Automated market makers (AMMs) provide customers with various creative options to generate income from cryptocurrencies. For example, users can trade using PancakeSwap as a decentralized exchange under a regulator. Anyone globally may trade with more than $600 billion in liquidity and hundreds of assets offered at PancakeSwap. And it is an exchange with AMM itself, which allows users to swap digital assets for liquidity pools and collect results. This is more like a stock of dividends or bonds than a typical exchange in which the order book connects purchasers and sellers. In AMM, customers lend their digital assets to a liquidity pool, which can subsequently be stacked with additional digital assets in return.

What Is BinanceMax ?

BinanceMax -15 (RMARS) is a decentralized exchange with a deflationary governance BMax architecture that is the next generation of Automated Market Making (AMM). BinanceMax -15 are your go-to yield farm, with features that let you earn BMaxs on Binance Smart Chain and Pancakeswap exchanges. Like with the current wave of second-generation yield farms, the goal is to develop a perpetual deflation BMax, the RMARS, with a continuous burn mechanism to cultivate an environment that can maintain long-term profits with continuously high APR for more enormous revenues.

BinanceMax -15 Features

BinanceMax -15 Offers many excellent features. Some of those are discussed below :

Safety and security

At launch, a time lock was introduced to the contract, and the migrator code was removed (inherited from Pancake swap) with a Diffchecker Audit for Emergency Withdraw.

Why Do You Need BinanceMax?

Instead of trading between buyers and sellers, users on AMM platforms trade against a pool of BMaxs known as a liquidity pool. A liquidity pool is essentially a pooled fund of BMaxs. Users contribute BMaxs to liquidity pools, and a mathematical formula decides the price of the BMaxs in the pool. Liquidity pools can be adjusted for different purposes by changing the formula. Anyone with an internet connection and ERC-20 BMaxs of any kind can become a liquidity provider by contributing BMaxs to an AMM's liquidity pool. Liquidity providers often receive a charge for supplying BMaxs to the pool. Traders who engage with the liquidity pool must pay this charge. In addition, liquidity providers have recently been allowed to earn yield in the form of project BMaxs through a process known as "yield farming."

The process of establishing order books and matching orders was sped up thanks to innovation. It also aided the business in cleaning up its public image by weeding out unscrupulous actors in the futures market. In addition, the advantages of automated market makers in trading have increased liquidity and reduced the market's susceptibility to human manipulation. BinanceMax -15 Futures will become a leading example of a trustless crypto futures exchange by integrating automation and blockchain technologies. BinanceMax -15 are leveling the playing field for novice crypto futures traders by removing commission costs while also encouraging seasoned traders with new trading models and tools.

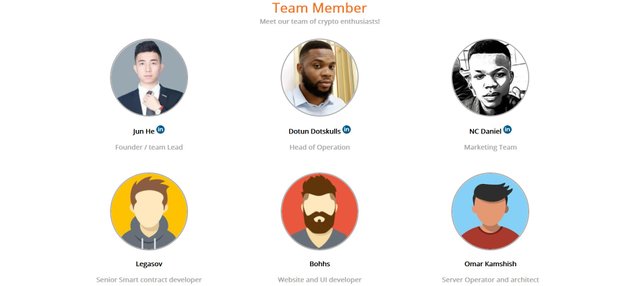

Team

Our team comprises of blockchain expert, smart contract developers, financial expert,

marketing and business expert that have great passion for the cryptographic and

decentralization.

We have a mixed team of both anonymous and onymous team, for some reasons

some dev will be working anonymously, this is to help increase our platform security

against attackers and to ensure no one possesses great control over binanceMax project,

however some team choose to be onymous in other to improve the project reputation.

Project Info:

Website: https://binancemax.net/

Twitter: https://twitter.com/Binance_Max

Email: [email protected]

Discord: https://discord.gg/nY9srxnFTU

Telegram: https://t.me/BinanceMax1

Publisher

Forum Username: Markusschwartz4

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=2899967

Telegram Username: @margarettajames

BEP-20 Wallet Address: 0x31E01922EA75e93C950Ef2F1FBf6165700C379Fe