This is a bit against my general coding review norm, but I happened to be investigating the performances of different forks over time and decided I might as well share this data. The concept started from the question of why do people do forks?

Recently we have seen a lot of forks coming into the market, first only Bitcoin (BCC), then Ethereum (ETC), now we already have forks of forks (LTC -> LTC Cash, BCH -> eBCH), so why are we seeing more and more forks? At the core of it, I want to say it is because people believe that they can do something technologically speaking better and that is why they decide to do the fork, but I can’t help but feel the rampant increase in forks have a financial goal in mind.

So how have all of these forks been performing?

At the very top let’s start with Bitcoin Cash

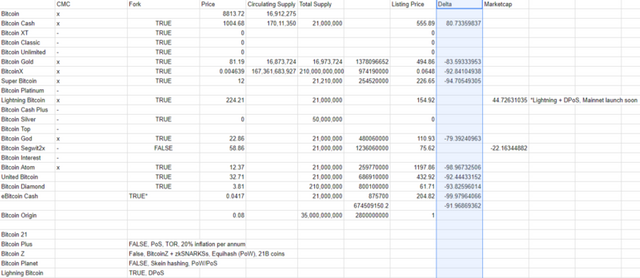

BCH listed at $555.89 and is currently trading at $1,005.68, that’s an increase of 80.73%. Given their marketing budget, this is to be expected, more money has gone into marketing than has development, so the price increase looks good. And that means we are off to a good start.

Next we had Bitcoin XT, followed by Bitcoin Classic, followed by Bitcoin Unlimited, all unlisted failures of a project. So not much to report here.

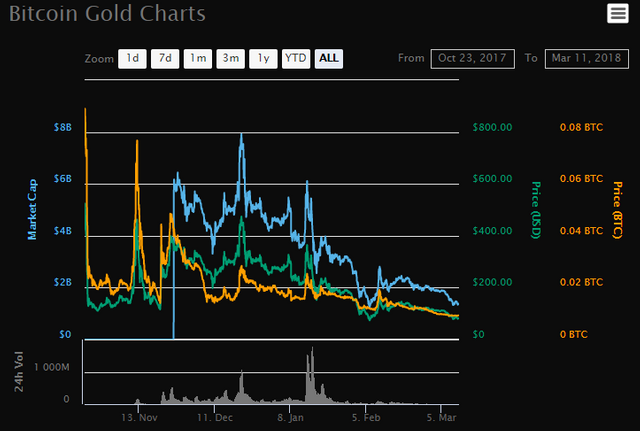

Next we look at Bitcoin Gold

BTG listed at $494.86 and is currently trading at $81.19, that’s a 83.59% loss in value. There was an interesting spike in November and December (which was the crypto boom we saw across the board, so that was just good timing), but if you remove this anomaly the interesting thing here is that the price has just been doing a clean decline.

BCX listed at $0.0648 (they increased the circulating supply by 10,000) and they are currently trading at $0.004639, that’s a 92.84% loss in value.

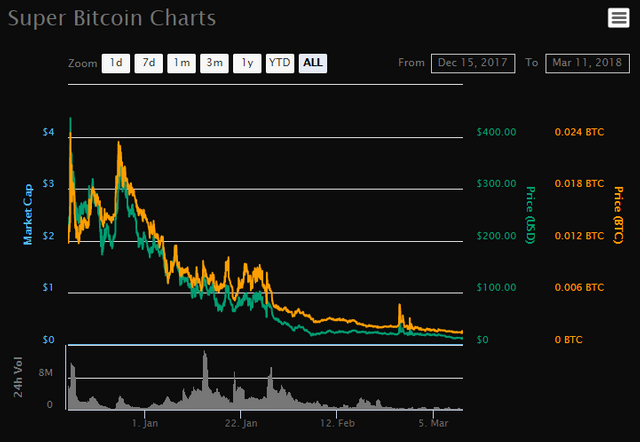

SBTC listed at $226.65 and they are currently trading at $12, that’s a 94.7% loss in value.

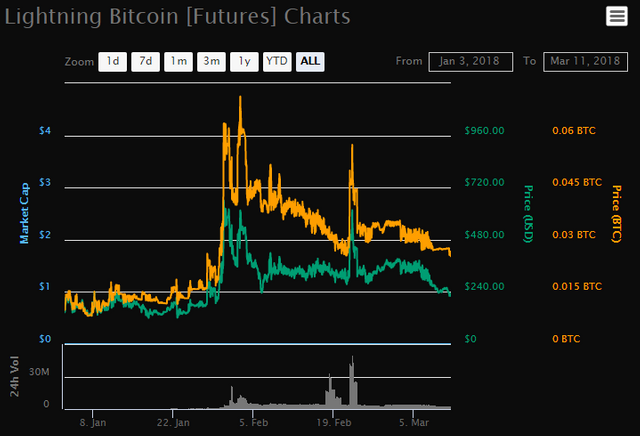

LBTC listed at $154.92 and they are currently trading at $224.21, that’s a 44.72% increase in value. A few interesting factors here though. 1, timing, look at when they launched, right as lightning network launch was expected, how much of this value is actually from the coin? 2, how much is simply the masses being confused by lightning network the tech and lightning bitcoin the crypto? 3, lightning Bitcoin does bring some interesting things to the table, dPoS, smaller block sizes, faster confirmation times, but not much else, I believe this one is a naming mistake, nothing more.

Same thing as above happaned with Bitcoin Segwit2x (although this one is not a fork), listed at $75.62 and currently trading at $58.86, that’s only a loss of 22.16%, but again this is people being confused with the technology Segwit vs the Crypto Segwit.

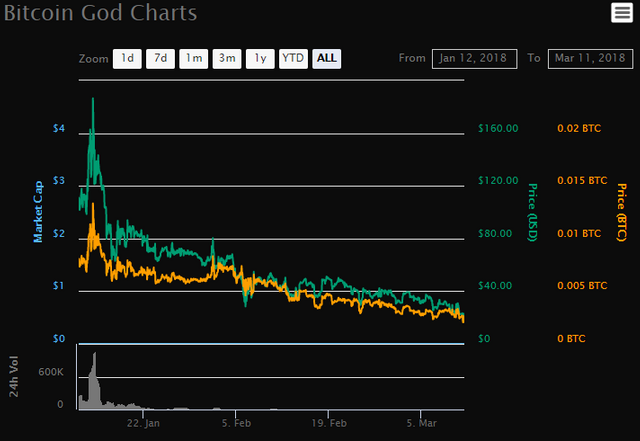

GOD listed at $110.93 and is currently trading at $22.86, that’s a 79.39% loss in value. Again we see that very clean decline in value.

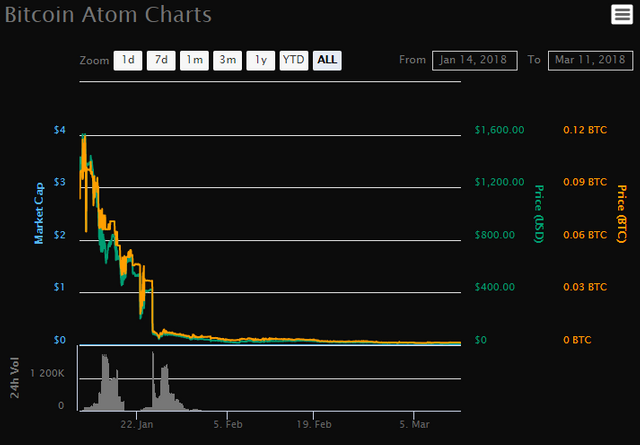

BCA listed at $1,197.86 and is currently trading at $12.37, that’s a 98.96% loss in value.

UBTC listed at $432.92 and is currently trading at $32.71, that’s a 92.44% loss in value.

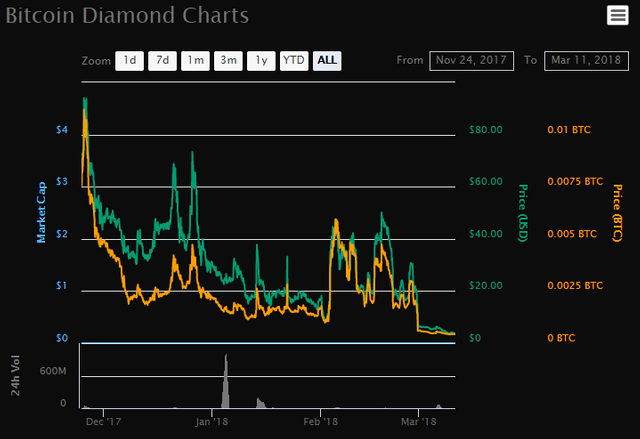

BCD listed at $61.71 and is currently trading at $3.81, that’s a 93.82% loss in value.

The average delta in loss is 91.96% of value lost since listing. I think this data largely speaks for itself

Which makes we wonder, why are people doing forks? The pattern is rather straight forward, if you give coins to people for free, they will sell it, because they have zero incentive to keep it. Same with airdrops, what happens after every big airdrop? The price dumps. People that didn’t have any reprecusion for their action won’t care about the value. And yet, we are still doing airdrops and we are still doing forks, even when the data clearly speaks for itself.

And if you think about it, this makes sense, we hold onto tokens we bought, because we have value connected to them, in fact, sometimes, we become finatical about the tokens (just go join some telegram groups…)

It’s the same concept when we think about it in mining, PoW has a cost and that’s why people don’t try to cheat the system, PoS (Casper specifically) will have the slasher protocol and that’s why there is risk in trying to cheat, but if there was no risk, then why not? This is why forks and airdrops simply diminish value.

Some companies have tried to do a different spin on this, Aion with their lock in airdrops for example, Mainframe with their community token creation and proof of caring, and these might work better, but the norm for now which is snapshot -> airdrop, or snapshot -> fork, these will continue to diminish in value.

Which makes we wonder about marketcap. A good example is Bitcoin Gold, it is currently sitting on a market cap of $1,361,085,166 USD. So this would mean if we were to sell every token right now for their current price value we would get that amount of money, but that simply isn’t true, are the order books thick enough to withstand a sell off of that magnitude? No, they aren’t, the price would quickly plummet to a fraction of cents as soon as the first big holder dumped. And then we aren’t event talking yet about all of the lost BTC we have in forgotten wallets. Or what about the 100k BTC in the Mt. Gox wallet, that same amount was forked as well into Bitcoin Gold, Super Bitcoin, Bitcoin Diamon, and every other fork that has followed. Essentially the liquidated Mt. Gox could destroy every single Bitcoin fork out there because there simply would not be enough volume (liquidity) to support the sell off.

So forks are a bad way of making money, and an even worse investment. Marketcap is vastly inaccurate for forks because the volume is not established (unlike say Bitcoin that actually had its volume established from $1).

Conclusion: We need to find another way to evaluate market cap, and we definitely need to stop participating in forks, but as a user, you get essentially free money, so why not? I feel truly sorry for any upcoming forks in the recent months, unless you bring something very special to the table. Don’t expect to be walking away with any profits.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://elevenews.com/2018/03/11/cryptocurrency-bitcoin-forks-are-they-profitable/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit