This article is part two of three. If you have not read part one yet, please go back and do so. You can find it here. This part will cover more technical aspects of Bitcoin and Cryptocurrencies in general. We'll define some of the buzzwords and examine what makes some of the most common coins different from one another. After all, not all Cryptos are created equal.

Origin Story

Before getting into defining our terms, I'm going to give a very brief origin story of Bitcoin. Now to be sure, every Cryptocurrency in existence will have its own origin story, and some are more transparent than others. In the case a Bitcoin, the details are a bit scant. Created by an entity by the name "Satoshi Nakamoto", Bitcoin first appeared on Internet forums in 2009 as open source software. I use the word "entity" because the actual identity of Nakamoto is unknown. Some have speculated that Nakamoto is merely a pseudonym for a group of programmers. Whatever the case may be, Nakamoto no longer controls the Bitcoin code base. It was handed over to Gavin Andresen in 2010, who has worked along with the Bitcoin Foundation to keep it decentralized and public.

So when the questions arise regarding Bitcoin and who controls it, the simplest answer is, no one. That is, no single individual controls it. The public mining community keeps it up and running. So now that we've established where it came from, let's define the terms we'll be using in this writing. By far the most important term to define – and indeed the one that sets Cryptocurrencies apart – is Blockchain.

Blockchain

Here's the formal definition from the Oxford English Dictionary: a digital ledger in which transactions made in bitcoin or another cryptocurrency are recorded chronologically and publicly.

Okay, but what does that really mean?

Well, imagine you have a logbook. Let's use the bookie example. Let's say we have a bookie who keeps track of who owes money to the Mafia. In this logbook, he records the date and time of each transaction. A transaction could be, for example, when a man takes out a loan from the Mafia. In the bookie's logbook, he records the account number that the money came from and who it was sent to, along with the amount of money. So date, time, sender, receiver, and amount. It may look something like:

From: Account 224299

To: Tommy Jones

Date: December 31st, 2017

Time: 1800 Hours

Amount: $50,000

Make sense? So going back to our definitions, the Blockchain is a digital logbook (ledger) filled with transactions. Now you may be thinking: so what? Every bank and financial institution in history has kept those same records. And you're correct, they have. But they only store them privately for themselves. A blockchain, however, is distributed and decentralized. Meaning it's located in many different places, and no one person or group controls all of it. So now imagine our bookie having a copy of that ledger on his laptop. Now add in 50,000 more bookies, all across the world, who all have identical copies of that ledger. This is, essentially, the blockchain. It is decentralized; it is transparent (in Bitcoin's case, at least).

Now, what's the benefit to this? Well for starters, more than a decade ago, the blockchain idea was first introduced to solve the Double Spending problem. For example, let's think of a paper check. Before instantaneous electronic banking, you could double-spend your money. Let's say you had $100 in your bank account. You go to the grocery store and write a check for some groceries for $85. Then you go to the gas station and spend $30 on gas, also by check. See the problem? You've now spent $115, or $15 more than you actually possess in your account. By the time the first check clears, there will only be $15 left in the account. So when the gas station goes to cash your check, it bounces because you're $15 short.

Now today, many of the (arguably few) places that still accept checks actually treat them like debit. Walmart does this. If you pay with a check, they will actually read your account info off the check and take the money directly from your account right then and there through electronic banking. But before they began doing that, double spending was a problem. The blockchain solved this. How?

Imagine having 100 Bitcoin (BTC) in your account. You spend 85 BTC on groceries, then another 30 BTC on gas, just as before. Well this time, your transaction of 85 would be processed on the blockchain, and multiple other "bookies" have a copy of it. So say 8 of them record your account as having transferred 85 BTC. Now when you try to spend more than your remaining 15 BTC, the "bookie" can come back and reject your purchase, since you don't have enough left. This occurs because your Bitcoin actually lives in the blockchain (the logbook).

I know this example doesn't seem that impressive anymore, now that we have automatic declination of credit and debit cards, and overdraft protection from our banks. But this is just the start. See, multiple "bookies" or "nodes" on the blockchain are all constantly working together to confirm transactions. As more transactions are being confirmed, these same computer "nodes" are all being updated (as they remain continually connected via the Internet) regularly so that they all have the same copy of the blockchain (the logbook).

The blockchain is further useful, not only because it defends against the double-spending problem, but also because it is secure. It is virtually impossible to steal coins from the blockchain unless you steal someone's account information (their wallet's private key, addressed further below).

We'll look at a security piece towards the end of the article covering a fear that some people have, that the blockchain can be hacked. For now, however, we're going to get into our second definition, and discuss how these transactions on the blockchain are actually processed.

Mining

When we talk about things that have value (like silver and gold), there are reasons those things have value. We looked at that in part one, but in short, it has value because people agree on it. In the case of silver, gold, platinum, diamonds, etc., these objects have value in part because they are rare. Most people in the world do not own bars of gold. Most people in the world don't have a box full of diamonds. These items are rare, and they have to be mined. So it is with Bitcoin.

Crypto mining is the process by which a computer (be it desktop, laptop, mobile phone, ASIC [see definition below], Raspberry Pi, etc.) runs a set of instruction to "mine" or "find" new coins. Many Cryptocurrencies, like Bitcoin and Litecoin, have a set limit. That is, a finite supply. In BTC's case, this number of 21 Million. Meaning once 21 Million BTC have been mined, there will be no new Bitcoins added to the supply. Ever. Just as silver and gold have a finite supply (you can't make silver or gold out of thin air, right?), so do many Cryptocurrencies. This serves to make them inflation-proof. But, I digress on that for now. Back to mining, which I'm sure makes very little sense at this point, so I'll expound on that.

Every device that is connected to the blockchain (we'll call them "nodes" regularly from here on) has a copy of the blockchain and its transactions. Most of those nodes also run mining software. This software executes a program that uses computing resources (processing power) to perform a calculation based on a given cryptographic algorithm. I'll slow down for a sec.

A cryptographic algorithm, you say? What the heck does that even mean? Well in short, an algorithm is like a recipe. It is a set of step-by-step instruction for solving certain mathematical problems/functions, and calculating certain values. In computers, algorithms are used for a massive array of things. For example, you've probably heard of the term "encryption" before. If not, encryption is basically a way of converting certain characters into other characters, based on a set of rules, to hide the original characters. For example, let's say I'm going to send a coded message to a friend of mine. I want him and only him to be able to read it. So, I want to say, "Hey man, how's it going; meet me on Main Street at 10 tonight." But let's say that I want to make sure no one else can understand the message. So I give a set of instructions to my friend and tell him, "Follow these instructions and you'll be able to decode the message I'm going to send you."

So to encode (encrypt) my message, the first thing I do is swap every occurrence of the letter "e" with the letter "x." Then, I replace the letter "a" with the letter "p." We'll also replace the letter "t" with the letter "c." Lastly, we'll replace every letter "o" with the letter "u." So now my message looks like, "Hxy mpn, huw's ic guing; mxxc mx un Mpin Scrxxc pc 10 cunighc."

Now without any prior context or knowledge, you'd have a hard time reading that. So my instruction set (that is, my algorithm) that I give to my friend is: swap e for x, a for p, t for c, and o for u. Once he does that, he'll be able to read my encrypted message.

Now that's a very, VERY basic example. Most encryption algorithms today are a lot more complex. But you get the picture. So mining software is a program that executes an algorithm. Every Cryptocurrency that is capable of being mined (and that is the vast majority of them) uses an algorithm. Bitcoin uses a well-known computer science algorithm called SHA-256. SHA stands for Secure Hash Algorithm. The 256 stands for the number of bits used in the algorithm, in this case being 256 (a common value found in computer science, as it is a multiple of 8 [8x32]). So Bitcoin uses the SHA-256 algorithm for what, exactly? And what is a hash?

Hashing

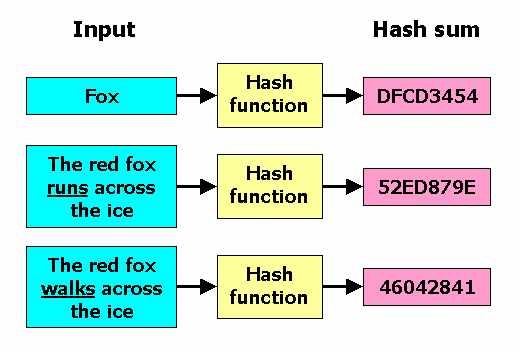

Definition number 3: Hash. In computer terms, a hash is when a string of characters (letters, numbers, symbols, or a mixture thereof) are replaced by a set value. For example, you could have a list of customer names from your business. John Smith, Lisa Johnson, Larry Robinson, and so on. Each of those could be assigned their own unique identification number as a means of securing the information. For what reason? Well let's say security. You don't want your competition to get a list of your customers. So when you enter their names into your business software, you "hash" the names and then instead use the hashed value. So instead of "John Smith" for example, you might have the value of 002. Instead of Lisa Johnson, you have 045. Instead of Larry Robinson, you have 127. (These values are arbitrary and based entirely on the rules laid out in the hashing algorithm). So now the names of your customers are hidden. From there you would have software that, as long as the user provided the right password, would return the original name from the hash value. So I log into my software as the business owner and when I type in customer number 002, it gives me account information for John Smith. Make sense? I am oversimplifying this quite a bit, but again, this is meant to stay in layman's terms.

So hashing takes a value and, based on a specific algorithm, performs its set of calculations/manipulations on that value. It then returns a new value. In our example, we took the value "John Smith" and hashed it and returned the new value, "002."

So what does this have to do with Bitcoin? Well the mining software that these mining devices (nodes) run, are programmed to run their given algorithm. A Bitcoin miner will, for example, take a value and run the SHA-256 algorithm.

So what values does it use, and how does it "mine" by doing so?

It uses blocks for its values.

Block as in blockchain?

Yes!

A block is a bundle of transactions. "John sent Lisa 100 BTC on 11/29/17 at 12:00:00 with transaction number 12255448855" would be an example of a transaction. Except on the blockchain, it has a wallet address in place of a name. We'll get to wallets in a minute.

So this bundle of transactions, this block, is assigned a value corresponding to its position on the blockchain, the transactions that are part of it, and an "answer" to a mathematical puzzle (called a nonce). This value is grabbed by the mining software, and the algorithm is executed to "hash" the value. If the algorithm's hashing produces the correct and corresponding "answer" to that mathematical puzzle, then this block is added to the blockchain. As a reward for verifying these transactions, the miner is paid in BTC. Each hashed value is unique; no 2 are alike. Changing even one letter or number in the block value will change the entire hash value that it produces. Similar to if I said John Smith hashed equaled 002, but John Smyth equaled 566. Changing even one character changes the entire value.

So, to recap: when people exchange BTC (send/receive it), the transactions have to be processed and verified. A bundle of transactions all get processed and verified at the same time, and they are collectively called a "block." This block has value. It includes all the transaction data as well as a reference to the previous block (thus chaining all the blocks together and lending to the creation of the name "blockchain"). All blocks are added sequentially and chronologically to remain consistent. A miner runs an algorithm that takes the block value along with a special unique value (the "answer" to a mathematical puzzle, the nonce), and performs a calculation based on it. Nowadays, most BTC miners are capable of running multiple tera-hashes per second.

(In Engineering terms, kilo means "times one thousand." Mega means "times one million." Giga means "times one billion." And tera means "times one trillion.")

So if you have a Bitcoin miner that can mine 1 TH/s (one tera-hash per second), that means it runs the SHA-256 algorithm one trillion times in a second (continually; so sixty-trillion times in a minute). This algorithm uses different values each time. So it performs its calculation once and if the answer doesn't match the block answer, it increments by one and tries again. Basically (oversimplification warning), if it tried the number 1 and performed its complex calculation, and using the number 1 didn't yield the answer, it will run the calculation again, this time using the number 2. If still no dice, it will try 3. Then 4, then 5, and so on. It does this a trillion times per second. (Most miners today, known as ASIC miners, run more than 10 trillion per second).

Difficulty

So with something like that, and with tens of thousands of nodes/miners out there, it must take only a fraction of a second to process a block, right? Wrong. This is where we find the difficulty level. You see, Bitcoin itself is code. Its blockchain is code. It was programmed with a set of rules to follow. One of those rules is regarding reward payout, and another is regarding difficulty (there are other rules, too). You see, if the difficulty was very low, meaning the mathematical puzzle that's being solved is really easy, then anyone and everyone could do it. Heck, millions of transactions could be processed in a nanosecond. But that being the case, the "reward" of getting paid to process transactions would get paid out very quickly, and then the whole 21 Million coin supply would already be mined. This is a problem because it would increase supply faster than demand, and the value of it would drop (as we noted in part 1). In only a matter of days or perhaps months, all would be mined. So what keeps that from being the case? Enter the network difficulty.

Bitcoin's difficulty says, in essence, that the value needed to compute a new block – and thereby earn a reward – increases exponentially over time as more blocks are discovered. Every 2,016 blocks, the difficulty increases, meaning it takes potentially more hashes to mine a new block and earn a reward. From March of 2014 to March of 2015, for example, the amount of nonces that miners has to try before completing the block increased from 16.4 quintillion to 200.5 quintillion (that is, 200,500,000,000,000,000). So sure, you can try 1,000,000,000,000 (one trillion) per second, but to get 200,500,000,000,000,000 would take over 2 full days. And that was 3 years ago; today, at the time of this writing at the end of 2017, this value is just over 8 septillion (that's the number 8 followed by 21 zeroes, or 8,000,000,000,000,000,000,000). This difficulty level is recalculated based on how quickly blocks are being completed, and how many are left. So if 10,000 miners suddenly go offline, the next time difficulty is updated (about every 2 weeks), the difficulty level will decrease, since it would take the remaining miners longer to complete blocks.

The whole purpose is to keep the time between blocks at around 10 minutes (that's by design). So if only one miner was left mining BTC, the difficulty would be so small, that just that one miner could complete a block in 10 minutes.

This actually brings us to pools.

Pools

You see, there's really two types of mining: solo mining, and pool mining. Each has pros and cons.

For solo mining, you set up your mining device and it mines straight to your wallet (explained next). However, given the excessively high difficulty level, it would take a LOOOOONG time before you'd likely complete a block all by yourself. For example, given the 8 septillion nonces mentioned above, using a miner that mines 10 terra-hashes per second (TH/s), it would take approximately 25 years to complete a new block. Sounds insane, right? Now there is a slight "luck factor" involved. Technically, your solo miner could complete a new block in a matter of seconds. Let's say it tried the number 1, as we mentioned earlier, and didn't return the proper result. Then it tried the number, then 3, then 4, etc. Well if it tried the number 102,450, which it would do in the first second, and if that number was correct, then you've just completed an entire block. However, the likelihood of this happening is extremely low. Some refer to it as the "luck factor" and others call it the "lottery factor" but regardless, it is the same.

For pool mining, you actually link up with a bunch of other miners, and everyone "pools" their hashing power together. So instead of your one 10 TH/s miner doing all the work, you join up with, say, 50 other people who also have the same computing power. Now, instead of approximately 25 years, you can do it in approximately 6 months. However, this means you share the block reward. So currently, the block reward is 12.5 BTC, split between 50 miners, would amount to 0.25 BTC per miner. However, most pools don't contain miners of equal hash power. That is, you may have a single miner at 10 TH/s, but someone else may have 5 of them, and someone else may have at only 5 TH/s. So most pools pay out using Pay-Per-Share (PPS) models. Meaning, however much you contributed to the entire pool, is the share of the reward you get. So again, if we had 50 miners, but you yourself contributed 10% of all the pool's hashing power, then you wouldn't get 1/50th of the reward. Rather, you'd get 1/10th (10%) of it, meaning 1.25 BTC instead of 0.25 BTC. This is done to fairly and equally distribute the reward, so that those who come in late to the game or only contribute a fraction to the hashrate don't take away from those that perform most of the work.

The downside to a pool over solo mining is, A) you have to share the reward with all pool members and B) whoever manages the pool get's a fee. Usually this is 2% or less, of the total reward.

Halving & Supply

As a side note to the block reward, I noted that it is (at the time of this writing) 12.5 BTC. Well it wasn't always this many. Bitcoin uses a process called "halving" where every 210,000 blocks (approximately every 4 years), the reward drops by 50%. Prior to July 9th 2016, the reward was 25. After that date, it dropped to 12.5. Sometime around mid-2020 it is likely to halve again, this time to 6.25. Then to 3.125. Then to 1.5625, and on and on. It is estimated that around the year 2110 is when the last BTC will be mined. This is a means of helping to grow the supply slowly over time, while also combating inflation before reaching the final supply limit of 21 Million.

It is worth mentioning also that while 21 Million is all that will have ever been created of Bitcoin, there will never be that many in use. Some BTCs have been lost. If a person loses their private key (explained below) and cannot recover it, then their wallet will never be accessed and the money is simply sitting in the blockchain, unable to move. This has happened multiple times to people, to varying degrees.

Wallet

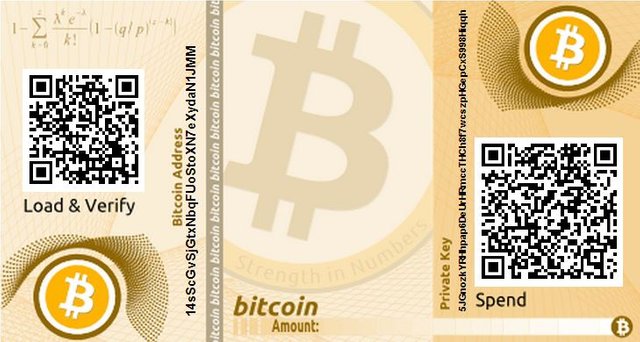

This one is pretty simple, and can usually be inferred just by the name: wallet. A Crypto wallet is essentially an account where the Cryptocurrency is stored. For Bitcoin, this could be an application on your computer, or an app on your iPhone/Android, or on a special flash drive called a "ledger" or on a cloud server somewhere accessed through a website. You can even store it in a QR barcode and print it out on paper and have a physical/tangible wallet.

A bit more technically, recall that all transactions are stored in the blockchain, the distributed public ledger (logbook). So really, all Bitcoins are stored there, too. However, your wallet contains cryptographic keys (sets of characters that identify your account and your amount of Bitcoin, specifically, in the blockchain).

Wallets use both public keys (addresses) and private keys (addresses). The public key is a string of characters that you give to others for them to send you BTC. (My public key/wallet address for BTC, for example, is 1MGkppcwF3ZaNCFd187UisP3LubEK8CZVS, just in case anyone wants to send some my way ;). The private key is used for sending and making payments, so it is kept hidden and only the owner should be privy to it.

When spending Bitcoin, this private key is provided by the wallet to allow the user (you and me) to write into the blockchain, thus creating a transaction. John uses his private key to send 0.5 BTC to Lisa's public key address. Think of your private key like your PIN number on your debit card. No one can spend money from your account without it (not even you). Then think of your public key like your bank account number itself (sort of). People can send money to your account simply by knowing your account number (public key), but without the corresponding PIN (private key), the money cannot be sent out of your account.

The above image is an example of a paper Bitcoin wallet; it has the keys printed on it as well as QR codes for sending/spending, and receiving/loading.

A person can have as many wallets as he/she desires. However, just as you can never have the same dollar in two physical places at once, so you can never have the same Bitcoin in two wallets at the same time; you would have to transfer it from your first wallet to your other wallet.

Brief Recap

Let's stop for a moment and recap everything up to this point. Bitcoin is a digital currency that has value because people agree that it does. It is run by a distributed, decentralized technology called the blockchain, that is essentially a giant logbook of all transactions. These transactions are combined into bundles called blocks. The blockchain is managed by – and transactions are processed by – Bitcoin miners. The miners are incentivized to mine and keep the blockchain going because they earn rewards whenever they complete new blocks. As more blocks are completed and the number of miners increases, the difficulty level increases. Because the difficulty level is so high, most miners combine their computing resources into pools, where they share the block reward. When miners are paid out rewards for completing new blocks, their BTC reward is sent to their BTC wallet. A wallet is like a Crypto bank account. A wallet uses a public key (like an account number, used to receive BTC) and a private key (like a PIN number, used for sending/spending BTC). Make sense? Hope so.

Real quick, you may have noticed that I mentioned previously there will be only 21 Million total BTC. And miners receive the new BTC payouts are rewards for mining. So why would anyone continue to mine, once that last BTC is paid out? Well the original plan for BTC at least, was that after the last BTC is mined, miners will be paid a transaction fee to keep the blockchain running. These fees can vary based on a number of parameters such as size of the transaction, amount of BTC being transferred, time, location, etc. So someone transferring 500BTC would expect to pay a higher transaction fee than someone transferring 0.25 BTC.

Now, I've mentioned ASIC miners a couple times already, so let's define that really quickly.

ASICs

ASIC stands for application-specific integrated circuit. An integrated circuit is a small computer chip that is built on a semi-conducting (as in, conducting electricity) material. These chips are miniature versions of larger, "discrete" electronic components. The phrase "application-specific" means that these integrated circuit chips are designed for a very specific application. In the case of Bitcoin mining, that specific purpose is running the SHA-256 algorithm.

You see, most computer processors are not application-specific, but rather, they are multipurpose. For example, you're reading this article right now on an electronic device. Maybe on a desktop, maybe a laptop, maybe from your mobile phone, or even your video game console. But regardless of the method, your device has a Central Processing Unit (CPU). This is the workhorse of a computer. The CPU takes instructions and input from the user and runs code to accomplish its task. The CPU that your device has can do many things. Maybe open an email in an email app, or open a web browser and view websites, or play Angry Birds, or take pictures. All these different tasks are executed (run) and controlled by the CPU.

But an ASIC doesn't use a CPU to do its task, and as such it isn’t a multipurpose machine; it uses a number of circuits built to only run one set of instructions, and that's to mine Bitcoin. In the image above, you see an array of ASIC (AVALON) chips designed for use in Bitmain's Antminer. These chips run their given algorithm repeatedly and rapidly.

Because these chips are made to only serve one purpose, they can do it far more efficiently than the typical computer. That's why, at least for Bitcoin, no one uses their laptop, desktop, or mobile device to mine it anymore: they only use ASIC miners. While a nice desktop computer may reach upwards of 700 Megahash per second (MH/s), this pales in comparison to ASIC miners. Remember that 700 MH/s = 700,000,000 (700 million) hashes per second. Meanwhile, a typical ASIC miner will perform at over 10 terahashes per second (TH/s), which = 10,000,000,000,000 (10 trillion). Meaning it would take thousands of those desktops to equal one ASIC miner.

There are many Cryptos, however, that are ASIC-resistant, and we'll look at those in part 3. For now, I hope I have adequately explained what an ASIC miner is, and why it's the only profitable way to mine Bitcoin anymore.

Power Usage

Power usage is another quick topic to mention. While it isn't really a term we need to define, it needs to be understood that this affects profitability. All electronic devices use power. You have to charge your phone and laptop batteries; your desktop has to remain plugged into the wall. ASIC miners are no exception. They do, however, draw a LOT of power. A typical gaming computer with two nice graphics cards (GPUs) and a really powerful CPU can typically be run just fine with an 800 Watt power supply. An ASIC miner, however, such as the Bitmain Antminer S9 (the most recent, popular, and powerful of commercially-available ASICs) uses a lot more power. The S9 has a maximum hashrate of 14 TH/s, which is incredible. However, it also uses 1372W of power. Let's break that down for a minute.

For a typical residential home in my area, electricity costs $0.09 (that’s 9 cents) per kilowatt-hour (kWh). Well, the S9 uses 1372W, which is 1.372 kilowatts (kW). Working out the math, that's roughly $3/day. Now that doesn't sound like much, but that's per day for only one miner. If you had 3 of these, that would be $9/day just for electricity costs. That's $270 on an average month in addition to your typical electric bill. So now imagine having a building set up with racks and racks of these things, maybe 100 in a small room. That's $300/day in electricity costs, or $9,000/month.

So ya see, it can be quite expensive. Now if you live in an area where electricity costs even more, like parts of the US where it's $0.13/kWh, then your one month bill would increase nearly $130/month per miner.

All that to say, this is something that has to be factored into mining. Never mind the fact that ASIC miners like the Antminer S9 cost anywhere from $3,000 to $5,000 in the US.

Exchanges

So aside from mining, how else can you acquire Bitcoin? Well someone can send you BTC, either as a gift, for a purchase, or for any other reason you receive money. You can also "purchase" Bitcoin on an exchange. This is practically no different than exchanging your Dollars for Pounds or Euros or Yuan or Yen. You can also exchange various types of Cryptocurrency for other Cryptos. So you could trade Litecoin for Bitcoin, for example, or Ethereum for Monero. (All of these other Cryptos will be addressed in part 3).

In North America, the largest and most prominent of these – and indeed, one of the largest in the entire world – is Coinbase. Coinbase currently provides wallets and trades/exchanges for Bitcoin, Ethereum, Litecoin, (I call them the Big Three) and recently they added Bitcoin Cash. Coinbase allows users to link their checking account to their Coinbase account, so that their fiat money (dollars) can be pulled out when they want to purchase a Cryptocoin. In turn, they get the equivalent amount in that Crypto, minus a small transaction fee.

Using/Spending

While we've looked at how BTC works, how it's mined, how it's stored and processed, we haven't yet looked at how it is actually used.

In essence, spending Bitcoin to pay for goods and services (or as a gift or donation) is no different, at least in theory, from spending regular paper money. The only major hindrance to this is, at this point, implementation. Just like a few decades ago, when only big companies and chains accepting credit cards, so too Bitcoin is taking a little time to get off the ground. Just because it's worth something, doesn't mean the vendor will accept it. However, we are still in the infancy stage right now. Soon it'll be no more difficult to spend Cryptocurrency than it is to spend money on a credit/debit card, or using Apple Pay/Android Pay.

As a matter of fact, Coinbase is actually working on improving their platform of payment processing, and making the service available to others. This is similar to PayPal. You have money in your PayPal account, and when you go to spend it, PayPal processes the transaction, deducts the money, and pays the vendor. So too is Coinbase doing with Bitcoin, allowing consumers like you and me to purchase from online vendors by spending Crypto.

There are also other vendors out there that are working on creating Crypto products. There are companies that do investing, such as IRA retirement accounts, where they invest the money not in the stock market but in Cryptos. There are multiple banks such as Goldman-Sachs now looking at allowing financial buys and trades into Cryptos. Ebay is looking into accepting Crypto payments, and a large tech company in Japan is now paying employees all or in part in Bitcoin.

So in the coming years, it will not at all be odd for companies to offer benefits including Cryptos, just like many offer stock options and profit sharing now.

And if you're looking into Cryptos but are thinking, "Man I'd love to buy Bitcoin, but I don't have $15,000 lying around to get started." Well, don’t fret, dear friend! You do not have to purchase a whole coin. Rather, you can purchase smaller denominations. Just as a US Dollar can be broken down into 100 pieces called cents, so too can a Bitcoin be broken down. Except it can be broken down into 100,000,000 one-hundred million) pieces, called Satoshi. So the smallest denominations of BTC is 1/100,000,000th of a BTC, or 0.00000001 BTC (equal to about $0.00015 dollars).

Security Warnings

As with anything in cyberspace, there is always a risk. Many people fear that Cryptos cannot be trusted because they can be hacked. And yes, there are ways to hack Cryptocurrencies. But remember, there are ways to hack your checking account and credit cards, too.

The blockchain is actually virtually impenetrable by nature, and this is its major strength. When describing the double-spending problem, I noted that we would look at how the blockchain is so secure. Well you may wonder, "What if someone hacked into the blockchain and started just inserting new blocks full of transactions where they gave themselves Bitcoin?" The simple response is, that's not possible. First of all, in order for the blockchain to accept a new block at all, the new block must contain a reference to the block before it. In addition to that, it must solve the mathematical puzzle that requires it to hash its value so many times. So essentially, in order for a hacker to insert new blocks into the blockchain, he would have to be mining as well, and hoping to force his falsified block into the blockchain. However, even if he succeeded, the other nodes on the blockchain would recognize that his newest block doesn't match the prior transaction data that they possess, and they would reject the block, and as such it would not be credited to the hacker.

The most dangerous way for a person to lose their Bitcoin to hacking is actually by the hacker obtaining your wallet's private key and basically sending themselves Bitcoin from your wallet. This would be no different than someone stealing your debit card and PIN number and withdrawing your money from an ATM.

Another way that people steal Bitcoin via hacking is done by hacking the exchanges. The most notorious example is Mt. Gox. Mt. Gox was, for a couple years, the largest Crypto exchange in the world. The Japanese company handled roughly 70% of Cryptos in the whole world. However, beginning in late 2011 and ending in 2014, Mt. Gox was hacked, to the tune of 850,000 Bitcoin (at the time worth nearly $500 Million, and now valued at over $12 Billion). While about a quarter of that was recovered, much of it was lost.

So how did it happen? What's to keep it from happening again? Well for starters, Mt. Gox was hacked by someone who stole login credentials to their system. The money that was stolen was that which had been deposited into Mt. Gox wallets for trading and exchange purposes. So while users may not have had their personal wallets hacked, their corresponding Mt. Gox wallet, used for trading, was hacked. This is why it is important to maintain tight security on your wallets. It's also why many people opt for what's known as "cold storage" or hardware storage. Storing wallet private keys in a private, offline place, so that it cannot be stolen. This, however, is a security issue itself. Let's say your store your keys on a flash drive (a ledger), but then you lose it. Well if you can't recover it and have no backup, your key is gone for good. Those BTCs will sit in the blockchain indefinitely, as mentioned in the Halving and Supply section above.

A more recent example of security problems happened not but just a few weeks prior to the writing of this article: NiceHash was hacked.

NiceHash is a company that allows a miner to sell their hash power. Basically, let's say that I build a mining rig, but don't want to mine for myself. I can connect to the NiceHash network and "Rent out" my miner to someone else. They pay NiceHash and NiceHash pays me, to allow them to rent out my mining rig and mine the coin of their choice using my rig, remotely.

NiceHash also has its own mining pools for various currencies, and their own mining software that allows the user to test their hardware and mine whatever Crytpo is most profitable at the time with their rig. While mining, the user has to wait until they hit a certain threshold before they can get paid. This is about 0.01 BTC (today equivalent to about $150). So before hitting that threshold, your hash power has been used to mine coins, and those coins are sitting in a sort of holding. Once you hit the minimum, you can withdraw the mined amount in BTC.

So what the hacker did was find a way into that Crypto holding area and dump from the holding account into the hacker's account. So while individual users didn't lose their own Bitcoin, they did lose any potential payout they were awaiting while working towards hitting the threshold. The hacker made off with roughly $70 Million worth of BTC.

Market Warnings

So now that you (hopefully) understand a bit more about how it works, let's focus on the doom and gloom warnings that are sounding off right now about it. For starters, you've likely heard Bitcoin referred to as a bubble. This is a market term, essentially meaning that the value of something is rising based entirely on speculation and isn't going to stick around. Some classic bubbles in American history are the Dot Com bubble in the 90s and the Housing bubble at the beginning of the Obama Administration. Speculation, falsely low interest rates, and easy risky loans meant a LOT of people took out housing loans and investments. When the market began to correct itself – as markets always do – the "bubble" burst, and a lot of people were left broke, holding a mortgage. Add to that the Wall Street investment problem: where investors were investing money into those same mortgages and loans. This money came from many peoples' retirement accounts. When the bubble burst and the loans defaulted, the invested capital was gone, and the people lost their money.

So the "bubble" warning is certainly plausible. However, one must remember that Cryptocurrency is not like other investments. Sure, it's still an investment and yes, it still bows to economic principles such as supply & demand and scarcity. But it is still different. As I mentioned, Cryptos are still in their infancy. And even more, is that the level of mass implementation is just now beginning to take off. Once that happens, it will solidify them in the marketplace.

Another warning is in regards to Crypto's inherent volatility. Meaning that the value can rise and fall drastically in no time at all. This is obviously true. Earlier in 2017, towards the end of the summer, Bitcoin saw a massive jump. It climbed the $2k, $3k, and even $4k marks in a matter of days. It reached $5k when a major Chinese market dissolved, and a ton of Bitcoin was dumped into the market as people were selling off. This sharp increase in supply caused the price to drop by 50% in a day. However, the market corrected. Again demand began to rise and with it, the price. Bitcoin then began to rise steadily, climbing to nearly $20,000 before taking another hit and settling around $14,000. Yet even in its two major dips post-Summer, it never dipped as far as it was even at the beginning of 2017.

So yes, it is volatile. You could invest $100 on one day, and the next day it would be worth $350. But then a day later, it could be worth $75. This is where it helps to learn the market. Learn about different coins, and what their purpose is. Once you do this, you'll be able to more accurately predict what the market will do, which coins will rise, and which will fall.

And with that, I will close this second part. I hope this has enlightened you as to some of the inner-workings of Bitcoin specifically, and indeed Cryptocurrencies in general. In the next part we will look at different Cryptos, different rules (forks), mining rigs and other hardware, and the like.

Congratulations @jabrown! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @jabrown! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit