Assuming that Bitcoin is a company, then he has only one anonymous founder, Satoshi Nakamoto, who has no permanent staff, only full-time volunteers, and all cryptographic deities. The company does not have a penny marketing budget, but users have increased exponentially in recent years. If Bitcoin's market value is regarded as the stock price, it is already the top ten companies in the world. What is more interesting is that after founder Nakamoto Satoshi sent bitcoin on track, he disappeared into the shadowy forest. The current Bitcoin in his account is enough to make him the top 50 richest man in the world. [1] And this money has been lying motionless in his account for years. His beliefs about him are regarded as God, and the textbook white paper he wrote ten years ago was also enshrined as the Bible in the field of cryptocurrency.

Someone sighed on Twitter: "Nakamoto created the most successful virus spread in history, and his name is Bitcoin."

Let’s start by capturing what the great gods have invested in Bitcoin in recent years.

Real money fund

The most popular bitcoin investor in these two days is Xu Xiaoping's teacher of the real-life fund. Whether this is an event marketing or not, this is a blockchain technical platform that is still very relevant. Instead of mentioning Bitcoin, Mr. Xu emphasized the underlying technology blockchain, pointed out ICO chaos, and called for entrepreneurs to return to the essence of technology and business to create value. If you want to think that Teacher Xu is a believer or confused, it would be naive. In recent three years, the Realger Fund has invested a lot of successful blockchain projects, and has also promoted the construction of the cryptocurrency and blockchain infrastructure. This should be his best practice.

The real-world fund invested in China's Bitcoin exchange's Huobu Network at the end of 2013. In 2014, Huo-Net became the largest exchange in China. So far, Huo-Net is still the personal exchange that I personally use the most. At the same time, the Real Estate Fund also invested in the Bitcoin mining company 21 INC, but it seems that the company has died and changed its face. The underlying construction of the cryptocurrency as an investment exchange is also a sign that it has long been optimistic about this market. After all, it is a famous angel investment fund. Thinking is really ahead of ordinary people for several years.

- Tim Draper

The second person to introduce is Silicon Valley investment god Tim Draper. In 1996, Tim Draper invested in Hotmail and contributed to the first viral marketing in the history of the Internet. This is also considered to be the starting point for growth hackers. The growth black box was introduced in the previous article, "If People Are Not Named, Concentrate on Growth," Tim Draper also made a preface to the book "Growing Hacking" written by Fan Bing. He is an investor who is very willing to help entrepreneurs.

Tim Draper's best-known bitcoin investment was to auction 30 million Bitcoins from the U.S. government for 20 million U.S. dollars in 2014. The U.S. government has so much Bitcoin because the FBI investigated the largest black market "Silk Road" at that time. Despite the auction part, the FBI still holds 144,342 Bitcoins, worth more than 2 billion U.S. dollars.

Just as Tim Draper predicted three years ago, in December 2017, Bitcoin broke through ten thousand dollars.

Simultaneously, Tim Draper said at the 2017 Global Network Summit (Web Summit 2017) with a bitcoin logo tie:

“In five years, you’re going to try to pay in fiat currency at Starbucks and they’re going to laugh at you.”

On November 8, last year, when Tim Draper was wearing a Bitcoin tie to open the conference, he added something he said to entrepreneurs:“Are they challenging the oligarchy? That’s what I look for in an entrepreneur.”

- Peter Till & Li Kacheng

Then introduce two people who are well-known to invest in the great god that is Peter Tiel of the United States and Li Ka-shing, the richest man in Hong Kong.

Peter Thiel, one of the founders of PayPal, is also a legendary investor and author of the best-selling book, Zero to One. As PayPal’s “gangster” boss, his personal charisma and strength are unquestionable. Once 500,000 U.S. dollars were invested in Facebook, and they received a 20,000-fold return.

Peter Till had already invested Bitcoin's terminal payment system Bitpay as early as 2013, and Bitpay can be seen as a bitcoin version of Paypal. At the same time, he is also often the Bitcoin platform, claiming that Bitcoin is undervalued, and its investment company has also bought about 20 million US dollars of Bitcoin, which is now worth about 100 million US dollars.

Recently, news has revealed the bitcoin investment experience of Hong Kong's richest man Li Ka-shing three years ago. The media concluded that "I am more conservative, I only invested one billion bitcoin." It must be said that some Chinese media are still good at making big news. After my investigation, this sentence was taken out of context.

In May 2014, Li Ka-shing did increase investment in bitcoin in the reverse market. However, the one billion yuan invested did not buy into Bitcoin, but it was in the second round of Bitpay's layout with Peter Thiel. In my opinion, this type of investment is not so conservative. It is better to say that it pays for Bitcoin for a long time. After all, terminal payment is the result of closing transactions. The number of people who use Bitcoin will be more and more, and the amount of transactions will increase.

The average number of Bitcoin transactions over the past three years has increased by about 5 times, the currency price has increased by 30 times, and the transaction volume has roughly 150 times. The return on this investment, I believe Li Chao people also surprised.

Why do so many people invest in Bitcoin?

We take history as a mirror and look at the history of Bitcoin development over the past decade.

Global financial ruin

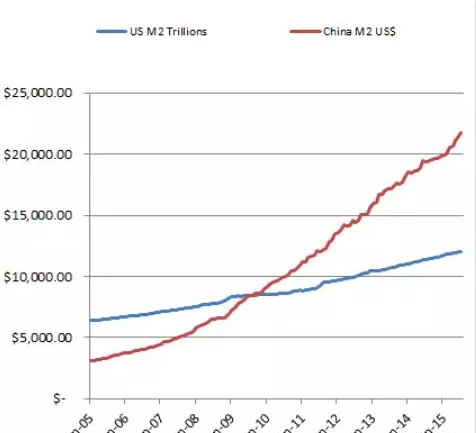

In the two years between mid-2004 and mid-2006, the Federal Reserve raised 17 consecutive interest rates, raising the federal funds rate from 1% to 5.25%. With the sharp rise in interest rates and the cooling of housing prices, homebuyers in the United States continue to default on the subprime mortgage market, and the subprime mortgage crisis continues to escalate.

Until September 15, 2008, Lehman Brothers, the fourth largest investment bank in the United States, declared bankruptcy and the global financial crisis officially kicked off. Starting in 2009, in order to cope with this mess, the world has started a race for over-currency. The national machine used printing money to dilute the returns that the working people produced. To give an example that is not representative and definitely not my own home: Xiao A’s family invested in a second-tier city in China in 2008 at a price of 10,000 yuan/square meter. In 2017, the price of the property was 40,000/square meter. If you did not invest in real estate at the time, but held cash, the property of the small A family had fallen by more than half in just a decade, and now you can buy up to two toilets in this second-tier city. The 28 effect is always there. In the past decade, 20% of the people have bought 80% of the real estate. For those who are unable to invest in real estate or find a better investment direction, their average purchasing power is decreasing year by year. In the final analysis, the devaluation of money is too fast, and the appreciation of the labor force never runs out of appreciation of assets.

- Nakamoto's mail and white paper

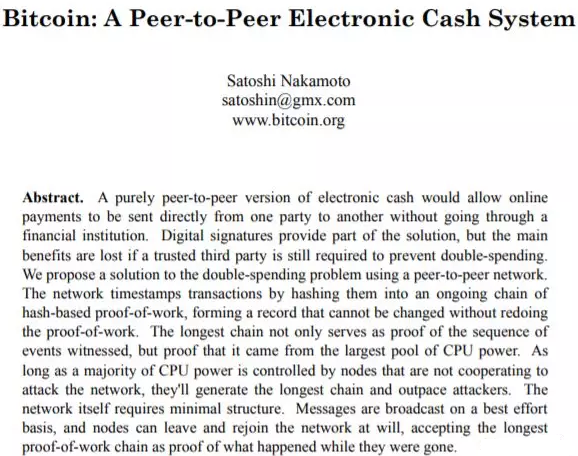

On October 31, 2008, a self-proclaimed man named Sakamoto published the bitcoin white paper that is now regarded as the cryptocurrency Bible on the The Cryptography mailing list.

(Mail sent by Satoshi Nakamoto on October 31, 2008)

(Overview of Bitcoin White Paper in Mail)

Bitcoin is a payment system that does not require a third-party intermediary. Transactions can be completed between two people. Because if a third-party intermediary is involved, the third party may profit, and the transaction may be tricky, such as the "double-spending" situation.

In order to mediate, Bitcoin needs everyone to provide CPU power to keep accounts, so there is no need for third parties to keep accounts, unless 51% of the CPU's power comes together to tamper with the books, otherwise the books will not go wrong. In this theory, Nakamoto believes that the vast majority of people are good.

Note that Bitcoin does not use the word currency in its white paper summary. According to the white paper, Bitcoin is a decentralized, untrusted, distributed accounting system.

Assume that there is a transaction between users A and B. The transaction information will be broadcast on the entire network. Most other people will record their own account books after receiving the broadcast of the transaction information. Finally, everyone will bring out their own account books. One pair, the discovery was the same, then the deal was confirmed.

Unless, if more than 51% of users say bad things together, they ignore the transaction on their books, and this transfer is ignored because most people cannot have a consensus. Any user who deliberately undermines this rule, Bitcoin's consensus mechanism will be destroyed, resulting in their own Bitcoin has become worthless. Therefore, if you want to benefit together, you must be an honest person. Or better to say that everyone has to be honest because the cost of doing evil is too high.

In contrast, even if Alipay has such a trusted third party, no one can guarantee that no one will do evil, and the account book is not wrong. Therefore, the state has very strict review of Alipay and other third-party agencies. At the same time, as a single center, Alipay itself also bears the cost of the celestial server. The computer of each Bitcoin node user is a distributed server that crowds the cost of Bitcoin operations.

- Bitcoin Creation

In the same year, that is, in November 2008, Nakamoto released a bitcoin code antecedent version, and he designed a bitcoin generation rule similar to gold mining.

The total amount is fixed, and mining is getting harder and harder: the gold reserves on the earth are limited, and mining is getting harder and harder. Similarly, Bitcoin has set a ceiling of 21 million, and every four years, production will be halved (for example, 12 years, 16 years are the production of half of the year), and finally in about 2140 to dig out all the bitcoin.

Mining is needed: Gold mining is well understood, and Bitcoin is using the CPU to "mine." Bitcoin requires users to provide computing power to maintain the books. Since there are requests for users, there must be incentives to encourage users to keep accounts. Bitcoin sets a reward rule, a ten-minute round of bookkeeping contest, and the user with the fastest bookkeeping every ten minutes can get a certain amount of bitcoin rewards.

The first miner in the world is naturally Satoshi Nakamoto. The first block he created was called the genesis block, and Satoshi Nakamoto wrote in the creation block.

"On January 3, 2009, the Chancellor of the Exchequer was on the verge of implementing the second round of bank emergency assistance."(The Times 03/Jan/2009 Chancellor on brink of second bailout for banks)

And this sentence is also always recorded in Bitcoin's books. This satire on the old system was chosen from the headlines of the Times newspaper of the day. It spelled out the pain points of the government under the financial crisis. In fact, governments in other countries have no other way to save money than to print money.