Following the cryptoshpere on twitter and elsewhere I notice that quite a few myths hold steady in different parts of the community. Mostly my judgement here is based on the fact that I cannot help myself, but almost every week I smile to myself and think “I cannot believe this is all happening again, it is like I am in the same film twice”. I am referring to the .com bubble of course and the exact same way that events unfold and sentiment manifests itself today as it did then. It truly is as if I have seen this once before.

So I decided to put down what I consider to be the biggest myths around cryptocurrency and blockchain investing. I try (did not manage at all times) to stay clear of the technical aspects that I am not an expert on, but I do believe you can take my opinion seriously on the investment side of things. It is what I have done my entire life and if you check out my articles here you can see that my thoughts on bitcoin price and crypto in general have been reasonably accurate on that side so far. Remember all of the below is my opinion, it is never advice and if I have learned one thing investing it is that I can be wrong. Without more of a preface, here we go.

The biggest myths in cryptocurrency investing (in no particular order)

We are still so early. If you buy crypto now, you are an early investor

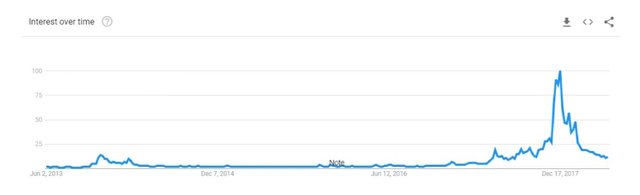

Google Trends data for “Bitcoin”

Look, I know it would be great if that were truly the case and I know everyone in the community tells you so. But think for a moment. There is more than one daily crypto show on US national TV, CNBC and Bloomberg show the price of bitcoin in their on-screen tickers, and as opposed to earlier hype cycles in bitcoin price, this time it truly caught hold with the majority of people (if you don’t believe it did, check out the google trends above; the December interest high was easily 6x higher than the 2013 high).

In 2013/14 only the rarest of dinner parties would breathe a word on crypto. Back then, despite the fact that prices rose 10x, you had maybe 15 (if that) serious “alts” listed. This time around everyone is talking about bitcoin and blockchain. There are over 1,000 altcoins and I know of at least 10 bitcoin forks that further increased the supply side of crypto. There have been over 150 crpyto “hedge” fund launches last year. Still we 10x the price. Only this time, a lot more capital was necessary for that to happen and the signs are all there: this is the final (or at least the largest) bubble in crypto. This time is when the majority of people that would ever consider investing money at all got involved. Whether or not you think crypto is a great investment now, which is a fair opinion to have, you got to realize you are not an early investor.