In this article I want to show my evidence that EURUSD it getting ready to change its direction to the upside.

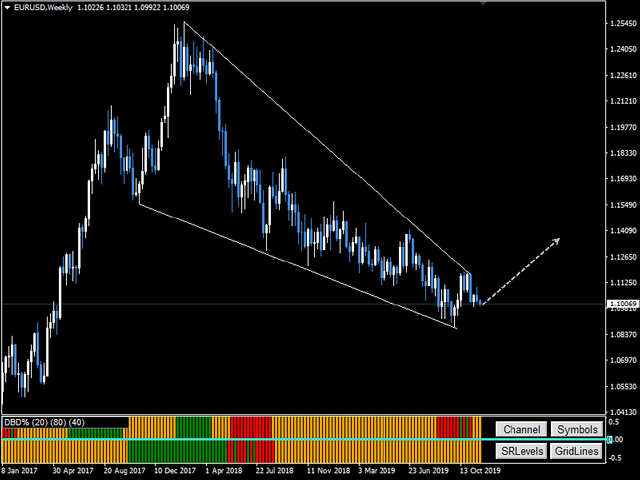

EURUSD move inside a descending channel that come at the beginning of a new uptrend.

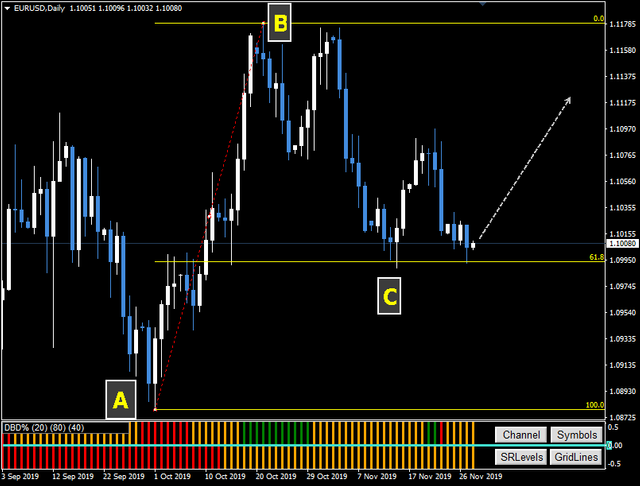

EURUSD might find some support around the Fibonacci level 61.8%.

The Dual Bermaui Deviation Percent shows that both, short and long term trend is sideways now, after being bearish until the begin of October. This might be a clue that the downtrend is over and that EURUSD is getting ready to change its direction to the upside.

EURUSD Weekly chart show what looks like a Descending Wedge pattern, ready for a breakout to the upside.

If breakout happen to the upside then, our DBD% Zig Zone Levels shows that our first target will be around 1.14000 and our second target will be around 1.18000

Nowadays, most traders want to trade the very short term trend and they don't give attention to major changes that happen on higher timeframes. But in reality taking a look at long term trend might have a lot to do with short term success in trading, and that is why I wrote this article.

If my analysis is right and EURUSD is at the beginning of a new uptrend then, it might be a very good opportunity for many traders to make money.

If you like my indicator "Dual Bermaui Deviation Percent" then you can

know more about it from here:

https://www.mql5.com/en/market/product/37495

Good luck everyone

Muhammad Al Bermaui, CMT