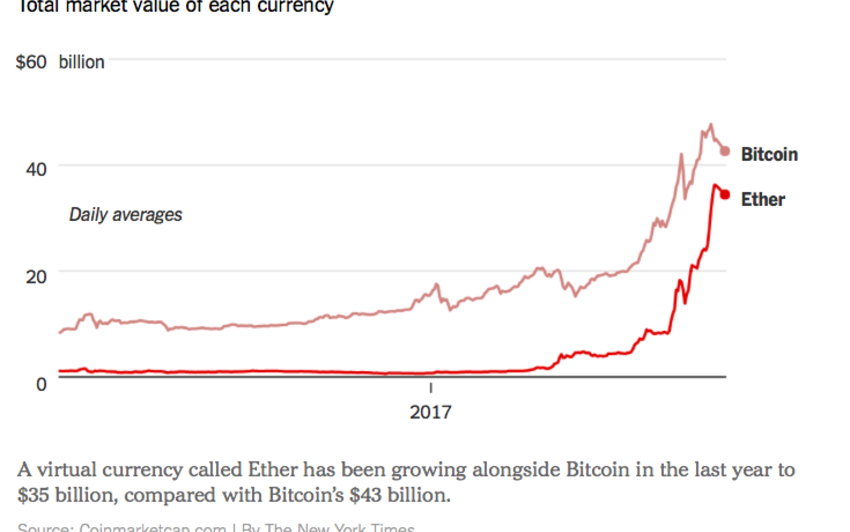

A vertiginous flight. The bitcoin, which was worth less than $ 500 in early 2016, broke its ceiling in June, climbing to about $ 3,000. The value of the encrypted currency has increased six-fold in less than eighteen months. Based on the technology of the blockchain, the motto is based on a decentralized network that can not influence the banks or the states.

Since the beginning of 2017, the competitor system of ether has been deployed even more rapidly, with a growth of 4500% bringing the unit to more than 300 dollars. This valuation brings the value accumulated in this currency to some $ 34 billion, or 82% of the sum raised by the bitcoin in 7 years of existence, underlines the New York Times.

Behind the Ethereum project is a 23-year-old Russian, Vitalik Buterin. After a childhood in Canada, the young prodigy based his project in Switzerland, in the region of Zug called Crypto Valley because of the implantation of many companies active in this field. Already a millionaire in ethers, Vitalik Buterin indicates on the list of these places of residence Cathay Pacific Airlines because he spends most of his time in the air.

Read also: Switzerland, Mecca of the bitcoin for start-ups

In 2017, interest in virtual currencies is no longer limited to insider circles. The Zurich bank Vontobel issued 11 months ago a Bitcoin-Tracker-Certificate, whose issue volume doubled last March, reports Finanz und Wirschaft. For its part, the Zuger Crypto Fund announced at the end of the year the issuance of an ETF (index funds) fund of encrypted currencies, intended initially for institutional investors.

Who will dominate?

If digital currencies hit record on record, it is only because of ever-increasing demand because their prices reflect the sums that investors are willing to pay to acquire them. However, the risks remain high. No one can say what the bitcoin will represent in five or ten years. If the growth of virtual currencies seems certain, it is not known which will dominate and if some will disappear. There are around 800 different encrypted currencies in the world, including the Ripple which also has the wind in its sails. The capitalization of all these currencies currently exceeds $ 100 billion, more than the market value of UBS or ABB, said Finanz und Wirschaft.

Today, the bitcoin already enjoys wide recognition, for example from companies like Overstock.com and Expedia. Japan accepts it as a means of payment as well as Australia, while China is studying new regulations. However, the Bitcoin community is confronted with technical limitations as well as strong internal divisions. His image also suffers from his association with criminal drug deals and racketeering demands from hackers.

Read also: Does the bitcoin have a place in a portfolio?

Launched only two years ago, the ether has yet to face any scandal. Supported by both geeks and large companies like JPMorgan Chase and Microsoft, the Ethereum project extends the use of blockchain to a new type of global computer network, beyond a simple virtual currency. According to William Mougayar of Virtual Capital Ventures quoted by the New York Times, the moment when the Ethereum will surpass the bitcoin is near. "There is practically nothing that can be done with the bitcoin that the ether does not allow as well. "

About a hundred companies, including Toyota, Merck and Samsung, have joined the non-profit organization Enterprise Ethereum Alliance, which works to integrate Ethereum standards into the corporate world. The tipping point where the capitalization of the ether must exceed that of the bitcoin has already been baptized with a dedicated Flippening site and on Twitter, observers use the hashtag # Theflippening.

Initial Coin Offering

Ether is used for purely financial transactions, for example to raise funds for start-ups that work from the Ethereum project. It is in this context that the term "initial coin offering" (ICO), which echoes "initial public offering" (IPO), is used. This operation allows entrepreneurs to raise ethers that they can convert into dollars and use for their operating expenses. In mid-June, investors injected $ 150 million into the start-up Bancor specializing in virtual currencies. One movement followed closely because a failure of Bancor would be very bad omen for the project Ethereum.

Many internet platforms allow to acquire virtual currencies. These bourses auction the amount of money that sellers put up for sale, on the same principle as e-Bay. The buyer determines the most attractive offer

Nice article!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

follow me and will always upvote your post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit