Bitcoin hit $6,200 last week! Yay, the euphoria continues! Well, maybe not "yay," since the rest of the crypto market continued to experience weakness over the last few weeks. If you are an investor in the sector who is endogenously diversified, gains in Bitcoin may not have increased the total value of your portfolio in fiat terms. Heck, if your crypto portfolio is not dominated by Bitcoin you may be suffering heavy losses. Overall, this is a change in the trend, and this accumulation of strength in Bitcoin and weakness in the rest of the sector is a red flag. What will happen when Bitcoin turns around? Will the alts go to the moon? These questions prompt us to focus on a few fundamentals and technicals today. The bottom line: the crypto sector is lacking fresh capital from the outside!

Crypto Market Divergence

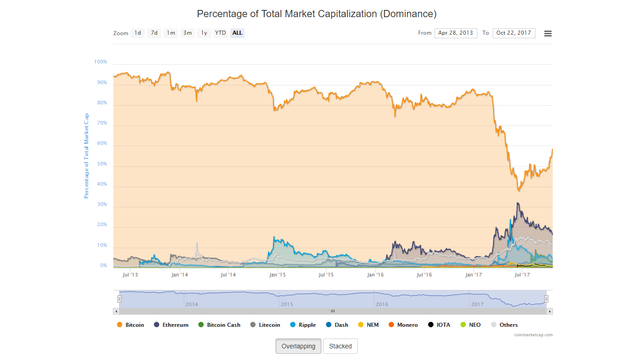

The divergence between Bitcoin and the alts started to carve an obvious path a few weeks ago when Bitcoin was setting a pace the rest of the crypto market couldn't keep up with. If one takes a look at the market capitalization percentage data of the crypto sector below, we can trace the beginning of this divergence and capital flows out of altcoins and into Bitcoin dating back to mid June of this year - increasing Bitcoin's market dominance. Not all the altcoins started to experience this divergence at the same time, but the data allows us to theorize in more general terms. Of course, maybe each consecutive instrument simply reached its peak price and capital left the sector without redistributing to Bitcoin or some other crypto instrument. Note that with this data here we simply don't know how much of the capital stayed in the market and moved around internally, or how much "new" capital flowed into the sector. From this data, one thing we can see for sure: net capital is leaving altcoins and going to Bitcoin.

Chart by CoinMarketCap.com - https://coinmarketcap.com/charts/#dominance-percentage

One good example of this change in trend is OmiseGo, who in August, was following Bitcoin fairly well...up and down. This relationship is now experiencing inversion....

Going back to the crypto market cap chart above, you will see how inversion began some time mid June (2017), most notably with Ethereum.

What has happened to Ethereum since then? Well, Ethereum has traded sideways and has failed to establish new highs on the daily chart. If the daily is showing us a symmetrical triangle, don't forget that symmetrical triangles can breakout to the downside just as much as they can break to the upside.

Interestingly, Ripple experienced divergence as early as mid May (2017). If you take a look at Ripple on a chart, you might see something similar to Ethereum. Both Ethereum and Ripple outperformed Bitcoin at one point in time. Now, Bitcoin is outperforming.

Crypto Market Capitalization

One of the big questions floating around right now is, what will happen when Bitcoin starts to correct to the downside? Will the alt market follow the weakness or will they continue this current inverse relationship and outperform bitcoin's weakness against fiat currencies? Many subscribe to the theory that we will see capital "rotation" from Bitcoin into the altcoins when the former decides to take a break. Before we bet on this conclusion, we should consider some evidence.

The fact that some of the altcoins experienced variation in capital flows (as noted above) casts light on this idea of "rotation." In other words, not all boats might float at the same time, and so the entire altcoin sector might not get a boost from weakness in Bitcoin if strength on weakness is the case. We might see rotation, but only in a few dominant players while the rest sink to even deeper technical levels. Why are we seeing this "rotation" in the first place? Would a healthy market exhibit such structure?

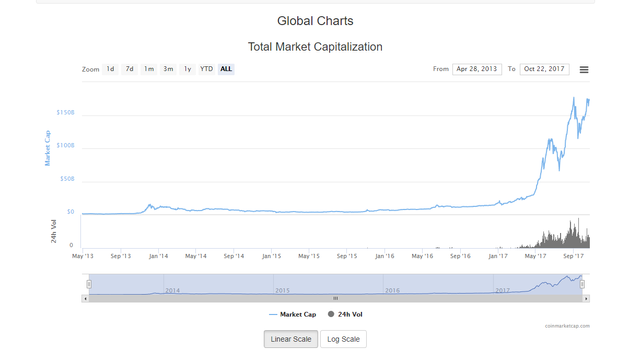

Chart by CoinMarketCap.com - https://coinmarketcap.com/charts/#dominance-percentage

For one, this rotation in capital may be a symptom of, and could be a signal for, a potential top in the crypto market capitalization in its totality. Without fresh capital coming in, we run out of buyers for these instruments. The capital in the market now may simply be rotating around on fundamentals (think "hard fork") and technicals (we never went beyond important fibo and trend line levels in Bitcoin...yet). What we could be seeing, is a final rally concentrated in Bitcoin because of its strength and appeal. Wyckoff analysts would call this moment in time a "distribution" phase, where big players are cashing out on strength, while new retail money floods the market. In this case, the distribution signal could have been from the total market capitalization. Have we hit important levels in the total market capitalization charts?

Notice on the chart above how the market capitalization of the entire sector has not surpassed the previous high. Bitcoin surpassed the previous all-time high by over $1000. On the total market cap chart it looks like there is a risk of forming a "double top" if Bitcoin turns around soon, or we could see a "5th wave" within the 1 to 5 Elliot Wave sequence. Uhoh! Now, one thing we must consider is that the current structural wave 5 in Bitcoin has not ended, and that we might continue higher. But, we are likely to form a top soon by completing the final sub-wave 5 within that structure. This suggests we could still see more capital flow into Bitcoin - maybe even into the entire sector - bringing the total market cap up over that previous high. The question is how much capital, when, and from where? If you take a closer look at the chart, you will see there is some room left to run and still potentially form a double top or breach a key support level (yes, market cap charts have those, too).

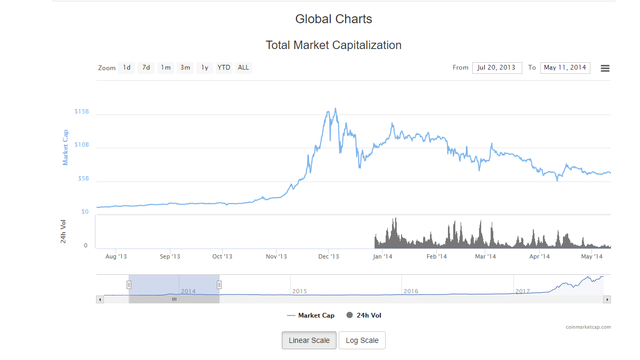

Chart by CoinMarketCap.com - https://coinmarketcap.com/charts/#dominance-percentage

If we exclude Bitcoin's market cap, as the chart above does, we see the degree to which there has been a slow down in the capital flowing into the altcoin sector. The reason for this could have been the low technical levels reached in many altcoins such as Ethereum, Litecoin, Bitcoin Cash, OmiseGo, etc., particularly against Bitcoin. Breaching a major key fibo, for example, can encourage big players to cash out once the market swings back around to the major fibo or the previous high. This last signal was the reason why I began to let go of my entire investment portfolio in the crypto space back in June when I saw the massive selloffs (although I am still holding Quarkcoin that I've been accumulating since 2013 ;) ). This "selloff" capital might have then moved into Bitcoin as a safe-haven due to its technical and fundamental strength (this is one contextual reason why I have been opening long positions in Bitcoin). At the moment, it seems "new" money is entering the market only relative to Bitcoin. A sense of euphoria is plaguing that market right now, and as new capital from the "outside" comes in, the smart capital may be leaving. Of course, this can only be validated once things have toppled or moved on pretty far. By the time this conclusion is validated, the entire crypto space may have already been plunged into a bear market.

Chart by CoinMarketCap.com - https://coinmarketcap.com/charts/#dominance-percentage

I'm not a fan of making a correlation with the previous bubble in this space, simply because so much of the fundamentals have changed. But, this total market capitalization chart above showing 2014 should not be ignored. Notice the double top structure, coupled with a drop to a support zone which was a lower low, followed by a lower high. I can imagine a pattern like this repeating itself. This is a sure signal you should sell what you have taking into consideration potential risk of a bear market. This bull market did not see all the same top 20 instruments we saw in the last one, so the coins you could have "invested" in recently may reach a fiat value close to zero. This is exactly what happened with Quarkcoin I began accumulating during the last bubble. Live and learn (rather than live and earn), sometimes I guess!

Now, what may happen as Bitcoin begins to complete its current structural wave 5, is capital DOES begin to rotate back into the rest of the sector (altcoins) rather than leave. This would unleash some serious gains in the altcoin market, while Bitcoin loses value. However, the lesson here is that this would have to result in an increase in the total market capitalization (i.e., new capital to the entire sector). I still cannot imagine the altcoin market flying without Bitcoin, but the altcoin market will definitely not fly without a fresh supply of capital from the outside world.

House Keeping...

If you have been following my threads here and on Trading View over the last few weeks, you will notice that I have been flat or short on most instruments except the big B (although I was looking carefully for a crown reversal in Bitcoin). Just to remind you, I do not consider the current crypto environment ripe for "investing" and hodling for the long term. This was an activity that should have been carried out during 2015 and 2016, so I am going to wait for the next bear market to start accumulating again. I advise you do the same. I plan on blogging well into the bear market and showing how I caught the last one for enormous gains.

***On Friday I could not access Steemit (this happened numerous times over the last few weeks), so I could not post a technical report. I've also notice the site has been working very slow at times. Due to the unreliable nature of this platform - something I did not notice until I joined - keep in mind that you can access my technical charts at TradingView.com/Agency at any time. Because of this unreliability, I would advise some of you to withdraw a portion of your Steemit Tokens and consider selling them for fiat as the bear market might be approaching ;) . A bear market in the crypto world would result in a collapse (in fiat terms) of the value of upvotes and curation rewards you receive. If you are in it for the long-term (years and years), maybe just leave it alone! I know in the next bear market, I will be investing into Steemit and whatever other blockchain social media project comes to life early.

Cheers!

-Erik