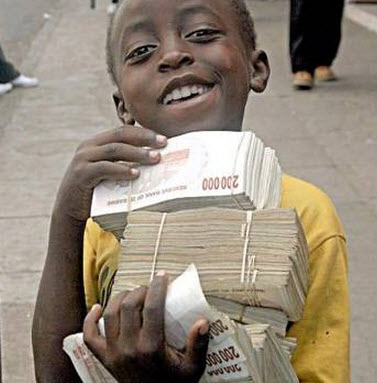

Dangers of allowing corrupted people to manage our national fiat currencies can be seen in Zimbabwe where the people fell victim to hyperinflation. Over the course of five years (2003 - 2008) the inflation rate went to Mars. The worst of the inflation occurred in 2008. In June 2008 the annual (yearly) rate of price growth was 11'200'000%. The peak month of hyperinflation occurred in mid November 2008 with a rate estimated at 79,600,000,000% per month.

Imagine having to explore the possibility of using your nations fiat currencies as toilet paper because the toilet paper was worth more than your nations currency, this is all possible due to corruption. In 2009 the Zimbabwean government abandoned printing the Zimbabwean $. This solved the chronic problem of lack of confidence in the Zimbabwean $, and compelled the people to use a foreign fiat currencies of their choice. Since then Zimbabwe has used a combination of fiat currencies, mostly US dollars.

Fiat currency was essentially a receipt for gold, this relationship was good for fiat currency because this meant that in theory too much could not be printed as the government only held $14.5 billion in Gold (1970). Unfortunately the government did print too many $ and the foreign dollar holdings were $45.7 billion (1970). Knowing this more banks started redeeming their $ holdings for gold. The United States could no longer meet this growing obligation.

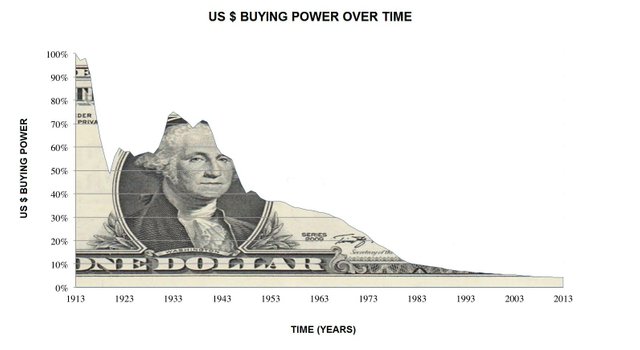

In 15th August 1971 Richard Nixon (US President) ended the gold standard, centralising the real wealth back to the US government by taking gold off the people again and leaving them with funny money worth nothing in reality, they did this by making gold not redeemable for $. The reason I said "taking the gold off the people AGAIN" is because Executive Order 6102 was signed by Franklin D. Roosevelt (US President 1933 - 1945) on 5th April 1933. Executive Order 6102 meant that the right to hoard gold was made illegal and if the people did not give up their gold they would have been imprisoned. The peoples right to prosper had been stripped on both occasions and gold rose after it was taken.

When Richard Nixon (US President 1969 - 1974) ended the gold standard. He not only severed the link between US $ and gold but severed all fiat currencies and gold as the US $ was the reserve currency of the world. Fiat currencies are not backed by anything. This meant all governments worldwide could now start printing even more recklessly, it's like a domino effect when one country/nation gets more reckless printing their fiat currencies for growth others follow so their competition doesn't outgrow them. This is all done at the expense of the people, this is why it is more than x5 more to buy something now than in the 1970s and as long as we use fiat currency as our store of value we will continue to suffer this misjustice of wealth.

To change something you must build a new model that makes the existing model obsolete. Now think you never change things by fighting existing reality to change things you build a new model that makes the existing model obsolete. Blockchain technology has the power to dismantle corruption. It can do this because it is code based and has eliminated the possibility for human corruption which all of us are unfortunately capable of.

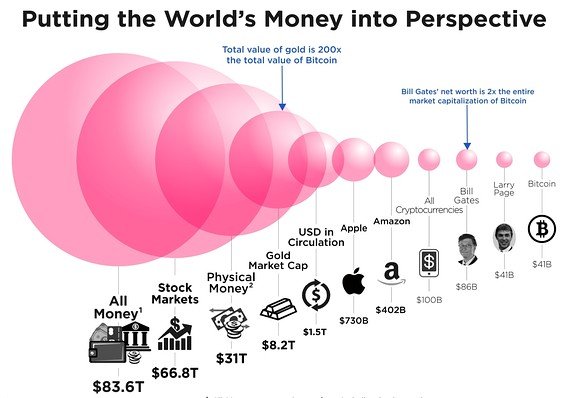

Bitcoin was the first currency made using blockchain technology. It has gone a long way since it was released in January 2009 as a open source code. There are 1'500'000'000'000 US dollars in circulation and 41'000'000'000 dollars worth of bitcoin in circulation as I write this. If bitcoin was more widely used than the US dollar which isn't far fetched as bitcoin is a international currency that is used world wide and so much more convenient in so many ways than the US dollar, than bitcoins fair price should roughly be x365 more than its trading at as I write this.

I came to this conclusion by converting a fraction (1'500'000'000'000/41'000'000'000) into a percentages (0.2733333%). I then multiplied 0.2733333 several times with different numbers to find out 365 x 0.2733333% = 99.7666545%, bitcoins fair price to me should be over $912'500. Its still 365 x cheaper than the dollar so thinking bitcoins in a bubble and the US dollar is not, isn't really fair.

There are 16,405,737 bitcoins in circulation as I write this and there will be a maximum of 21'000'000 by the year 2110 - 2140. The coins that are added into circulation by rewarding miners (computers) across the world for powering the network, anyone can run their computer and support the network and get rewarded. Bitcoin started rewarding miners 50 bitcoins per block (approx every 10 min) for confirming transactions on the network this gets halved roughly every 4 years and currently miners are rewarded 12.5 bitcoin per block until 2020 when it will get halved again to 6.25 bitcoins. This means every 4 years the supply halves, this shouldn't really affect miners because when the supply of bitcoins drop the price of bitcoin will go up unless the demand drops drastically.

Other factors that affect mining is how powerful your hardware is and how many people are mining + how powerful their hardware is. Just like the job market when there are more people able to do the job payments will decrease, to stay profitable mining bitcoin upgrading hardware regularly is needed as more and more people start to mine. In the first months of bitcoins people were able to mine 10'000+ bitcoins daily using a basic computer, 10'000 bitcoins were under $10 then and worth over $25'000'000 now.

Congratulations @aarohn! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit