Introduction

Cryptocurrencies promise someone to make money and payments that are universally accessible– to anyone, wherever they are in all parts of the world. The decentralized finance (DeFi) or Open Finance program takes that promise one step further.

Imagine a global and open financial alternative for every financial service you use today such as savings, loans, trading, insurance and more accessible to anyone in this world with a smartphone and internet connection.

Decentralized finance (or simply DeFi) refers to an ecosystem of financial applications built on top of a blockchain network. Specifically, the term Decentralized Finance may refer to the movement to create an ecosystem of financial services that is open source, illegitimate and transparent, available to all and functioning without a central authority. Users will maintain complete control over their assets and interact with this ecosystem through decentralized peer-to-peer (P2P) applications (dApps). The main advantage of DeFi is the ease of access to financial services, especially for those who are isolated from the current financial system.

What is BeFiT DeFi?

BeFit Defi is the premier platform for community staking and farming and Liquidity extraction. A place to freely create passive crypto income. BeFit allows you to earn high returns on your crypto by stacking and providing liquidity.

The BeFiT protocol is designed to enable a fully decentralized marketplace for Farming/Staking and Liquidity extraction on the Binance Smart Chain.

DeFi Features

Decentralized finance (or simply DeFi) refers to an ecosystem of financial applications built on top of a blockchain network. Specifically, the term Decentralized Finance may refer to the movement to create an ecosystem of financial services that is open source, illegitimate and transparent, available to all and functioning without a central authority. Users will maintain complete control over their assets and interact with this ecosystem through decentralized peer-to-peer (P2P) applications (dApps). The main advantage of DeFi is the ease of access to financial services, especially for those who are isolated from the current financial system. Another potential advantage of DeFi is the modular structure on which it is based: DeFi applications that can be operated on a public blockchain have the potential to create new financial markets, products and services.

Because DeFi application frameworks can be pre-built, deployment is much easier and much more secure. Another important benefit of such an open ecosystem is the ease of access for people who should not have access to any financial services. Because traditional financial systems rely on profit-making through intermediaries, their services are generally absent in places where low-income people live. However, with DeFi, costs are significantly reduced and low-income individuals can also benefit from a wider range of financial services. DeFi appears to be opening up many exciting new passive income opportunities in Farming and Non-Custodial Staking. Opportunity to Become a Trendsetter for Community Betting and Money Extraction Platforms. Private and community tokens are rewarded. The main conclusion of this new token is that a small cap can lead to a quick upgrade with a community willing to support you. This is one of the best ways to engage our community - providing instant feedback to your first fans will inspire them to become your best supporters.

How does it work?

Just like other cash withdrawal programs, participants only need to provide cash to this BFT/BNB PancakeSwap V2 pool. Due to the new nature of the experience, notes must remain in the pool for a period of one month to be eligible for rewards.

Ecosystem $BFT Token triggers rewards from those who give cash in PancakeSwap V2. The more liquidity you provide and the longer you leave it, the larger your share of the BFT pool you receive. BFT/BNB is the main liquidity pool for the ecosystem. It is up to you to create Pools with more tokens and digital assets on the platform with partners and their rewards for the community.

There are currently two types of decentralized exchanges on the Binance Network:

- Peer-to-peer order book exchange (e.g. 0x exchange like P2P)

- Liquidity pool exchanges (eg PancakeSwap) Order book exchanges rely on a buy/sell system to execute trades.

When a trader places an order to buy or sell at the selected price for the token, the exchange's matching engine only executes the trade once the order opposite the price is available. Placement (limit)

traders' orders in the order book are called market makers and traders who execute their orders against orders that have been entered in the order book are called takers.

Therefore, the price of the token is determined by the merchant who chooses at what price level to place an order. This system works quite well when there are enough buyers and sellers in the market, but there are some unavoidable problems: Tokens that lack liquidity due to low volume or low interest do not exist. only difficult to buy and sell, but also sensitive to unexpected price fluctuations caused by large individual transactions. Therefore, tokens characterized by high price volatility and inefficient conversion are unlikely to be adopted.

BFT Token Liquidation

BFT Token Liquidation Balance works similar to liquidating cash with one extra step. The liquidator must first convert the BFT Tokens into cash by selling them in the BeFiT liquidity pool or by purchasing the BFT Tokens at their collateral value. Once the BFT Tokens are converted into cash tokens, the liquidation proceeds as usual. BFT token liquidation increases the account's excess collateral position by increasing the account collateral surplus or reducing the account collateral requirement.

Governance The BeFiT protocol is powered by the BFT Token, a governance token for the community to guide its evolution and development over time. On-chain governance is designed to bootstrap the long-term sustainability and growth of the BeFiT Protocol, using the BeFiT BFT governance token. At genesis, 10,000 BFT tokens will be minted to encourage community participation economically. BFT tokens drive BeFiT governance mechanisms and can be staked in on-chain voting for improvement proposals.

Governance features include:

- Adding new crypto assets or stablecoins to the protocol

- Adjusting variable interest rates for all markets

- Set a fixed interest rate for each market

- Added new market for different maturity

- Voting for protocol improvement/proposal

- Delegate protocol reserve distribution schedule A certain amount of BFT tokens will be allocated to all borrowers as a reward to increase initial liquidity, proportional to the amount of debt each account borrows. Similarly, a certain amount of BFT tokens will also be allocated to lenders/liquidity providers in return, in proportion to the amount of liquidity each account provides.

Token Sale

BeFiT is a worldwide cryptocurrency and payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. Peer-to-peer networks and transactions occur between users directly, without intermediaries. These transactions are verified by network nodes through the use of cryptography and recorded in a publicly distributed ledger called the blockchain.

Tokenomics

- 10% Pre Vent

- 10% Development

- 70% Liquidity

- 5% Complete

- 5% Récompenses d'extraction de liquidity

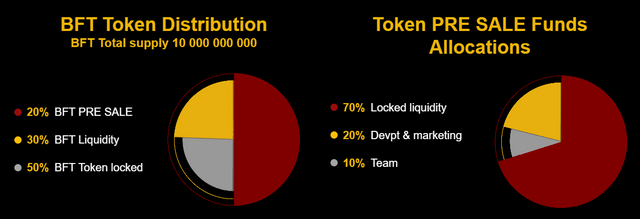

- 20% BFT PRE SALE

- Liquidity 30% BFT

- 50% BFT Token locked

- 70% Liquidity Locked

- 20% Development & marketing

- 10% Team

Roadmap

- Q4 -2021. Community research and evaluation of project ideas, implementation planning.

- Q1-2022. Product development and creation of DeFi liquidity pools. More exchanges and community and LP approaches. Bring more utility to tokens in the community and marketplace.

- Q2-2022. Fully DeFi ecosystem for money mining and digital asset betting. The future hasn't been written yet....

Conclusion

The BeFiT protocol is designed to provide a fully decentralized and secure marketplace for interest, term loans. BeFiT allows lenders to leverage their idle crypto assets by providing liquidity to earn some interest income; it also allows borrowers in need of liquidity to take out loans pledged by over-secured crypto assets for specific and predictable fees. BeFiT will be deployed on the Binance Smart Chain, to avoid friction and problems when using Ethereum, including congestion, high gas costs, and lack of interoperability with other ecosystems. This enables the creation of a scalable liquidity market that is fully regulated by the community through the BFT governance token.

For More Information:

Website: https://befit-defi.com/

Whitepaper : https://drive.google.com/file/d/1GIErfvDWTwqP58Fn384GYNMF6j1s_Nxe/view?usp=sharing

Telegram : https://t.me/BeFiTDefi

Twitter : https://twitter.com/BeFiTDeFi

Author : Amild

Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=2583828

My BEP-20 Wallet : 0xbf00577895715883E63C6694D33dA51b1cDEBDa8