Binance's recent BNB run is showing tremendous pace of growth. From the outside, you might wonder why, but it is inevitable that money is a photocopier that makes money because it is in the center of the Barnan DeFi, which acts as the main pickaxe.

In fact, if you want to discuss the value of the governance tokens mined while entering DeFi, there are many times when you feel like security in the form of entrusted with some authority, such as stocks of the corresponding platform. This is especially the case with mining tokens on platforms such as Cake in Banan, such as Ethereum's Uni or 1-inch swap.

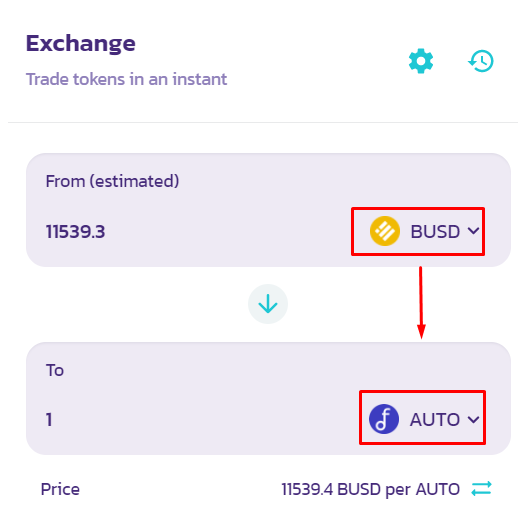

In addition to this, the effect of copying money after copying is appearing while inducing LP participation in offers for new tokens in the form of IFOs. In the case of Banan's auto platform tokens, the amount of issuance itself was kept small, and the transaction was initially at $700, but now it has exceeded $10,000.

In this way, compared to Banan's financial power and Ether, it is quickly dominating the DeFi world with a low commission system (although it is a double-attached chain).

Of course, Ether's funding power is still very high, but it is showing a different rate of fund growth than Tron's last DeFi, so you can observe that Ethereum's funds are flowing.

Even those who thought that the DeFi craze was dead, if they only bought BNB in early 2020 due to the influence of the fire market along with Binance's DeFi, they are seeing quite good profits by now.

Personal thoughts

Not all of the DeFi platforms will survive. In addition, there are also projects that hack into smart contracts and deliberately behave, so if you invest, you must state that it is a high-risk Gorisk high return.

I don't think so it pumps more than 400$. In near future

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I hope so that

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit