Content

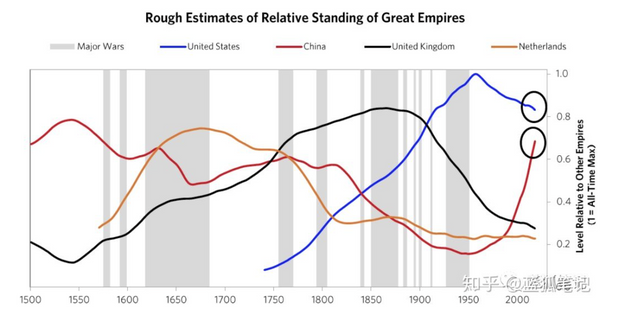

The founder of the world's largest hedge fund Bridgewater Fund (also the author of The Principles) recently published an article on macro-historical research. He tried to explore the reasons for the rise and fall of great powers in the past 500 years and the historical trend of cyclical change. From his macro-historical analysis, we can see an important point: the power of each period is accompanied by the rise of its currency. During its dominance, the country’s currency becomes the world reserve currency, and after the peak period, its world reserve currency The status of currency tends to decline. Of course, due to certain network effects and historical inertia, its disappearance will lag behind the process of relative economic weakness of the dominant country.

The rise and fall of the world's reserve currencies in the past 500 years, there have been several dominant countries in different periods: the Netherlands, the United Kingdom, and the United States. At each stage, their currencies have become the world's reserve currency along with their strong economic fundamentals and military power. In human history, so far, there has not been a dominant force that can last forever.

Any dominant force is replaced. As Dario pointed out in his research on the history of the past 500 years, the Netherlands, the United Kingdom, and the United States have been the dominant forces in the past 500 years, but they all have a tendency to change. Why is there a trend of replacement? With the establishment of the new world order, relative peace and prosperity, productivity growth, and debt expansion, these promote the rise of the dominant force until it enters a peak period. Then the maintenance cost is too high, facing increasingly fierce competition, the marginal income drops, the debt bubble bursts, the economy is down, the country starts to print a lot of money, the gap between the rich and the poor in the society expands, and social conflicts and even wars are brought about.

Finally, the dominant force declines and forms The new world order. According to Dario's explanation, the replacement of this major cycle seems to be a historical inevitable. (Blue Fox notes: The following information about historical cycle changes refers to Dario's article) The Dutch guilder is the first worldwide reserve currency. It has become a world reserve currency with the rise of the Netherlands. Before the rise of the Dutch guilder as a world reserve currency, Spain was the dominant economic power in the Western world at that time. The Netherlands became the dominant force in the Western world from 1625 to 1780, and 1650 was the peak of the Netherlands. The Netherlands was the wealthiest country in Europe at the time. Its per capita income was twice that of most European countries at the time, and its literacy rate was twice the world average. The strength of the Netherlands is due to its advanced education, advanced shipbuilding technology, and, most importantly, the rise of Dutch capitalism.

The Netherlands invented the first listed company, the famous Dutch East India Company. In addition, the Netherlands created the first stock exchange in 1602, establishing the most developed debt market in the world at that time. This has greatly increased the economic and military strength of the Netherlands. At the peak of the 17th century, the Netherlands accounted for about 25% of the world’s major inventions and one-third of international trade. The Dutch investment market is full of innovation and profit opportunities, attracting a large number of investors. At this time, Amsterdam became the world's financial center, and the Dutch guild became the world's first "world reserve currency". In order to maintain its dominant power, the Netherlands paid high costs until it was no longer profitable to maintain it. During this period, the United Kingdom challenged the Netherlands.

There were various economic conflicts between the two sides. For example, British law stipulates that only British cargo ships can transport goods to the United Kingdom. (Blue Fox Note: Is this similar to the trade disputes of various countries in the world today? ?). There have been many wars between the two sides. At the same time, Dutch debt has increased, internal conflicts have increased, and military strength has been declining. From 1780 to 1784, Britain again launched a war against the Netherlands. Britain won the victory, the Netherlands went bankrupt, and was heavily in debt. The Dutch guilder declined along with the Dutch empire. The decline of the Netherlands began with its excessive expansion. In order to support the great empire, it needed to increase spending, which led to an increase in debt. At the same time, it faces competition from other countries such as the United Kingdom, which has led to a decline in its overseas income. With the increase in the rate of return on investment in the United Kingdom, people transferred funds from the Netherlands to the United Kingdom for investment.

The war between the United Kingdom and the Netherlands led to further aggravation of its debt, especially the Dutch East India Company suffered heavy losses. The Bank of Amsterdam tried to print money to rescue the Dutch East India Company. Savers began to run on it. This caused the precious metal supporting the Dutch guilder to run out and the Dutch guilder continued to depreciate. Lost the credibility of its value store, and finally went to collapse. The rise of the United Kingdom made the British pound become the world's reserve currency after the Dutch Guild. After Britain, Russia, Austria and Prussia won the war against Napoleon, the victorious countries redesigned the world order. This laid the foundation for the rise of the United Kingdom and gradually promoted the pound to become the world's reserve currency.

The British East India Company replaced the Dutch East India Company as the most powerful company in the world at that time. Its standing military power was even greater than the standing power of the British government at that time. In addition, around 1760, the Industrial Revolution was born in England, which liberated productivity through the invention of the steam engine. Britain leads the world in trade, economy, and military power, bringing the leading period for Britain for more than 100 years. London replaced Amsterdam as the world's financial center, and continued to introduce innovative financial products, attracting a large number of investors to enter. This is exactly the same as the attractiveness of Amsterdam at the time. At this time, the world reserve currency is no longer the Dutch guilder, but the British pound. At the peak of the 19th century, Britain created 20% of world income and controlled more than 40% of global exports. The pound became the world's reserve currency. But after 1900, Britain began to decline. Britain participated in World War I and World War II. In order to maintain the empire, the United Kingdom expanded its debt, and its income dwindled. This is similar to the original Netherlands.

After the Second World War, the United States surpassed Britain in all aspects of economy, military, and politics. Although in 1960, about 50% of international trade was denominated in pounds sterling, people found that the United Kingdom was heavily indebted, while the United States was financially sound. The pound depreciated continuously after World War II. In 1949, the pound depreciated by 30%, and in 1967 it depreciated by 14%. Even the Commonwealth countries are reluctant to hold large amounts of pounds. The pound's status as a world reserve currency can no longer be sustained, and the U.S. dollar has become the new dominant international reserve currency. In the middle and late stages led by the United Kingdom, the United States was fully developed.

The United States initially copied British technology, and later made great breakthroughs in steel, automobiles, electricity, and communications. Telephones, electric lights, and phonographs were invented during this period. The power of the United States is constantly rising. While the relative power of Britain began to decline, Britain began to borrow heavily, and the cost of maintaining its empire became high. In the early 20th century, there were huge disputes about the wealth gap and distribution of different countries, and economic and military conflicts occurred between European countries. These conflicts eventually led to the First World War. As Germany sank an American merchant ship, the United States was also involved in the First World War. After the First World War, the United States, Britain and other victorious countries tried to establish a new world order through the Treaty of Versailles.

However, after the First World War, the United States continued to choose isolationism, while the United Kingdom continued to maintain its global colonial empire. The pound is still the world's reserve currency. However, after the First World War, the new world order was not established. In the 1920s, a large amount of debt was accumulated and the gap between rich and poor increased. In 1929, the debt bubble burst again, leading to the era of the Great Depression. At this time, additional currency issuance led to currency depreciation, leading to domestic and international conflicts, and finally World War II broke out. After World War II, the victorious countries once again proposed a new order, hoping to shape a new world order based on the Bretton Woods Conference, the Yalta Conference, and the Potsdam Conference. One of them was the establishment of a new currency and credit system.

The U.S. dollar was pegged to gold, while the currencies of other countries were pegged to the U.S. dollar. At that time, 40 countries adopted this currency system. The United States also had two-thirds of the world's gold reserves at that time, and the U.S. dollar gradually became the world's reserve currency. While Britain is facing the end of the colonial era, it is also the end of the pound sterling as the world's reserve currency. New York became the world's financial center. In 1971, U.S. banks did not have enough gold reserves to support the U.S. dollar system. The U.S. ended the monetary system anchoring gold and entered the era of the legal currency system. The fiat currency system led to an increase in the dollar's currency debt and inflation, and triggered the economic crisis of 1980-1982. The fiat currency credit system also produced capital bubbles in 2000 (Internet bubble), 2008 (real estate bubble), and 2019 (before and after COVID-19). Each bubble issued more currency than before.

Economic problems have led to intensification of internal and external conflicts. The United States faces the same power crisis as the Netherlands and Britain. Although the U.S. dollar is still the main settlement currency for international trade and the world debt is still dominated by U.S. dollar debt, the status of the U.S. dollar as the world's reserve currency will depend on the fundamentals of the U.S. economy. Of course, there will be a lag. Ultimately, the challenge itself does not come from other countries, but the fundamentals of the United States' own economy and the sustainability of the cost of maintaining its dominant position. Judging from the history of the Dutch guilder, the British pound and the US dollar as the world's reserve currencies in the past 500 years, they all have similar experiences as the world's reserve currencies, and have achieved leading positions in education, technological innovation, economic mechanisms, and military power. Without the support of economic and military strength, and without a global trade network, it cannot become a de facto world reserve currency.

After World War II, the United Kingdom worked hard to maintain its position as a world currency reserve for the pound sterling, but even with the support of the Commonwealth countries (and even the United States to a certain extent), in the end, the fundamentals of its economy could not support the pound’s world reserve. Currency status. At that time, most countries preferred to hold U.S. dollars instead of British pounds. The continued depreciation of the British pound shook people's confidence.

Many central banks changed their reserve currencies from pound sterling to U.S. dollars. The replacement period of the world's reserve currency and the opportunity of Bitcoin. It can be seen from the replacement history of the world's reserve currency in the past 500 years that countries and currencies are highly integrated. The status of the world's reserve currency is the natural externalization of the country's economic and military dominant forces. In this context, the state and currency are not in a separate relationship.

According to Dario’s analysis, the current world may begin to enter a new cycle of replacement. Coincidentally, the former U.S. Treasury Secretary Paulson recently published an article "The Future of the Dollar" in the American Foreign Affairs magazine. , It proposed that the US dollar’s position as the world’s reserve currency may face challenges from the renminbi. So, what does this have to do with Bitcoin? From a historical point of view, any replacement of the world's reserve currency is not something that can be completed in three or five years, but can be completed for decades or even hundreds of years. Today, the United States is printing and distributing a large amount of US dollars, generating a large amount of debt, which is similar to the historical scenario.

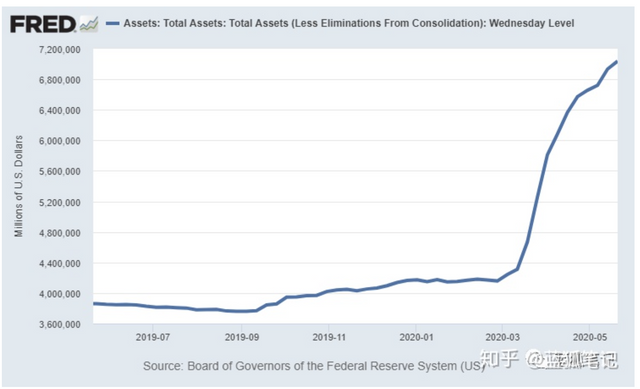

The Fed’s balance sheet has exceeded $7 trillion. At the same time, from a fundamental point of view, although the United States is still in a leading position in terms of economy, technology, education, and military, it is still strong. However, the dominant power of the US economy has been relatively declining. From 1960 to the present, its world GDP has fallen from 40% to 25% today, while emerging economies are accumulating power, especially China’s economic scale has rapidly increased.

(From "The Big Cycle of the Last 500 Years" by Rui Dalio)

At present, the US dollar is still the world's main reserve currency. As many as 79.5% of world trade is still settled in US dollars, 84% of the world's non-domestic debt is US dollar debt, and about 100 trillion US dollars of debt is denominated in US dollars. Due to the demand for repayment of debt denominated in US dollars, in the current period of frenzied issuance of US dollars, not only has there been no inflation, but there is also a lack of liquidity. As demand for the U.S. dollar is rising, the U.S. dollar will also continue to rise. The rise of the dollar has made it more sought-after, more in short supply, and aggravated the debt repayment crisis. The increase in demand for the dollar has led the United States to stimulate through fiscal policy. However, this additional issuance system cannot be sustained for a long time. Moreover, in the end, the oversupply of currency will trigger inflation. Not only will it lead to inflation, it will also exacerbate economic inequality. After the US dollar is over-issued, the income of the richest people will grow faster, because the rich hold various assets (1% of Americans own 50% of American stocks), while ordinary people and poor people have fewer assets. Or there is only a small amount of cash, and these cash depreciate as the US dollar is over-issued, and assets appreciate because of the release of water. The income of most groups decreases and the income of a small number of Americans increases. This situation will exacerbate the gap between the rich and the poor in the United States.

Like the Netherlands and the United Kingdom in history, the decline of its fiat currency world reserve currency status will have a certain lag period. That is to say, even if its economic fundamentals cannot support this status, it will still be due to the inertia of its currency system. Lasts a long time. Britain began to decline in 1900, but its status as the world's main reserve currency continued until the 1960s. In the transitional period of this relatively unstable world reserve currency, the U.S. dollar was issued frantically, and Bitcoin was born after the world financial crisis in 2008. It is a system completely different from the expansion of legal currency credit. It is a very "hard". The cryptocurrency has a limited issuance. Currently, there is an S2F similar to gold. It will not be issued unlimitedly.

It has grown to more than 163 billion U.S. dollars in assets just over a decade after its birth, and it has absorbed a large amount of legal currency. . As long as an organization such as a country dominates the world, fiat currency will still be the world's main currency. From this perspective, Bitcoin cannot shake the dominance of fiat currencies. However, the emergence of Bitcoin is very similar to gold in history. Gold is not closely coupled with the country. Gold is a currency that transcends the form of a country. Bitcoin has formed a trustless currency form through encryption technology and game mechanism. Like gold, it is also a form of currency that transcends the national form. There is a long transition period before the dollar may decline and another world-leading reserve currency emerges. The economy during this transitional period may be unstable.

If according to the previous history of the evolution of the Netherlands and the United Kingdom, in order to maintain its dominant position, the United States may have a large number of over-issues, large debts, a widening gap between the rich and the poor, and the possibility of internal and external conflict Increase, which may gradually shake the confidence of dollar holders. Of course, from the current point of view, this is only historical experience, only a conjecture about the future. We can wait and see how long it will evolve and how it will evolve.

According to the historical perspective, as the dominant reserve currency tends to decline, Bitcoin may be favored by some legal currency holders. They regard Bitcoin as an important asset for hedging the risks of the legal currency system and regard it as a digital era. gold. And if inflation intensifies, the importance of Bitcoin may win more people’s recognition, thereby exacerbating the migration of the U.S. dollar to Bitcoin, just like when people exchanged Dutch Guilders for British pounds and British pounds for U.S. dollars. For people, economic gains are the biggest driving force for migration. However, because the country is the main form of the world, legal currency will still be the basic unit of valuation and medium of exchange (Blue Fox notes: this has nothing to do with whether it is paper currency or digital currency, both of which are essentially legal currency).

Inside, Bitcoin exists more as a form of currency similar to gold, and it has become a choice for people to invest and hedge risks. There is another factor that will promote the adoption of Bitcoin and gold, as Paulson said: “Washington should also realize that the hegemony of the dollar makes unilateral sanctions possible, but it is not without cost. In this way Weaponizing the U.S. dollar can inspire American allies and enemies to develop alternative reserve currencies, and may even join forces to do this.