You might have heard or seen the option to place OCO orders on Binance. This is called “One Cancels the Other” Orders. They are pretty helpful for you to have a limit sell and also a stop-loss order.

A Quick Introduction to trading anywhere

Trading is buying and selling of a stock or an asset. For every asset or stock you sell, there should be a buyer and vice versa.

However, if you sell at market price, you might gain or loss depending on how the wind is at that moment. Hence Limit orders are advised.

If you want to learn about market and limit orders — Check this link.

A new kind of order on Binance

So, to add to this, Binance added a new kind of order called OCO — They call it “One Cancels the Other” order.

Think of it as 2 friends called you for a party — you haven’t decided which one to attend. You can’t be at both places because of physical limitations. So, when you accept one invite — you automatically decline another one. This is one canceling the other.

How to place an OCO Order

In trading terms, they provided a way to sell at a higher price or to place a stop limit to sell if it goes below a certain price.

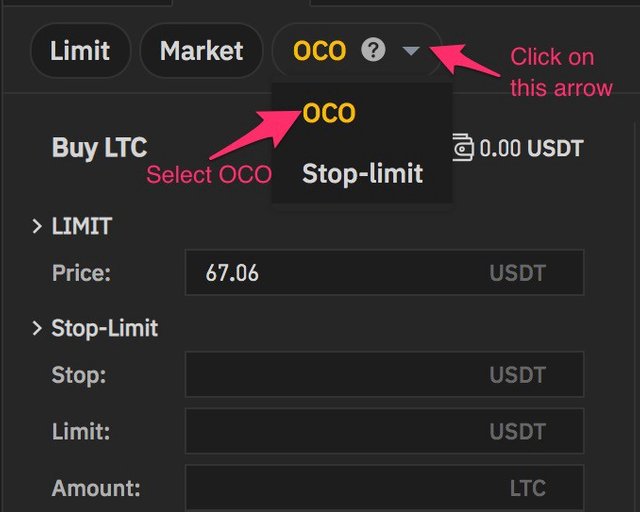

To set this, click on the arrow beside the OCO and select OCO from the list. This will add more fields where you can place your price and quantity. We’ll see what those fields are below.

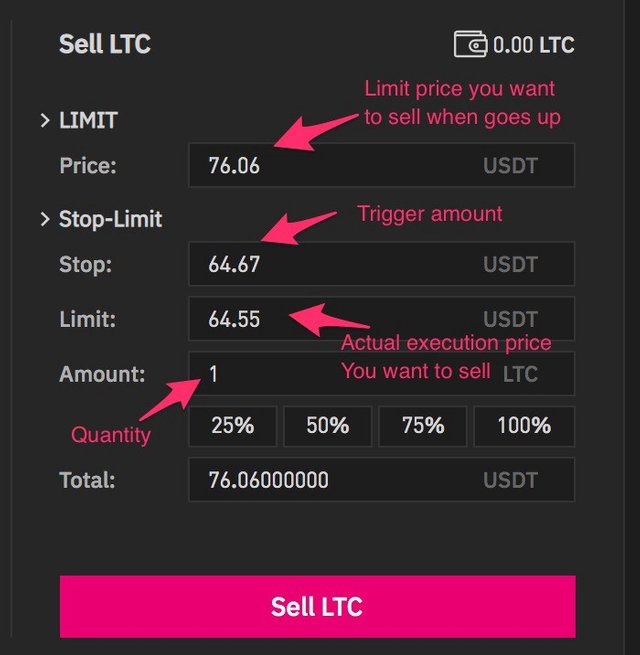

Sections for OCO order

So, it has 2 sections.

One is Limit and another is Stop-Limit.

Think of Limit as selling for profit and Stop-limit as an order to minimize losses if it crashes.

I bought LTC at $70. Now it is trading for $67. I want to sell it if it goes beyond $76.06 and make $6.06 profit. However, if it falls below $64.55, I want to sell it off to limit my loss to about $6.5

Placing an Order

When I place these numbers into the fields, following orders gets created. In this first one is Limit-Maker (Learn more on Maker/Taker here), and the second one is Stop-Limit order.

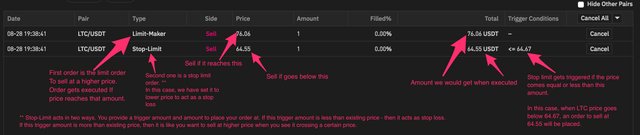

Orders placed by Binance

The first order is the limit order to sell at a higher price. Order gets executed if the price reaches $76.06 and we get $76.06 for selling 1 LTC.

And, second-order is a stop-limit order. In this case, we have set it to trigger if the price goes below $64.67 and to sell at a price of $64.55. This gives us $64.55 when it sells 1 LTC.

If anyone of these two orders gets executed, the other one gets canceled as there would be nothing to sell. That’s OCO — One Cancels the Other.