Traders turn to betting on SEC approved spot Ethereum ETFs;

The current signs of regulation suggest that regulatory agencies may give the green light.

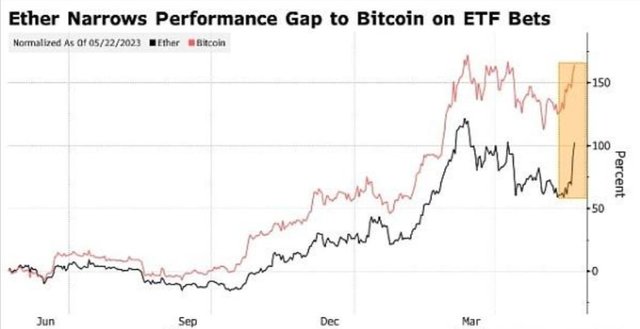

Due to signs that the United States has approved exchange traded funds to directly invest in the second largest token, Ethereum, cryptocurrency prices have surged, which is completely different from last week's more pessimistic outlook.

The market speculation about spot Ethereum ETFs is partly due to the resurgence of investor enthusiasm for Bitcoin funds in the United States. The listing of Bitcoin funds in January stimulated the rise of this largest digital asset to a historic high.

Ethereum rose nearly 14% during trading hours in the United States, the largest increase since November 2022, and then further rose during Asian trading hours. As of 9:33 am Singapore time on Tuesday, the exchange price rose to $3666. Bitcoin once climbed to $72000, approaching its historical peak of nearly $74000 in mid March.

According to insiders, the US Securities and Exchange Commission has contacted at least one exchange and at least one potential Ethereum ETF spot issuer to update the relevant 19b-4 filing documents. As this matter has not been made public, insiders have requested anonymity. A person familiar with the matter said that this indicates that the likelihood of approval by the US Securities and Exchange Commission may be increasing. The person added that this conversation was an unexpected change, but there can be no guarantee that it will be approved.

ETF file deadline

The 19b-4 file is only a part of the required files. The issuer also needs regulatory authorities to sign the S-1 registration statement before launching the product. At least one decision on Ethereum spot ETF application will be made before May 23rd.

A spokesperson for the US Securities and Exchange Commission stated that the agency will not comment on documents submitted by individuals.

"The US Securities and Exchange Commission is more likely to lean towards potential approvals, and traders are now rushing to build positions because many people have completely ruled out the possibility of obtaining approval," said analyst Chris Newhouse on social media.

Ethereum is the native token of Ethereum block chain, which is the most important commercial highway in cryptocurrencies. This network is very popular in decentralized financial services, where investors trade and borrow through automated software protocols instead of traditional intermediaries.

Increase in pass rate

On Monday, Eric Balchunas, an ETF analyst at Bloomberg, stated that he and his colleague James Seyfart have increased the estimated probability of approval for spot Ethereum ETFs from 25% to 75%.

Bloomberg News reported on Friday, citing two insiders, that some fund companies were originally expected to be rejected because their private negotiations with the SEC were not smooth compared to the preparation stage before the launch of Bitcoin spot ETFs.

The cautious attitude of some investors remains evident. FalconX's market director Ravi Doshi said, "The derivatives department has seen that most of our counterparties have downplayed this measure, and it is expected that the SEC's action will be slower than market expectations."

The skeptical US Securities and Exchange Commission had been cracking down on cryptocurrencies, but after a reversal in 2023, the commission reluctantly acquiesced to the US spot Bitcoin ETF at the beginning of this year. The products of companies such as BlackRock and Fidelity Investment have accumulated $58 billion in assets, making it one of the most successful debuts in the history of fund categories.

BlackRock and Fidelity are also seeking to launch the Ethereum Fund. The digital asset industry sees US ETFs as a way to expand the investor base for cryptocurrencies. Retail investors, hedge funds, pension funds, and banks have all invested in Bitcoin funds - Millennium Management, Steven Cohen's Point72 Asset Management, and Elliott Investment Management are well-known buyers.

After the Ethereum spot ETF is approved, the impact on the crypto ecosystem will be profound.

I think it mainly manifests in two aspects:

One is that Wall Street's traditional capital will eventually cover the entire import and export of cryptocurrency (in US dollars) and control the pricing power of all mainstream cryptocurrency assets (through financial instruments such as spot ETFs).

The second is that traditional giants on Wall Street will inevitably have a comprehensive layout in the infrastructure and application fields of the crypto ecosystem.

Let's take a look at the first point today.

The financial giants on Wall Street have successfully reaped spot ETFs from Bitcoin and Ethereum.

But I believe their goal is not just these two tokens. The bloodthirsty nature of finance will surely drive them to find ways to reach out to all possible targets and extend their influence to the entire crypto ecosystem.

Therefore, after Bitcoin and Ethereum, they will tirelessly search for one new target after another, launching one new cryptocurrency asset spot ETF after another.

In the current encryption ecosystem, from a technical perspective, we can roughly divide (homogenized) tokens into two categories: one is native tokens based on blockchain (such as Bitcoin and Ethereum), and the other is derived tokens based on blockchain protocols (such as ERC-20 tokens and BRC-20 tokens).

According to the latest FIT21 law, blockchain based native tokens are relatively easy to consider as "non securities" because they are relatively easy to decentralize, more like for services or consumption, and can avoid being like securities in operation.

There are two mainstream tokens in blockchain based native tokens based on different consensus mechanisms: POW based tokens and POS based tokens. Among these two categories, POW is a minority, while POS is the majority.

According to past statements by the current SEC chairman, native tokens in the POW category are relatively easy to avoid suspicion of securities, and Bitcoin is a typical POW and the king of the entire crypto ecosystem, so Bitcoin spot ETFs were the first to be approved.

For POS tokens, due to the current chairman's previous negative comments, we thought that their pledge mechanism would be an obstacle to the approval of token ETFs. The approval of Taifang spot ETF indicates that in terms of approval standards, POS and pledge mechanisms are not obstacles.

In this way, both POW and POS native tokens in the entire ecosystem have become potential targets.

In addition to POW and POS tokens, there is also a larger group of tokens in the entire crypto ecosystem, which are derived tokens based on the blockchain protocol, especially tokens based on the Ethereum ERC-20 protocol.

For tokens in this field, it seems that no institution has submitted any relevant spot ETF application materials. From this, it can be seen that at least for now, these types of tokens are not yet the focus in the eyes of institutions.

It is interesting that most of the project owners who issue ERC-20 tokens have not linked the tokens to the expected returns of the project, but have only endowed the tokens with so-called "governance functions". This makes these "governance tokens" seem to be unrelated to "commercialization" and achieving "expected profits" at present.

However, it is relatively easy to touch upon the judgment of decentralization from these ERC-20 tokens.

On the contrary, a large number of inscribed tokens, led by BRC-20, that have emerged in this round of Bitcoin ecosystem appear to lack the characteristics of "commercialization" and "expected profitability", and also appear to be more "decentralized". To some extent, as long as they have sufficient liquidity and accumulate sufficient consensus, it is entirely possible that they will eventually be issued as ETFs by giants.

Based on the clues and speculations above, I believe the general path of Wall Street's giants will be as follows:

Continue to search for new targets in POW and POS native tokens. But they will not blindly choose without purpose, but may choose tokens with such characteristics: large market value, strong consensus, good liquidity, and dispersed chips controlled by others.

In fact, the number of good targets for this type of native token is very limited at present, so when the good targets among these native tokens are selected, I believe they will definitely target protocol tokens such as ERC-20 and BRC-20.

In short, when we examine the entire crypto ecosystem in a few years, we will surely find that almost all of the good targets in the ecosystem have been issued spot ETFs by Wall Street giants. At that time, encrypted assets will undoubtedly become an emerging financial asset rising in the world.

Based on this route, let's wait for these giants to target which tokens when submitting new spot ETF application materials to the SEC next time.