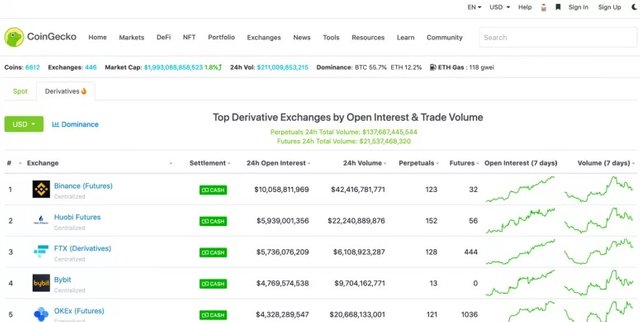

Open positions on the derivatives platform reached a record high of over $ 10 billion on Saturday, seeing growth of about 3,900 percent over the previous year, according to #CoinGecko data.

The increase in open positions or the increase in the value of derivative contracts bought and sold reflects an increase in the amount of money entering the market.

Some analysts feel that #Binance is directly related to individual traders. Jan Happel and Jann Allemann, founders of blockchain analytics firm #Glassnode, spoke in a February 26 newsletter about increased user registrations on Binance, not the most popular crypto exchange in the US, Coinbase, as evidence of increased individual engagement.

Stock markets that rank first in terms of open positions and trading volume. Source: CoinGecko / CoinDesk

Binance Futures was launched in September 2019 with perpetual futures created for Bitcoin. According to the information in CoinDesk, the representative of the exchange said that the derivatives platform has expanded the product package to more than 180 pairs.

🚨Binance is the leader in open positions

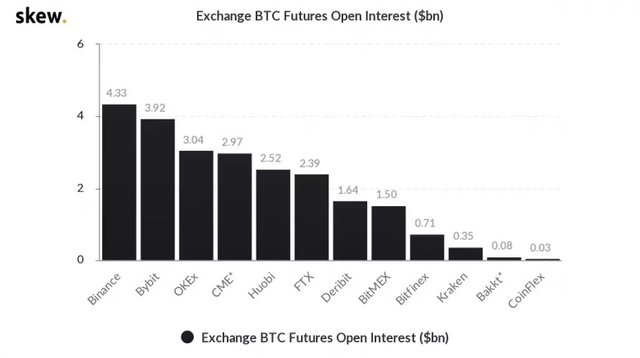

Binance is the largest Bitcoin futures exchange contributing $ 4.33 billion - 18.44% of the global amount of $ 23.48, according to data provided by crypto derivatives research firm #Skew.

Open positions in Bitcoin futures. Source: Skew