I've been on top of this subject for months. Since my "Bitcoin Call" back in January of 2013, at $9, predicting it will be of north of $1,000, I've been approached by many institutional investors, but my passion has always been to educate a larger group of investors, and not just the well-to-do crowd. That's the main goal of Wealth Research Group – to strengthen the financial fortress of investors in these times of blunt government and banking manipulation in favor of the elite at the expense of the masses.

The research on this specific investment play goes back to May 3rd, when I obtained the estimated number of shares to be liquidated by the ETF on a per-company basis by June 16th.

What this scramble for junior mining shares truly did was to generate a "takeover window" of 18-24 months going forward.

The ETF called GDXJ has basically liquidated out of juniors and bought mid-tier and large-cap miners instead. In other words, it allowed for liquidity to enter the major producers' share float at the expense of small-cap companies.

I absolutely love it, for this sector always comes alive and attracts funds with merger activity at higher levels, and that's what is about to be unleashed.

It dawned on me, during this due-diligence marathon, that my calculations have been too conservative regarding one company in particular, and I want to show how this mining legend opened my eyes to the intrinsic value of my top suggestion for this merger mania: First Mining Finance (TSX: FF & US: FFMGF).

For one of the most serially successful mining businessman of our era -- Keith Neumeyer, the founder of the company -- resource investing is about generating revenues.

Don't get it mistaken: Keith is all about big, fat, and consistent cash flows and thick, monstrous margins.

First Mining Finance was Keith's brainchild, and when we spoke last night, he summarized it this way: "Lior, just think of scooping up 25 brand new Boeing 747s in a country where there are currently no airports, so you're getting them really cheap, knowing full well that they're about to build 25 new runways and will need your planes. We bought proven properties for distressed prices during the bear years, and we now hold all the cards and have all the options because our properties are becoming more valuable as the gold price rises.

"The reason why I'm quickly accumulating shares right now is because the last financing, in which all the members of the management team participated, was done at CAD$0.80. I want to lock in my position for less.

This is what will happen to unlock the intrinsic value and potential of their assets and generate revenues for the company:

- Joint ventures with cashed-up majors.

- Royalty deals.

- Streaming structures (the best business model ever).

- Spin-outs of properties for a premium and earn-in contracts.

When the company signs these value-creating set-ups, shares will explode fast and hard, and you know it, because Neumeyer is a brand-name is the mining business and has made thousands of shareholders wealthy in the past 3 decades – people want to own his companies.

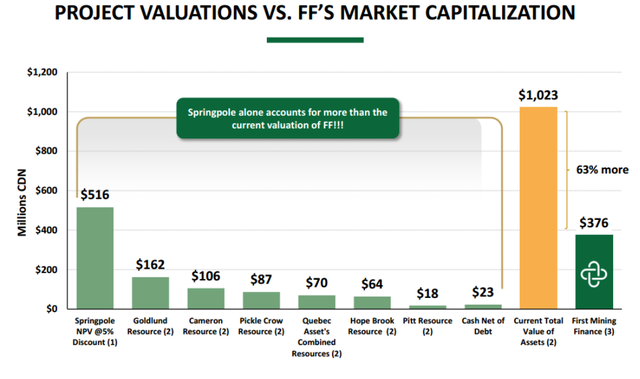

The baffling anomaly Wealth Research Group found in the form of a pocket of "free money" is the fact that Springpole, the company's premier Ontario, Canada project containing millions of gold and silver inferred and indicated ounces in the ground, is worth more by itself than the total price you pay for the full package – the company's 20+ projects and their $20M+ cash position!This is an extreme value moment created by a one-time event that will never repeat: the GDXJ rebalance!

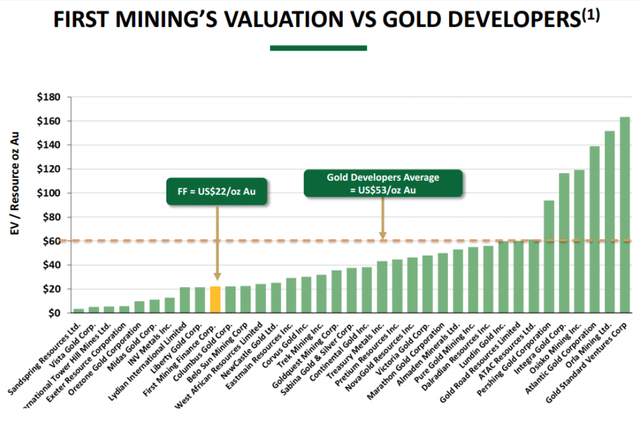

Even when you compare it to a slew of its peer companies, you can't shake the fact that all of their properties were acquired in the safest and most mining-friendly jurisdictions in North and Central America, with infrastructures in place, at incredibly attractive prices during the bear market years.

On top of that, you've got Keith Neumeyer making the calls for this management team – an added value that puts the company on a much higher platform.

You want to own gold in the ground, but not only that.

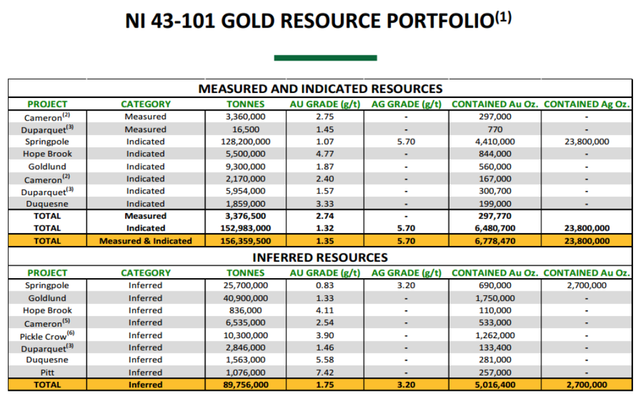

What you really want is to own it now, without depleting the resource base until gold prices are much higher, at which point this NI 43-101 gold portfolio will be the envy of thousands of other gold juniors.

Right now, you can buy First Mining Finance (TSX: FF & US: FFMGF), pay only for Springpole and get 24 additional high-quality assets for free, along with a treasury of CAD$23M and Keith Neumeyer at the helm.

This is served to you on a gold platter.

Access the full-length report on this company HERE!

Written by Lior Grantz

The Last American Vagabond

Posted by Ryan Cristián

Editor, Founder - The Last American Vagabond

really interesting !

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.gold-eagle.com/article/thank-you-gdxj-ultimate-rebalance-victim-trade

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

meep

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit