges alongside exacting prevent misfortunes to shield oneself from tremendous misfortunes if the costs begin to move the negative way because of any reason.

In financial exchanges, there will never be a 100% likelihood of winning each exchange, regardless of how experienced and shrewd a player is.