(Source: https://www.all-about-psychology.com)

(Source: Free Range, Organically Grown by my Mom and Pop Circa: none of your business, :-P)

Hi, I wanted to introduce this piece on Behavioural Finance and how I have related it to Stock Market Bubbles and Crashes, a labour of love I wrote I wrote a few years ago when getting into this subject matter.

It may be a long read, but I believe a satisfying one for those interested in the subject.

I hope will provide some insight into why these phenomena occur through the marriage of Psychology and Finance.

Your thoughts and feedback are welcomed...... @Shenobie

Introduction

Johansen (2004) defined crashes as the top-rank filtered draw-downs, and that all crashes can be linked to either an external shock or a log-periodic power law bubble with an empirically well-defined complex value of the exponent. This can affect an efficient market hypothesis depending on if the market instability the crash represents is internally or externally generated. Frankel (2004) added that stock prices will fall below fundamentals if there is a sharp decrease in demand for the stock. For this reason, naïve investors’ assessment of future volatility will be raised since they are risk-averse. Therefore, the presence of naïve traders encourages crashes to occur. Fund level-flow has a positive (negative) impact on a fund’s future performance for smaller (larger) funds whereas strategy-level flow has a negative impact on the fund’s future performance (Zhong 2008).

Characteristics of Bubbles and Crashes

Market crashes are generated from a slow accumulation of long time interval correlation which could lead to a critical collapse of the stock market (Johansen and Sornette 2000). The success of income trust in the retail market has been a significant concern given the complexity of the income trust units. Zetzsche (2005) suggested that income trust boom exhibited the following characteristics:

• Partial inefficiency of the capital market.

• The steep rise in stock prices.

• Leverage

• High volume of share purchase.

• Alignment of interested parties.

Rational investors usually overestimate the return their investment (Inderst and Muller 2002). Bubbles begin with an acceptable rise in stock prices. If the increase in stock price persists, people tend to invest more, and it raises the alarm for the naïve investors to own shares. In this sense, investors believe that the recent stock market performance could be used as a forecast of the future return by investing more in stock and this typically causes an increase in stock prices. These rational investors monitor the stock market by trading when there is an increase in share price, and sell when the share price falls thereby causing great fall in stock price. Bubbles are the outcome of the forecast expectations of individuals who have the notion that any recent occurrence will persist (Coffee 2003). During a bubble, those who are careful and prudent will be outperformed by those who recklessly have a forecast of extraordinary future return. Furthermore, Frankel (2004) demonstrated that rational investors decrease their demand for stock causing a sudden fall in share price. This fall in demand caused by risk-averse investors lowers the market’s risk bearing ability after the crash. The crash creates awareness to naïve investors of the risk in buying shares in the market, and this makes investors unwilling to own stocks. However, the involvement of naïve traders in the stock market is necessary for the crash to occur since they are reluctant to acquire shares on the crash day due to their high expectancy of future return, and this could lead to a dramatic fall in share price. Johansen and Sornette (2000) took up the observation made by Shiller (1995) that imitation could account for a market crash. Investors buy or sell a stock just because their friends are doing same. This attitude would lead most traders to do the same thing at the same time. For example, if imitation reaches a certain point known as the critical point, it will not be surprising that most investor may sell at the same time, thus encouraging a crash. Asset bubbles are still not well understood (Ball 2009). Fama (1962) Proposed the theory that efficient market hypothesis is a contributing factor to an asset bubble. The idea backing efficient market hypothesis consists of two notions, the first is the insight that competition imposes an association between revenue and cost. When there is an excess profit, investors will be attracted to invest, and this will reduce or eliminate the profit. The second notion assesses changes in asset price as a dependent factor in the flow of information to the marketplace. A combination of the two insights gives rise to an efficient market hypothesis which infers that an investor cannot expect to earn above the average return by using publicly available information since it is already reflected in the price. Ball (2009) argued with Fama (1962) that if there is competition and business is operating at the current market price, it will definitely become inefficient. Individual investors will get specific information from others because the current price does not adequately reflect every available public information.

Social and Psychological Factors

Herding can be divided into intentional and spurious herding (Bikhchandani and Sharma 1996). The former arises when an investor deliberately copies another investor with the notion that the investor is acting on information, and the latter occurs when two investors facing the same decision problem and the same set of information take same decisions. In respect of Johansen and Sornette (2000) contribution, people are led by what other people are doing without any genuine reason. They could end up fitting into the behaviour of others, and such conduct illustrates a form of herding, which assists in further explanation of bubbles and crashes. Stocks bought by herd steep up the stock price while stocks sold by herd leads to a dramatic fall in share price (Brown et al. 2008). If the individual view investors have concerning the market are unvarying, the stock market will as a result move in the same direction. There is an increase in the price of the stock when people buy stock because other people are buying and decrease in cost of stock if people sell a stock just because other people are selling (Arthur et al. 1996). When investors’ full rationality is on the market, they are no longer motivated to trade and exhaust all available information.

Coffee (2003) demonstrated that corporate governance depends on the gatekeepers. Gatekeepers are reputational means which provide verification and certification services to shareholders. Their primary functions are to verify the company’s’ financial statement, assess the company’s financial prospects and business opportunities, amongst other services. Suitable examples of gatekeepers are attorneys. In a bubble, gatekeepers become less useful which could lead to a decline in both their leverage over their customers and reputation, their services are not much required by investors even though they have been used as standards against fraud. One explanation for this is that individuals exhibit bounded rationality and do not obtain all information relating to an optimal decision because their false belief is based on the idea that extraordinary return will persist.

Barber et al. (2005) studied the trading behaviour of individual investors using the trade and quote (TAQ), an Institute for the study of security markets (ISSM) transaction data. The result obtained from the period 1983-2001 revealed an order imbalance which indicates strong herding by individual investors. The involvement of noise traders in the stock market affects stock prices (Shleifer and Vishny 2007). An informed trader would not want to buy a stock that is higher than the fundamental value if there is a perfect substitute that presents a low cost. If more investors do this out of sentiment, the prices of both the substitute and the overpriced stock will become the same. If investors trade at a discount at a large quantity, they are likely to buy and sell the same stock (Barber et al. 2005). Also, Arthur et al. (1996) analysed that agents form their expectations in anticipation of other agents’ expectation. They exhaust all available information and choose the one that predicts best which implies that prices of a stock are influenced by agents’ expectations and these expectations are a product in anticipation of other agents’ expectations. Kaizoji (2010) examined the rationality of the noise trader’s behaviour and proposed that the decision made by individual noise trader is influenced by the decision of the other noise traders. Noise traders act on rumours (Redhead 2008). They employ irrelevant and unreliable information in decision making. The pressure to act on the information does not allow them to know the accuracy because of the pressure. In such circumstance, many people would herd by buying into the rumour. The noise traders’ demand for the stock increase will create an increase in stock price, and when the bubble asset tends to zero, the demand decreases which calls for a decrease in stock price. Choi and Sias (2009) suggested that herding primarily arises due to the influence of information flow on the stock price. However, individual investors receive this information at different times, and the late informed investors seem to follow (herd) the earlier informed investors. Thus information merges with price over time. Bikhchandani and Sharma (1996) suggested that herding could be found among money managers when there are incentives provided by the compensation scheme. There is the likelihood that the nature of their employment entails that imitation is rewarded. They will prefer to do as the other managers do to secure his position. Choi and Sias (2009) added that another explanation to herding runs regarding reputation. Investors will want to preserve their reputation by copying other institutions with the same similarity of reputation. For instance, a mutual fund will copy another mutual fund that is reputable and shows much attraction to individual investors. Graham (1999) concurred with Choi and Sias (2009) that managers with good pay and high reputation will imitate managers with the same qualities to preserve their jobs and pay by taking actions those managers take based on their information. If there is an attractive incentive for managers who herd to preserve their reputation and pay status, they will be motivated to herd more. (Boyson 2010). Gleason et al. (2004) asserted that when uncertainty in the market increases, investors are likely to imitate other investors because they don’t have an idea of future return on investments, thus they believe that the other investors have better information. Another rational herd behaviour is the information-based and cascade. (Bikhchandani and Sharma 2000). In a situation where individual investors are faced with a similar investment decision, and there is public information with uncertainties, they will herd following each other’s action, not regarding the information. Herding emanates when there is the uncertainty about the correctness of average traders’ information. (Hwang and Salmon 2004).

The Implication of Behavioural Finance for Understanding Bubbles and Crashes

There are some psychological factors that could logically distort investors’ rationality (Redhead 2008). The following biases could account for stock market bubbles and crashes.

• Representativeness and Narrow Framing

Ljungqvist et al. (2004) explained that the impact of investors’ sentiment goes a long way to explain fluctuations in stock price. When investors’ sentiment is high, there is a greater issuance of stock, and when sentiments are low, supply will exceed demand resulting in an underperformance (Lee et al. 1991). In this sense, investors’ exuberance would lead to increase in stock price, and a decrease in underpricing as rational issuers take advantage of them (Ljungqvist et al. 2004). Redhead (2008) explained representativeness as an emergence of investors’ opinion with price affecting. Perhaps, the persistence of belief could affect trade which brings about bubbles and crashes. However, Redhead (2008) suggested that the effect of this persistence can be illustrated using the concepts of conservatism and confirmation bias. Conservatism portrays individuals who are unreceptive to new information even when their notion about price is uncertain. Confirmation bias is the likelihood of people buying ideas that are similar to their idea, ignoring any opposing notion.

Furthermore, Redhead (2008) observed that individual investors focus on the present neglecting the future (narrow framing). The consequence is bubbles and crashes since there is an increase in price which could further lead to future growth, hence, when the price reaches its critical value, a fall in price will be the outcome.

• Overconfidence

In most cases, most managers and entrepreneurs seem to overinvest because of their overconfidence (Ben-David et al. 2007). Deaves et al. (2010) demonstrated that those who have been fortunate and attained success in their various fields are usually more confident than the novice. Overconfidence could emanate when naïve investors suddenly get a hit to net income (Redhead 2008). They become overconfident of their skills, and they would be driven to invest more. The analysis conducted by Deaves et al. (2010) revealed that investors who invested more out of overconfidence experienced greater market experience. Those investors who have a greater financial market experience were overconfident. Behavioural finance analysis depends on the significance of overconfidence to shade more light on its effects on the stock market (Chuang and Lee 2006). Chuang and Lee (2006) explained that overconfident investors seem to trade in risky stock than the risk-averse, not considering the risk consequence. However, they borrow money to buy more stock to increase shareholding and maximise wealth. This elevates overconfidence because they give credits to their expertise as a result of their success. Hilary and Hsu (2011) concurred that overconfidence exists among managers. Hilary and Hsu (2011) took up the view by Hastorf et al. (1970) that managers believe that their achievement is based on their ability and attribute misfortune to external noise. They overestimate their skills and rate it better than average (static confidence). Furthermore, managers trust so much in private information that they seem to neglect any publicly available information signal (Kraemer et al. 2006). This is known as the weighting effect.

The Crash

Zhou and Sornette (2004) proposed that anti-bubble which results from a decrease in stock price was a case of market instabilities. Zhou and Sornette (2003) research revealed that positive feedback if unchecked leads to high deviation from fair value causing corporate herding and imitation among investors and the consequence is a crash. The mispricing effect of herding leads to a bubble and subsequently crashes. (Hwang and Salmon 2004).

Redhead (2008) suggested that emergence of new companies and rising interest rate can cause fall in stock price. The former occurs when new companies merge to compete with the existing companies. However, the new companies push down the profit margin of the current companies by issuing out shares. If the supply of the shares exceeds their demand, there is a gradual fall in share price which could end in a crash. The latter explains that rising interest rate could also lead to a crash. During a market bubble, investors usually borrow money to acquire shares, and in a rising interest rate circumstance, investors sell off their shares to offset the accrued interest, and this selling of shares could conclude in a crash.

Price Bubbles and Banking Crisis

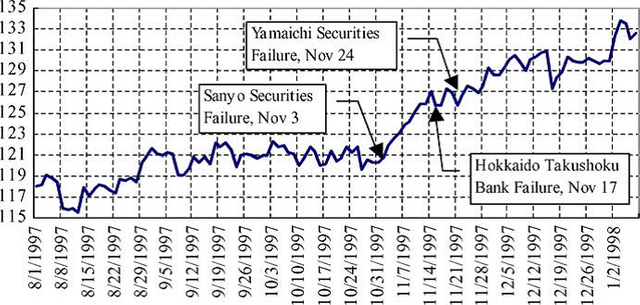

Fall in stock price does not only affect investors but destroys banks (Redhead 2008). This is because the banks buy shares and lend money to buyers also. If there is fall in share price, the price of properties will equally fall having a considerable impact on banks since the properties are financed with money borrowed from the bank. Peter (2009) stated that bank crisis emanates from the devaluation of bank assets. A most recent example is the Japanese bank crisis and the global financial crisis. Firms take a loan from the bank to buy assets (real estates) which they hope to resell at a valued price in future to the upcoming firms. When price declines, asset prices fall which affects the expected future returns on the assets. As a result, the older firms suffer loss, the banks’ wealth is affected, and a further decline in price will affect the bank capital leading to bank crisis. It resulted in banks restricted their lending ability to customers (Miyajima and Yafeh 2007). The analysis of the bank crisis in Japan revealed that not all the industries were affected. Some industries (transportation and electronics) were better off than the others (real estate, construction and textile). Those industries with high debts (real estate, construction and textile) were restricted from borrowing. Moreover, Banks call for the loan to be paid (Redhead 2008). This will lead the developers or speculators to sell off their assets to pay the loan. The more assets are sold, the more prices fall, and the overall assets fall below the value placed on debt. Hence they end up in bankruptcy. Hashimoto (2005) gave a clearer picture of the late 2007 Japanese bank crisis. Hashimoto suggested that the crisis must have been caused by liquidity effect before the Yamaichi Securities failure as illustrated below:

Fig. 1. JPY/USD daily exchange rate August 1, 1997–January 8, 1998.

The difference between Japanese Yen (JPY) and US dollars was huge and this affected Japanese stock market. Japanese banks were short of dollars which raised an urgent alarm for dollars from dealers. The crisis led to the closure of renowned securities in Japan including Yamaichi Securities which is one of the most prominent financial institutions in Japan.

The prospect of bank crisis could make customers to panic and strive to withdraw their cash (Redhead 2008). However, banks will not be able to pay out cash and will probably be on the run. For this reason, the central bank intervened by lending money to banks in an emergency to enable them to pay their customers.

Conclusion

Bubbles and crashes play a significant role in the efficient market hypothesis. The research on bubbles and crashes has been on for decades, and many researchers have come up with views of what triggers it. Some suggest the introduction of new information.

Bubbles begin with a justified rise in stock price motivating investors to act rationally. Individuals may have rationally based on their belief in expected future return. It is possible for an investor to acquire stock at a high price and later sell it at an even higher rate when there is a continuous rise in stock price and the reverse would create a loss.

The mispricing effect of herding is another reason that accounts for bubbles and crashes. There is a step up in stock price, and when price approaches its critical value, price begins to fall and results to crash.

Behavioural finance explains that investors act irrationally. Representativeness bias and narrow framing contribute to bubbles and crashes since the stock market is affected by trading behaviour mostly when naïve investors are involved.

REFERENCES

Arthur, W. B., J. H. Holland, B. LeBaron, R. Palmer and P. Tayler (1996) ‘Asset Pricing Under Endogenous Expectations in an Artificial Stock Market’, Santa Fe Institute, University of Michigan, Brandeis University - International Business School, Duke University and Independent, working paper series.

Ball, R. (2009) ‘The Global Financial Crisis and the Market Hypothesis: What Have We Learned?’, Journal of Applied Corporate Finance, Vol. 21, Issue 4, PP.. 8-16.

Barber, B. M., T. Odean and N. Zhu (2005) ‘Do Noise Traders Move Markets?’, EFA 2006 Zurich Meetings Paper, Working Paper Series.

Ben-David, I., J. Graham, and C. Harvey (2007) ‘Managerial overconfidence and corporate policies’. NBER Working Paper 13711.

Bikhchandani, S. and S. Sharma (1996) ‘optimal search with learning’, Journal of Economic Dynamics and Control, Vol. 20, Issues 1-3, PP. 333-359.

Boyson, N. M. (2010) ‘Implicit incentives and reputational herding by hedge fund managers’, Journal of Empirical Finance, Vol. 17, Issue 3, PP. 283-299.

Brown, N. C., K. D. Wei and R. Wermers (2008) ‘Analyst Recommendations, Mutual Fund Herding, and Overreaction in Stock Prices’, Georgia State University - J. Mack Robinson College of Business , University of Texas at Dallas and University of Maryland - Robert H. Smith School of Business, Working Paper Series.

Choi, N. and R. W. Sias (2009) ‘Institutional industry herding’, Journal of Financial Economics, Vol. 94, Issue 3, PP. 469-491

Chung, W., and B. Lee (2006) ‘An empirical evaluation of the overconfidence hypothesis’, Journal of Banking & Finance, Vol. 30, Issue 9, PP. 2489-2515.

Coffee, J. C. (2003) ‘What Caused Enron?: A Capsule Social and Economic History of the 1990’s’, Columbia Law and Economics Working Paper No. 214.

Deaves, R., E. Luders and M. Schroder (2010) ‘The dynamics of overconfidence: Evidence from stock market’, Journal of Economic Behavior & Organization, Vol. 75, Issue 3, PP. 402-412.

Fama, E. F. (1963) ‘Mandelbrot and the Stable Paretian Hypothesis’, ,” Journal of Business, Vol. 36, Issue 4, PP. 420-429.

Frankel, D. M. (2004) ‘Adaptive Expectations and Stock Market crashes’, AFA 2005 Philadelphia Meetings.

Gleason, K. C., I. Mathur and M. A. Peterson (2004) ‘Analysis of intraday herding behaviour among the sector ETFs’, Journal of Empirical Finance, Vol. 11, Issue 5, PP. 681-694.

Hashimoto, Y. (2005) ‘The impact of the Japanese banking crisis on the intraday FX market in late 1997’, Journal of Asian Economics, Vol. 16, Issue 2, PP. 205-222.

Hilary, G. and C. Hsu (2011) ‘Endogenous overconfidence in managerial forecast’, Journal of Accounting and Economics, Vol. 51, Issue 3, PP. 300-313.

Hwang, S. and M. Salmon (2004) ‘Market stress herding’, Journal of Empirical Finance, Volume 11, Issue 4, PP. 585-616.

Inderst, R. and H. M. Muller (2002) ‘The effect of capital market characteristics on the value of start-up firms’, Journal of Financial Economics 00 (2002) 000-000.

Johansen, A. (2004) ‘Origin of Crashes in 3 US Stock Markets: Shocks and Bubbles’, Physica A: Statistical Mechanics and its Applications, Vol. 338, Issues 1-2, PP. 135-142.

Johansen, A. and D. Sornette (2000) ‘Predicting Financial Crashes Using Discrete Scale Invariance’, Riso National Laboratory - Wind Energy Department and ETH Zurich.

Kaizoji, T. (2010) ‘A Behavioural Model of Bubbles and Crashes’, International Christian University, Working Paper Series.

Kraemer, C., M. Noeth and M. Weber (2006) ‘Information aggregation with costly information and random ordering: experimental evidence’, Journal of Economic Behavior and Organization Vol. 59, PP. 423–432.

Ljungqvist, A., R. Singh and V. K. Nanda (2004) ‘Hot Market, Investor Sentiment, and IPO Pricing’, AFA 2004 San Diego Meetings; Twelfth Annual Utah Winter Finance Conference; Texas Finance Festival.

Miyajima, H. and Y. Yafeh (2007) ‘Japan’s banking crisis: An event-study perspective’, Journal of Banking & Finance, Vol. 31, Issue 9, PP. 2866-2885.

Peter, G. V. (2009) ‘Asset prices and banking distress: A macroeconomic approach’, Journal of Financial Stability, Vol. 5, Issue 3, PP. 298-319.

Redhead, K. (2008) ‘Personal Finance and Investments’ Oxon: Routledge.

Shleifer, A. and R. W. Vishny (1997) ‘The Limits of Arbitrage’, Journal of Finance, Vol. 52, Issue 1.

Shiller, R. J. (1995) ‘Aggregate income risks and hedging mechanisms’, The Quarterly Review of Economics and Finance, Vol. 35, Issue 2, PP. 119-152.

Zetzsche, D. A. (2005) ‘The need for Regulating Income trust: A Bubble Theory’, University of Toronto, Faculty of Law Review, Vol. 63, No. 1, 2005, CBC-RPS No. 0008.

Zhong, Z. (2008) ‘Why Does Hedge Fund Alpha Decrease Over Time? Evidence from Individual Hedge Funds’, Rutgers, The State University of New Jersey, Working Paper Series.

Hey @shenobie, great post! I enjoyed your content. Keep up the good work! It's always nice to see good content here on Steemit! Cheers :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @exxodus,

I very much appreciate the feedback. It helps keep me motivated to keep going and do more for the community. Once again thank you.

Cheers,

@shenobie

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@shenobie Great content in there, keep it up!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @crypto-toast, thank you for your feedback. It is much appreciated.

Regards,

@shenobie

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I had to read it a couple of times and google terminology as it was my first time at this topic. But I think I got the general gist! Good work......

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@zeus2010,

Thank you for the feedback. Glad you found it useful!

Cheers,

@shenobie

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit