U.S. After the very anticipated launch of bitcoin futures contracts on derivative exchange CME, this bitcoin price has declined in one day.

Launch of CME Bitcoin Futures;

This is as CCN has listed the Bitcoin Futures for trading on the Chicago-based exchange on Sunday evening. This Bitcoin future was already trading on partner Chicago exchange CBOE for one week, but CME is a very large exchange, and analysts believe that attracting more and more trading volumes, especially from institutional investors will be from deep pockets.

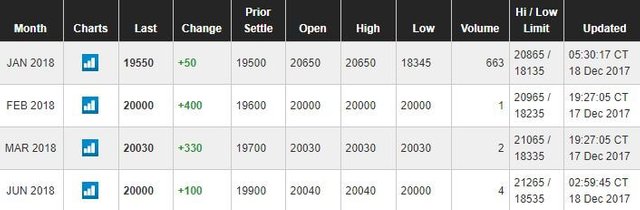

At the time of writing this CME, every 670 contracts equal to 5 Bitcoin were processed, which translates to the current bitcoin spot price in volume of approximately US $ 64 million. It was centered in almost all volume January futures, which was at a high level of $ 20,650 and $ 18,345.

Currently January futures are priced at $ 19,500, which represents a $ 1,100 reduction from the initial bid of the contract, but the current bitcoin is above the price of about $ 300 from the spot price.

Bitcoin price trades down to $ 19,000;

This bitcoin price rose by $ 20,000 in the weekend's anticipated futures to $ 20,880 a barrel, which eventually increased to BitFinEx at $ 19,891, but it declined soon after the market was opened done.

This late Sunday evening, Bitcoin reduced its value by $ 18,010, but on Monday morning it started to recover. At present, the price of Bitcoin is trading at $ 19,202 according to the CCN's price index, which represents a three-percent decline in a day and translates into $ 321.6 billion market capitalization.

These global average bitcoin values continue to trade at a higher level of several hundred dollars, due to significant premiums on the Bithumb and BitFinEx of Asian markets.

All bark no bytes;

Although this price of bitcoin has declined in the business after its launch on the futures market of CME, It is important that fast-moving traders in the market did not have to take a small position.

This can be because brokerage firms take precautions for bitcoin futures, which require traders to maintain exceptional margins, and in some cases, except for completely abandoning access.

While this may also indicate that despite the obvious vociferous declarations, this suspicion is not as much a recession as Wikipedia because they want to trust the public.

source - https://www.ccn.com/bitcoin-price-trades-down-after-cme-futures-launch/

Nice story to update

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit