<figure class="entry-thumbnail">

</figure>

This article was initially posted on Cointelegraph - an unbiased publication protecting cryptocurrency, the blockchain, decentralized purposes, the web of finance and the following gen internet.

The views and opinions expressed listed below are solely these of the creator and don't essentially replicate the views of Cointelegraph.com. Every funding and buying and selling transfer includes threat, it's best to conduct your personal analysis when making a choice.

The market information is offered by the HitBTC change.

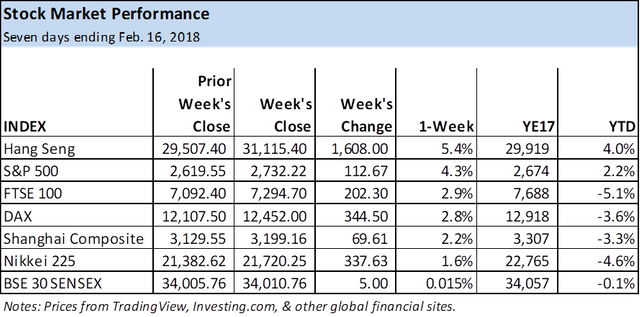

Both equities and cryptocurrency markets rallied collectively final week, as every recovered prior losses. Investors will proceed to observe for indicators of inflation and the trend of rising rates. The 10-year US Treasury yield has been main international charges increased, hitting a four-year excessive final week of two.93. Yet, for now, it seems like preliminary considerations have dissipated. The dollar is falling towards most belongings, which appears to be serving to equities. All of the foremost fairness markets adopted have been constructive, with India’s BSE Sensex the weakest performer, up solely zero.015%.

Much of Asia was closed final Friday as a result of Chinese New Year, but the Hang Seng was capable of full its four-day buying and selling week with a 5.four% advance to finish at 31,115.40, whereas the Shanghai Composite was up 2.2% to shut at three,199.16. In Japan, Bank of Japan (BOJ) Governor Kuroda announced he would keep for one more time period which was considered as supporting a continuation of unfastened financial insurance policies. This was considered positively by the market with the Nikkei 225 advancing 1.6% for the week to finish at 21,720.25.

The S&P 500 superior for every of the previous six days (due for a stall or pullback). That by itself ought to give investor’s pause as the chances now favor a pullback or not less than a relaxation within the near-term. Heading into the brand new week US monetary markets are closed on Monday for a authorities and financial institution vacation. This could have an effect on liquidity in international markets heading into the week.

German DAX Index

The DAX discovered assist at 13,003.four two weeks in the past, the place it accomplished an 88.6% Fibonacci retracement of the prior upswing and was 11.7% off its 13,596.90 file peak from a month in the past. That low assist was additionally round a previous swing low from August of final yr at 11,868.80, with the 14-day Relative Strength Index (RSI) in clear oversold territory. The RSI was essentially the most oversold since August 2015. This signifies that the uptrend construction, of excessive swing highs and better swing lows, has been maintained, not less than to date. Therefore, a good restoration may comply with quickly. It additionally signifies that the August low is crucial assist and a break beneath it places the bigger bull pattern susceptible to a deeper corrective section.

S&P 500 Index (SPX)

The S&P 500 Index hit a excessive of two,872.87 4 weeks in the past. That excessive was adopted by a waterfall decline into assist of two,532.69 reached two weeks in the past. Support was seen proper on the 200-day shifting common (purple line) and the 61.eight% Fibonacci retracement degree. It’s not stunning that worth was rejected with conviction from the 200 line as that may be a vital shifting common, and the primary time it’s approached shortly, it should incessantly reverse or not less than maintain a decline. November 2016 was the final time the 200-day shifting common was approached as assist. Subsequently, the index rallied as a lot as eight.7% as of final week’s excessive of two,754.42.

The SPX has been up six days in a row and is now due for a pullback. RSI hit oversold on the low and has since turned up, which is bullish. Watch the character of the pullback off final week’s 2,754.42 excessive together with the accompanying volatility for indicators of what’s to return subsequent. The key assist from two weeks in the past is understood. A drop beneath there's bearish. Otherwise, the possibility for a continuation of the long-term uptrend stays.

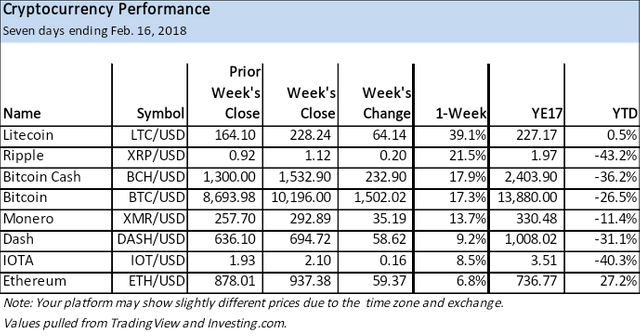

Cryptocurrencies: Strong efficiency throughout the board

Large capitalization cryptocurrencies continued to advance off their lows from two weeks in the past. A constructive for the sector as a complete was the launch of Coinbase Commerce final week, which can make it simpler to pay retailers in cryptocurrency, together with Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

Litecoin led the way in which for the cryptos rising $64.14 or 39.1% to finish at $228.24. A few developments appear to be driving the advance, together with a deliberate fork of Litecoin Cash and the announcement that LitePay, a service provider cost processing software for cryptocurrency will launch on February 26.

XRP, the cryptocurrency from Ripple was the second-best performer final week, rising $zero.20 or 21.5% to finish at $1.12. There have been constructive experiences from the Middle East and elsewhere with Western Union confirming they're testing Ripple expertise together with the Saudi Arabian Monetary Authority.

Next in line was Bitcoin Cash and Bitcoin, rising 17.9% and 17.three%, respectively. Bitcoin Cash superior $232.90 to finish the week at $1,532.90, whereas Bitcoin ended at $10,196, up $1,502.02.

The weaker performers included Ethereum, up solely $59.37 or 6.eight% to shut at $937.38, and IOTA, rising $zero.16 or eight.5% to finish at $2.10.

Ripple (XRP/USD): Breakout of bullish descending wedge

Ripple broke out of a bullish descending wedge sample seven days in the past. The preliminary breakthrough rally took the crypto as much as $1.23 earlier than resistance took maintain. At that time, it was up over 118% from the $zero.562 low reached two weeks in the past. That low nearly accomplished an 88.6% Fibonacci retracement of the earlier rally, and put the XRP/USD pair 82.6% beneath its file excessive of $three.35 hit in early-January. Following the preliminary spike excessive to $1.23 Ripple pulled again to check assist of the downtrend line earlier than shifting again up. The pullback can higher be seen within the intraday charts reasonably than the each day. This is a traditional bullish development of worth, the place a breakout happens, adopted by an advance after which a pullback to check prior resistance as assist earlier than the advance continues.

All of the above objects present a great foundation to conclude that the low has doubtless been reached for Ripple and that the dominant bias going ahead within the coming weeks or months is to the upside. Given that, weak spot is finest watched for alternatives to enter at decrease costs both for funding or buying and selling functions. Watch the downtrend line for indicators of assist throughout pullbacks, at a most.

IOTA (IOT/USD): Another bullish wedge breakout, however rather less distinct

There can be a bullish descending wedge breakout that has occurred in IOTA, as of 5 days in the past. This wedge is just not fairly as clear and distinct because the wedge in Ripple because it’s contained inside a bigger declining pattern, however it's there nonetheless. The IOTA/USD pair discovered a backside at $1.20 two weeks in the past and has risen over 84% as of Saturday’s $2.212 excessive. It subsequent has to deal with potential resistance round its downtrend line, which falls from the December record high of $5.80. At the low two weeks in the past the coin had fallen as a lot as 79% off the excessive.

Given the diploma of the current retracement, together with the response off the low, it seems like a low has been decided for IOTA. Further, the 14-day RSI is rising after touching the oversold border.

The market information is offered by the HitBTC change; the charts for the evaluation are offered by TradingView.

To learn extra from Cointelegraph follow this link.

Great one

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Coins mentioned in post:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit