Recent tensions between Russia and Ukraine have attracted worldwide attention, and the latter has even tapped into blockchain to finance its military operations. This marks the first time that cryptocurrencies ventured into global finance while playing an all-new role. In light of the market swings as the result of the military tensions, crypto investors should take additional measures (e.g. trade contracts according to market fluctuations) while keeping track of the latest changes in the industry.

Contract trading has remained a popular investment choice in the market of crypto derivatives. For example, perpetual contracts have become mainstream crypto derivatives within a very short period thanks to features such as long-term holding, long/short trades, and high leverage. Under market swings, you can trade contracts to mitigate the relevant risks.

On a crypto exchange, the funds for different types of trades are independently stored in different accounts, which work like your bank accounts — One account for fixed deposits; another for investment. In the crypto world, asset transfer resembles the transfer of funds between bank accounts. For instance, the funds in your finance account and margin account are unrelated. More specifically, assets in the finance account are designated for financial operations; if you need to use these assets for margin trading, then you should first have them transferred to the corresponding margin account. The same applies to contract trading. Before trading linear/inverse contracts, you’ll have to first complete asset transfers to make sure that there are sufficient funds in the contract account for trading contracts.

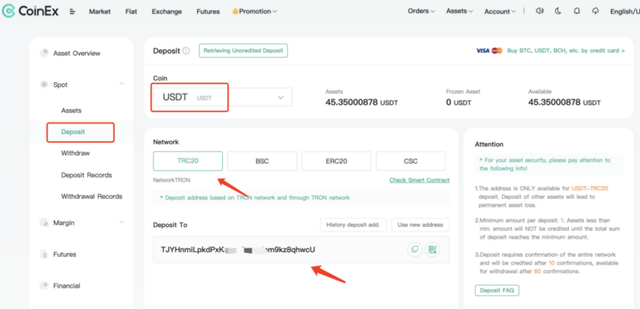

If you are logging in to CoinEx for the first time, please be sure to deposit sufficient cryptos in the spot account. In the case of USDT, you’ll need to select USDT as the Coin to be deposited, as well as the Network, and then deposit USDT to the address specified on the page (see below) from your wallet or other accounts.

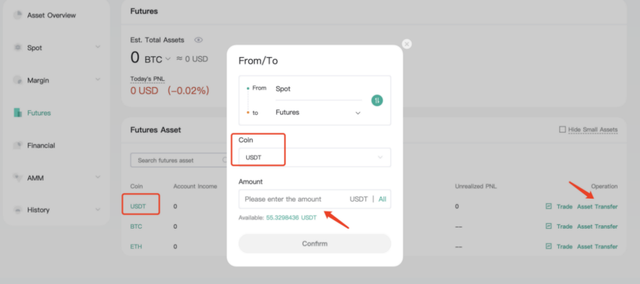

You can transfer the assets to the contract account once assets are available in the spot account. In the case of USDT, there are two methods of asset transfer. First, you can select Futures under Assets on the CoinEx website, click on USDT on the Coin list, enter the amount you wish to transfer, and then click on Confirm. On CoinEx, asset transfers between accounts are conducted in real time, which is convenient and fast.

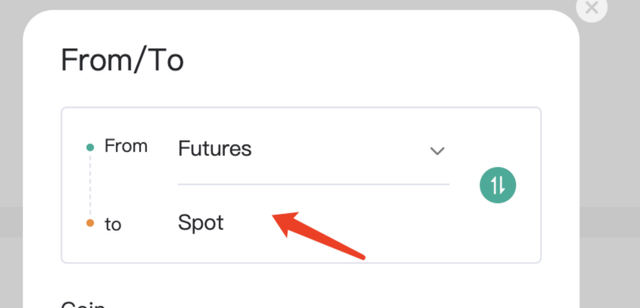

By the same token, you’ll also have to go through asset transfer when transferring assets from the contract account to the spot account. Please note that the From/To setting differs, and in thise case it should be From Futures to Spot.

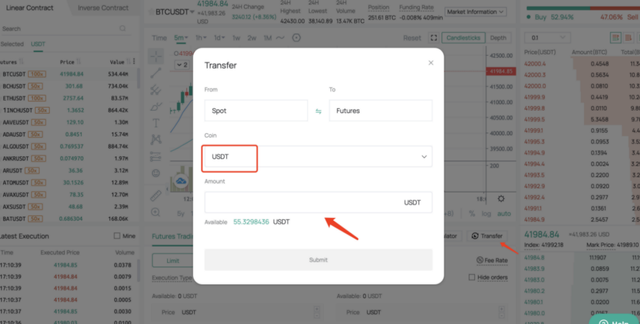

The second method of asset transfer is to click on Transfer on the Futures Trading page and click on Submit once the Coin and Amount are determined.

Having learned how assets are transferred between different accounts, you can now allocate your funds to the contract account in no time even if you are still a crypto newbie. Under the Cross Margin model, you can simply transfer assets to the contract account with great efficiency if you wish to add more margin (added automatically using assets in the contract account). It is fair to say that asset transfer is an essential operation in contract trading.