Bytecoin (BCN) is in the news again for its listing on Binance, and this helped in its price surge by 130% today. But it was reported that Bytecoin and Binance were involved in market manipulation, orchestrating a perfect pump and dump scene. Let's discuss this in detail.

History of Bytecoin

Bytecoin is another privacy focused coin like Monero, Zcash or Dash helping in hiding users' transactions and concealing senders' addresses. Bytecoin was started in 2012, and it was the first to implement the Cryptonote algorithm. Monero and Dash are forks of Bytecoin. Many big exchanges have listed BCN, and this has helped in its adoption. Monero forked from BCN, citing the reason that the latter is highly centralized with 82% of the coins being premined and held by some unknown actors.

Controversy in Biance Listing

Bytecoin got listed today on one of the biggest exchanges in the world: Binance. This, in turn, helped the price of the coin to surge by 130 %. But, experts and crypto community point to many red flags regarding this listing and also the price surge that followed.

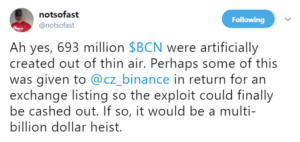

It was widely reported that 693 million BCN were artificially created out of thin air. This 693 million was then given to Binance as a bribe for getting it listed. The news spread like wild wire all across the social media and below is a tweet from one of the people following it.

In short, 700 million was printed out of thin air and paid as bribe to Binance for listing.

Bytecoin and Binance Involved in Market Manipulation

Another controversy that broke out was that the Bytecoin management and Binance were involved in market manipulation today. We would like to explain it in detail to our readers on what exactly happened with Bytecoin (BCN), as it is one of the most sophisticated pumps and dumps.

BCN was trading at around 72 satoshis on both HitBTC and Poloniex; there was a surge of 30% when the news broke out that it would be listed on Binance. When it was listed on Binance, the price was 300 satoshis and it slowly rose to 2320 satoshi on Binance, whereas the price remained the same on HitBTC and Poloniex at 190 satoshis. To put this into perspective, the circulating supply of BCN is 183,878,867,869 (taken from CMC), whereas the current price on Binance is 0.22$. This puts BCN on a market cap of $40 billion; right on the third position, between Ethereum and Ripple.

Withdrawals from HitBTC and Poloniex were not working nor were the BCN web wallets. When checking their blockchain explorer, no new blocks have been mined for the past 2 hours. Since the time trading started, only 46 blocks have been mined, containing a total of 997 transactions. The number of transactions that went through seems very small for a coin that just went up over 32x in a few hours. Thus, most investors are not able to sell their BCN on Binance. This still caused a 150%+ surge on exchanges such as HitBTC and Poloniex.

Not saying that the Bytecoin team is involved, but it seems very shady that their coin got listed at a time that (nearly) no one can move their token towards Binance. More importantly, we think it's strange that Binance still listed a coin that is (nearly) impossible to move around and thus easy to manipulate.

Not only by listing BCN, but also by keeping trading enabled while there's such a huge price discrepancy between different exchanges, and also while there's no ability to arbitrage it. We've seen the same kind of pumps happening before on coins that couldn't be moved around, for example, Bitcoin Diamond.

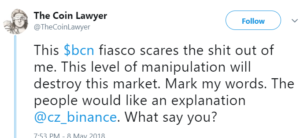

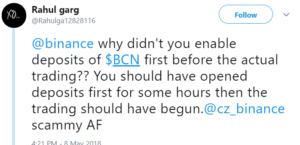

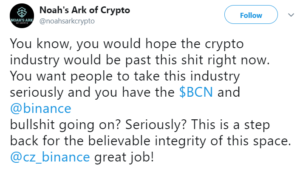

Anger on Social Media

Many expressed their anger on social media. Below are some of the angry tweets.

This is a serious red flag and high-level market manipulation. This manipulation is a black mark for the entire crypto space, and we cannot deny Warren Buffet if he calls Crypto 'Rat Poison Squared.'

Posted from my blog with SteemPress : https://cryptocoremedia.com/bytecoin-binance-manipulation/