Introduction

Decentralized Finance or abbreviated as DeFi is a blockchain-based financial application ecosystem that can operate without a central authority such as a bank or other financial institution.

Today, almost every financial service including savings, lending, insurance, and the stock market is still managed by a centralized system. That is, we must have a bank account or access to a financial institution to be able to take advantage of various financial products and services.

In fact, in reality there are still very many people who do not have a bank account and access to financial services. Meanwhile, access to financial services has been proven to help people move out of poverty and boost economic growth.

What is BeFiT DeFi?

BeFit Defi is the premier platform for community staking and farming and Liquidity extraction. A place to freely create passive crypto income. BeFit allows you to earn high-yield rewards on your crypto by stacking and providing liquidity.

DeFi Features

Decentralized finance (or simply DeFi) refers to an ecosystem of financial applications built on top of a blockchain network.

Specifically, the term Decentralized Finance may refer to the movement to create an ecosystem of open source, illegitimate and transparent financial services, available to all and functioning without a central authority. Users will maintain complete control over their assets and interact with this ecosystem through decentralized peer-to-peer (P2P) applications (dApps).

The main advantage of DeFi is the ease of access to financial services, especially for those who are isolated from the current financial system. Another potential advantage of DeFi is the modular structure on which it is based: DeFi applications that can be operated on a public blockchain have the potential to create new financial markets, products and services.

Because DeFi application frameworks can be pre-built, deployment is much less complicated and much more secure.

Another important benefit of such an open ecosystem is the ease of access for people who would otherwise not have access to any financial services. Because traditional financial systems rely on making profit through intermediaries, their services are generally absent in places where low-income communities live. However, with DeFi, costs are reduced significantly and low-income individuals can also benefit from a wider range of financial services.DeFi seems to be opening up a lot of exciting new passive income opportunities in Farming and Non-Current Betting.

Opportunity to Become a Trendsetter for Community Betting and Money Extraction Platforms.

How does it work?

Just like other cash withdrawal programs, participants only need to provide cash to the BFT/BNB PancakeSwap V2 pool.

Due to the new nature of this experience, the LP must remain in pool for one month to qualify for the prize.

Ecosystem $BFT Token triggers rewards from those who provide cash in PancakeSwap V2. The more liquidity you provide and the longer you leave it, the larger your share of the BFT pool you receive. BFT/BNB is the main liquidity pool for the ecosystem.

It is up to you to create Pools with more tokens and digital assets on the platform with partners and their rewards for the community.

BeFiT DeFi Plate Shape

This is where market moves can be in your favor or against you. Because you are required to provide an equivalent value of the two assets in the pool, a significant change in price between the supply and withdrawal of one of the assets can result in a loss to the pool. simple holding of each asset individually in a 50/50 portfolio (referred to as "impermanent loss" in some sources).

Therefore, the realized returns that investors get also depend on changes in prices and pool ratios in addition to the trading fees earned.

Protocol Architecture

There are three types of users who can interact with the BeFiT Protocol: Stakers, Farmers, and Liquidity Providers. The Pledge Protocol is on the Binance Smart Chain, and facilitates the use of BFT

Token. The BFT token offers a simple way for BeFiT users to commit to a transfer of value any time in

future. Buying and selling BFT Tokens allows users to move value from present value to future value in time value of money perspective.

To facilitate Staking, Farming, and liquidation functions, these BFT Tokens are transferable tokens representing claims for positive cash flows (entitled to receive) or negative (obliged to pay)

at the specified maturity.

Betting User

They can supply BFT Tokens and WELB Tokens to the BeFiT Protocol and earn rewards. Stakers will choose the contract period they want to block their BFT or WELB, according to the level of rewards they want to achieve.

BFT tokens are the building blocks of the BeFiT Platform, which are transferable tokens that represent claims to positive (entitled to receive) or negative (obligatory to pay) cash flows at a specified maturity. BFT tokens can be used to hedge against other assets or transferred to a cold storage wallet that supports Binance Smart Chain.

- Term – Minimum 1 Month

- General Steps – 5

- Stakers decide how much BFT or WELB to bet and how long to hold that deposit.

- Stakeholders will receive a fixed rate payment amount as part of the first decision to

deposit coins - Stakers will receive periodic payments in the form of BFT Tokens

- When the Staking contract expires, Stakers can exchange their BFT Tokens for underlying assets. In the

In the following example, a Staker deposits 1,000 BFT for 3 months. With a maturity of 3 months, this means

APY remains at 10%. When the contract expires, the Staker is eligible to redeem 1,000 BFT principal

and 25 BFT interest. (non-compound interest in this example)

Token Sale

BeFiT is a worldwide cryptocurrency and payment system. It is the first decentralized digital currency, as the system works without a central bank or single administrator. Peer-to-peer networks and transactions occur between users directly, without intermediaries. These transactions are verified by network nodes through the use of cryptography and recorded in a publicly distributed ledger called the blockchain.

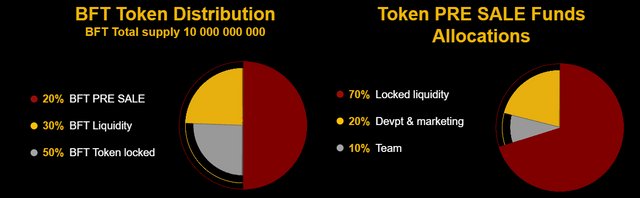

Tokenomics

- 10% Pre Vent

- 10% Development

- 70% Liquidity

- 5% Complete

- 5% Récompenses d'extraction de liquidity

- 20% BFT PRE SALE

- Liquidity 30% BFT

- 50% BFT Token locked

- 70% Liquidity Locked

- 20% Development & marketing

- 10% Team

Roadmap

- Q4 -2021. Community research and evaluation of project ideas, implementation planning.

- Q1-2022. Product development and creation of DeFi liquidity pools. More exchanges and community and LP approaches. Bring more utility to tokens in the community and marketplace.

- Q2-2022. Fully DeFi ecosystem for money mining and digital asset betting. The future hasn't been written yet....

Conclusion

The BeFiT protocol is designed to provide a fully decentralized and secure marketplace for interest, term loans. BeFiT allows lenders to leverage their idle crypto assets by providing liquidity to earn some interest income; it also allows borrowers in need of liquidity to take out loans pledged by over-secured crypto assets for specific and predictable fees. BeFiT will be deployed on the Binance Smart Chain, to avoid friction and problems when using Ethereum, including congestion, high gas costs, and lack of interoperability with other ecosystems. This enables the creation of a scalable liquidity market that is fully regulated by the community through the BFT governance token.

For More Information:

- Website: https://befit-defi.com/

- Whitepaper : https://drive.google.com/file/d/1GIErfvDWTwqP58Fn384GYNMF6j1s_Nxe/view?usp=sharing

- Telegram : https://t.me/BeFiTDefi

- Twitter : https://twitter.com/BeFiTDeFi

AUTHOR

- Bitcointalk Username : lani123lani

- Bitcointalk Profile Link : https://bitcointalk.org/index.php?action=profile;u=1220105

- BSC Wallet Address : 0xaeC6B59a69a13FBea61AC87b27Cc50d8F594F923