Last time we described major reversal patterns like the hammer, the hanging man, and the engulfing pattern. In this post, we will present some more patterns which are also considered to be important reversal signals.

Dark-cloud cover as a top reversal

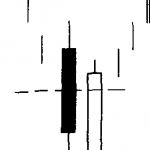

This is another 2 candlestick pattern which forms a top reversal after an uptrend. The first day of this pattern is a strong white real body. The second day's price opens above the prior session's high (that is, above the top of the upper shadow). But by the end of the second day's session, the market closes near the low of the day and well within the prior day's white body. The greater the degree of penetration into the white real body the more probable a top will occur.

Dark-cloud cover

More bearish confirmation is needed

It is advisable to wait for more bearish confirmation if the black candlestick does not close below the halfway point of the white candlestick.

The reasoning behind this bearish pattern is as follows: A strong white candlestick is followed by a gap higher on the next session's opening. So far, the bulls are in complete control. But then no continuation of the rally happens. Instead, the market on HitBTC closes at or near the lows of the day moving well within the prior day's real body.

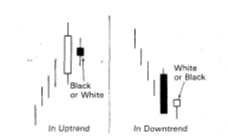

Piercing pattern as a bottom reversal

Opposite to the dark-cloud cover being a top reversal, the piercing pattern is a bottom reversal. This pattern is composed of 2 candlesticks in a falling market. The first candlestick has a black real body and the second is a long, white real body. The second-day candlestick with a white real body opens significantly lower, under the low of the prior black day. But then prices push higher, forming a relatively long, white real body that closes above the mid-point of the prior day's black real body.

Piercing pattern

The piercing pattern is less flexible to build a bottom reversal signal

In the bullish piercing pattern, the greater the degree of penetration into the black real body, the more likely it will be a bottom reversal. Ideally, a piercing pattern will have a white real body that pushes more than halfway into the prior session's black real body.

But with the piercing pattern, there is less flexibility than with the dark-cloud cover. The piercing pattern's white candlestick should push more than halfway into the black candlestick's real body to form a bottom reversal signal.

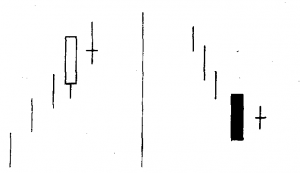

Harami pattern

The harami pattern is the reverse of the engulfing pattern. In the engulfing pattern, a lengthy real body engulfs the preceding small real body. With the harami, a small real body follows an unusually long real body. For the 2 candlesticks of the engulfing pattern, the color of the real bodies should be opposite to one another. For the harami, this is not necessary. However, most of the time, the real bodies in the harami are oppositely colored.

Harami

The harami cross is a major reversal signal

A harami cross has a doji for the second day of the harami pattern instead of a small real body. The harami cross, as it contains a potent doji (more about doji later), is viewed as a major reversal signal.

Harami cross

While the color of the second session is unimportant, the decisive feature of this pattern is that the second session has a tiny real body relative to the prior candlestick. Plus the small real body is inside the larger one. The size of the shadows is usually not important in either a harami or harami cross.

The smaller the real body the more plausible the trend reversal

As a general principle, the smaller the second real body, the more potent the pattern. This is because the smaller the real body, the greater the ambivalence and the more likely a trend reversal will occur.

Note that the harami cross carries more significance than a regular harami pattern. Where the harami is not, the harami cross is definitely a major reversal pattern. Harami crosses also call bottoms, but they are more effective at tops.

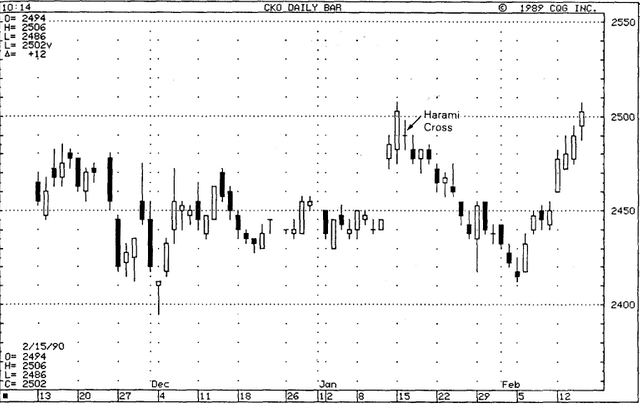

Example of a harami cross in a Japanese candlestick chart

In our next article, we will finalize our overview of major reversal patterns by exploring star patterns.

Source: Japanese Candlestick Charting Techniques (by Steve Nison)

Posted from my blog with SteemPress : http://companywebsolutions.com/japanese-candlestick-charting-on-hitbtc-major-reversal-patterns-part-2/