Prominent analyst #Willy #Woo says that powerful investors bought #Bitcoin ( BTC ) after the massive capitulation that drove it from $ 59,000 to $ 52,000 in hours. Woo, a new tweet sequence was determined by factors that lead to violent chain sales data later.

A power outage in the province of #China contributed to the biggest decline in Bitcoin's hashrate since November 2017, according to the analyst who studied on-chain metrics:

“The power outage in Xinjiang (giving significant power to the Bitcoin mining network) was known before the BTC price drop.

Woo says a whale with insider knowledge of the events took advantage of the situation:

“ 9,000 BTC has been sent to Binance . See this as the sale of those coins. I would like to point out that Binance is hosting more sales volume in Asia than in the West. It was probably sent from a whale who was keeping a close watch on what was happening in China. "

Woo stated that the event was coupled with the sale of quarterly futures contracts used by sophisticated traders in the derivatives markets, which have been running since April 13.

According to Woo, the two catalysts were enough to push the price below the $ 59,000 liquidation level and stop losses to trigger a chain reaction of sales. The analyst says more than $ 15.20 billion has been liquidated in crypto markets affecting the accounts of one million traders.

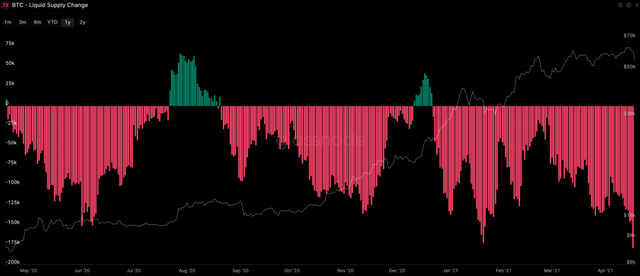

While taking a sudden blow to the value of Bitcoin, Woo reveals that buyers with very little history of selling BTC step in and buy from the decline:

"Strong holders buy at the bottom (red = Rick Astley style holders)."

Woo also highlights that after the April 17 crash, a major address bought tens of thousands of Bitcoins:

“The address that held 9,000 before the crash started holding 20,700 BTC after the crash. Is it the same whale? "

The on-chain analyst adds that Bitcoin is strongly validated as a trillion dollar asset, as 13.5% of the BTC supply changes hands while the leading crypto asset is trading above $ 1 trillion.

Woo: Bitcoin metrics signaling "buy bottom"

Woo concluded that metrics on the chain are now signaling to "buy at bottom" as the long-term foundations remain strong.

“In simple terms, profit sales of long-term investors are completed. Few sales force remained, with investors not wanting to sell at a loss at entry prices. Not likely in the bull market.