Stocks moved toward a record on Wednesday, with the S&P 500 posting a little addition yet missing the mark regarding that new high after a Federal Reserve official communicated worries about expansion, proposing that national bank authorities were ready to pull back on help at the economy whenever cost acquires keep on holding up.

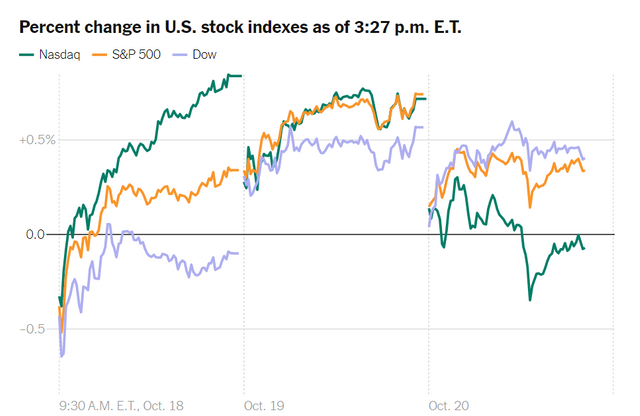

The S&P 500 rose around 0.3 percent in early-evening time exchanging, after prior moving over its Sept. 2 shutting record of 4,536.95. The record has energized in excess of 5% in under three weeks, recovering its misfortunes from September, which was the financial exchange's most exceedingly terrible month in the current year.

Wednesday's convention was tempered fairly after a Federal Reserve lead representative, Randal K. Quarles, said that his consideration was moving to too-high swelling — with cost builds running above and beyond the Fed's objective of 2% — and that the national bank's arrangement setting Federal Open Market Committee would be ready to respond on the off chance that it remains as such.

"On the off chance that swelling stays more than reasonably over 2%, be guaranteed that the F.O.M.C. has the structure and the instruments to address it," Mr. Quarles said in comments ready for conveyance at the 2021 Milken Institute Global Conference.

Mr. Quarles' remarks repeated those of one more Fed lead representative, Christopher Waller, who said on Tuesday that "if month to month prints of expansion keep on running high through the rest of this current year, a more forceful strategy reaction than simply tightening likely could be justified in 2022."

The alert comes as the Fed plans to start paring its huge scope security buys — a cycle generally called tightening — and as authorities begin to discuss when and how rapidly they should raise financing costs from close to nothing.

The two arrangements have assisted with continuing to get costs low and request solid, and financial backers are intently looking for signs that the national bank might hurry its arrangements to pull back on the help.

All things considered, even the generally little increment on Wednesday was the S&P 500's 6th sequential addition, a run that mirrors the abrupt change in feeling in the securities exchange. Stocks had tumbled in September as financial backers stressed that exorbitant costs and easing back monetary development would make for a poisonous blend for organizations — with some on Wall Street raising the possibility of 1970s-style stagflation as a worry.

The latest series of gains has matched with the beginning of profit announcing season, as various high-profile organizations turned in outcomes for the three months finishing off with September that beat assumptions