Hello dear reader,

In this post, you are going to learn about the tools, fundamentals and technical chart analysis I use to form an opinion on whether or not a coin is worth investing into.

This is a guide directed at beginners in specific but experts might learn something as well.

Disclaimer: This article is a 15-minute read.

Who am I? - I've been in crypto since 2013, my first trade I flipped many Litecoin's from $4 a pop to $37 each, I've been chained to crypto ever since. In 2013 I put money into mining and primarily mined Dogecoins at the time.

The crypto market is fast paced, I don't want to waste your time by rattling on about basic concepts that you most likely already know, so without further ado, let's learn how to properly trade.

Fundamentals

First off, these are some basic parameters that you should stick to when starting to trade to ensure long term growth and wealth preservation:

- Your portfolio should ideally consist of about 30 - 50% long term holdings.

- To maximize long term wealth growth you will need to trade with multiple time frames (long/medium/short term)

- Each position you open (trade you make) should consist of about 5 - 10% of your capital, this is to ensure diversity to minimize risk.

- Your portfolio should consist of at least 10% Bitcoin, this is in the case of short term investment opportunities arising, you will have the funds to invest.

Tools

To make your trading experience more streamlined there are many tools I use to help me find out about the latest trends, and opportunities, as well as just making life easier :). - I recommend making a folder in your bookmark bar, named 'Crypto' or something along those lines, and bookmarking many of the following sites.

Research

Every morning I do my daily routine of scanning through the following sites to see what is happening in the cryptosphere.

Coinmarketcap - Most people already know this, but under tools > Recently added, you will find new coins. I will usually look at their concept, team, how 'professional' it looks etc. to see if this is a coin that has potential to become large. One very important thing to keep in mind is when looking at a coin. Don't pay attention to the price per coin per se. Pay attention to the Market Cap. Ask yourself, do you think that this coins market cap is too small? Compare it to other coins. Many coins have market caps of many 10's or 100's of millions of dollars.

Bitcointalk - Bitcointalk is usually the first place where new coin's post their plans, there is a lot of garbage however so try to see past this.

Important things to remember when looking at new coins are

Is the concept unique? - (for example Substratum is doing a decentralized internet. However, I don't buy it, since I know from research that MaidSafeCoin is already doing this, and has been doing this for years.)

Does this concept need to be on the blockchain? - Many coins are created to do something, but think to yourself, does this technology really need to be on the blockchain? (example: DetectorToken which is basically a bot that detects market change, however programs like this have existed forever and I don't believe require blockchain integration.

Look at the team behind the coin. A team filled with people who have worked on previous blockchain projects is a very good sign.The Bitcoin Pub - This is a forum, still in its early stages, but has a very active and kind hearted community that will usually spot things before many others.

Reddit - Of course, you probably expected this one. There is basically a subreddit for every coin which is great when wanting to find specific information. There are also some larger, broader subreddits out there that I check on to see what others are doing. These subreddits include: r/bitcoin, r/CryptoCurrency/, r/icoCrypto, r/ethTrader.

Twitter - All coins have a twitter, this is also a great place to see what the developers are up to.

Discord servers - Discord is a client that lets you chat with others. There are many cryptocurrency chat rooms which can be a good place to network and talk with others. Examples; Crypto Traders Room, or Data Dash.

Trading

These are the tools I use when looking at a coin's market performance.

Coinigy (Ref) / Coinigy (non-Ref) - Coinigy is probably my favourite website for trading. Coinigy is an all in one tool that allows you to see all the Market information you need ( depth, time frames, multiple indicators, alerts (even SMS!), portfolio information, directly connected to exchanges, and much more.) My only gripe with Coinigy is that the plans range from $19.99 to $15.42 /mo depending on how many months you buy at once. - Luckily there is a free trial that lasts for a month, that doesn't require any credit card information or anything. So there is no damage in trying it.

TradingView (Ref) / TradingView (non-Ref). TradingView is the best source of high-quality charts and a community section which shows you what other people are doing. I use Tradingview daily as I believe its the easiest to use and most feature packed chart software there is. TradingView does not cost any money, however, if you wish to use more features (example, more than 3 indicators) then you do need to upgrade, however. TradingView's pricing plan ranges from Free to $39.95 USD.

Altpocket (Ref) / Altpocket (non- Ref) - Altpocket.io is a relatively new website, which specializes in portfolio management and overview. Altpocket.io has been getting almost daily updates due to the hard working devs. I like Altpocket because you can link your currency exchanges to it and Altpocket will do all the work for you! -And best of all, it's FREE!

Chart Analysis

Now that you've got the tools, it's time to start looking at opening positions and making some money.

There are many ways to trade; swing trading, day trading, HODLing (long term holding), trading on the news, etc.

These all require different features to notice, so I will try to be broad and show you the main features that indicate a good entry point, all of the graphs you will see are from previously mentioned- Tradingview.com.

Pre-requisite

I use the following indicators, to help me make decisions. You might want to as well.

- Bollinger Bands - Essentially shows movement size, which helps show how overbought or oversold something is.

- MACD - Shows the average trend, by comparing the sell volume with the buy volume.

- Volume - Shows how much power is needed for movement. (useful for historical data)

- RSI - Shows market strength.

- Heikin-Ashi Candlesticks - I prefer them over the default candle sticks, as they remove a lot of market noise.

All of the above indicators are very famous and can be found on Google if more explanation is needed.

Let us get started.

When looking at a graph, you will need to look at multiple time frames, I recommend at starting with the bigger picture. (It depends on how long the coin has existed but I suggest first looking at the charts anywhere between 6 hours and 1 day. - This will help you get an overall bigger picture of a coin, showing its historical highs and lows, and then moving into the more specific.

There are many ways of finding an entry point, but the idea is essentially very basic. Yes, I am going to say it...

Buy Low. Sell High

-"But how do I do this"

It's all about timing.

Let me give you an example. Do you think it's better to invest into chart 1, or chart 2?

chart 1

chart 2

The answer should be chart 2 since it's historically at a resistance point (a price where there are so many people buying, that the coin doesn't go lower), and the chance to make money is significantly greater. Chart 1 has increased significantly in a very short time beating its previous ATH (all time high) and has a high chance of dropping in price to correct itself, meaning you will lose money.

In every graph, you will be able to find a trend, these trends are what help you predict the future.

For example; If a graph is ping-ponging its way upwards, then you are able to predict its next low, and get cheap coins

Other patterns include:

- Ascending triangle; This has to be my favorite. An ascending triangles features include a flat top and an upward trending bottom. Ascending triangles boom upwards in price at the end of the wedge since the average price reached the resistance and breaks through.

- descending triangle; descending triangles are technically the opposite of previously mentioned ascending triangle; They include a flat bottom and a descending average trend. Often the price significantly drops at the end of the triangle.

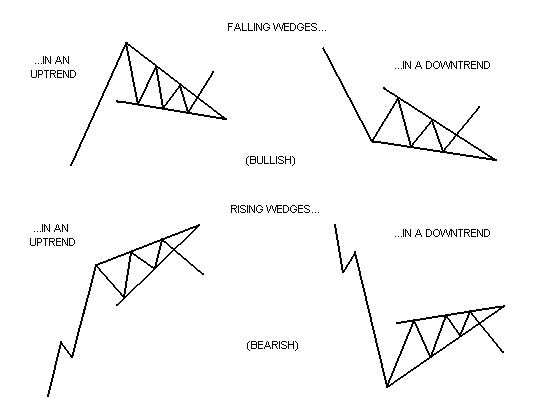

- And wedge. A wedge is when there is no flat bottom or top, there is so to say 2 trend lines that will touch at some point in time. Wedges are often followed by a lot of market action and the price can go either way.

This is all for now if Steem.it wants to know more I will follow this post up with a more detailed guide to graph patterns. Please let me know down below.

Thanks, Alfred

Disclaimer: Statements on this site do not represent the views or policies of anyone other than myself. The information on this site is provided for discussion purposes only, and are not investing recommendations. Under no circumstances does this information represent a recommendation to buy or sell securities.

nice post

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks this is vry easy to follow and is easy to follow, definitely will be using these tips!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @alfred0211! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit