I was writing a reply to a comment on @PlanB’s insightful blog Modeling Bitcoin’s Value with Scarcity.

That comment is reproduced below because while contemplating my reply to the comment, I stumbled onto (in my sleep) some mathematical and economic theory secrets about Bitcoin which apparently were unknown to the public until now.

If correct and true these secrets reveal a highly disturbing, dystopian outcome for Bitcoin and the world, with the Bitcoin valuation accelerating instead of slowing down as the immutable 1 MB block size becomes full due to skyrocketing transaction fees.

Most (apparently incorrectly) assume the valuation of Bitcoin will be negatively impacted by skyrocketing transaction fees. Note I may have been the first person to ever raise the spiraling transaction fees issue (c.f. also, also and also).

@Hamoun Ghanbari wrote:

(ii) also thinking in terms of ‘efficient markets’, if the home market knows about this law shouldn’t the price just jump right now instead of gradually waiting for the SF to increase?

Apparently not. I’m tentatively qualitatively (with some quantitative support) modeling the lag with a differential equations conceptualization, but see also the transaction fees ramifications in following model development.

“Unforgeable Costliness”

(i) you mentioned “unforgeable costliness”. Another conclusion from your article seems to be that proof-of-work (with gradual increase in SF) is essential to the economic value of bitcoin and adoption. since POW makes marginal cost of creating a coin equal to it’s market value.

I’m wondering about the implications of this for pre-mined coins or coins with proof-of-stake.

“Unforgeable costliness” was explained by Nick Szabo as necessary for “bit gold” before Bitcoin was even announced! As you may know that Szabo’s “bit gold” proposal predicted many of the properties of Bitcoin.

Szabo seems to think it’s the improbability of being able to replicate the cost that imparts the public confidence consensus in the money, i.e. that others will accept it as a transfer of utility in the double coincidence of wants.

Using the data for the annual BTC mined and the price history I researched, I roughly estimate the weighted cumulative mined value:

(2625000 × $000.0015) +

(2625000 × $000.10) +

(2625000 × $003) +

(2625000 × $007) +

(1312500 × $100) +

(1312500 × $500) +

(1312500 × $300) +

(1312500 × $500) +

(656250 × $1000) +

(656250 × $5000) +

(656250 × $5000) ≈ $9 billion

That’s less than a 10th of the modeled and actual market capitalization. That does provide a substantive value compared to the float, which is much smaller than the market cap.

“Unforgeable Costliness” in the S/F Model

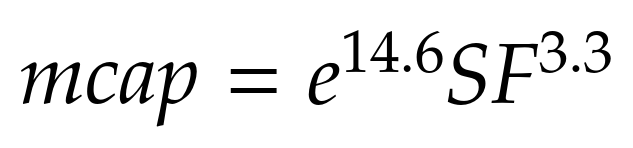

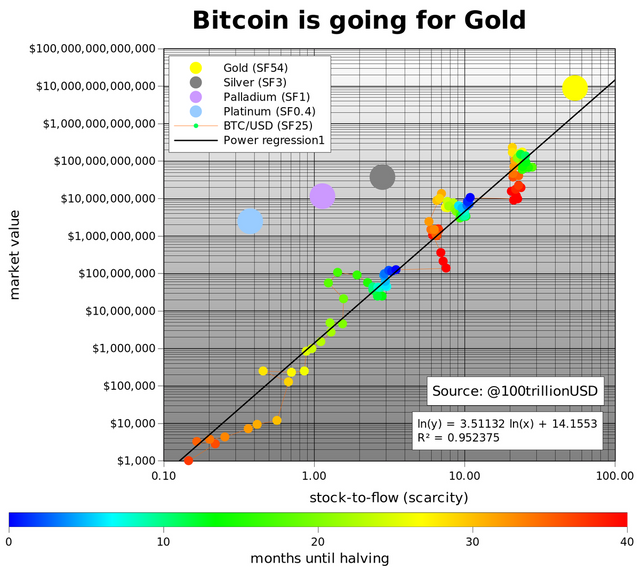

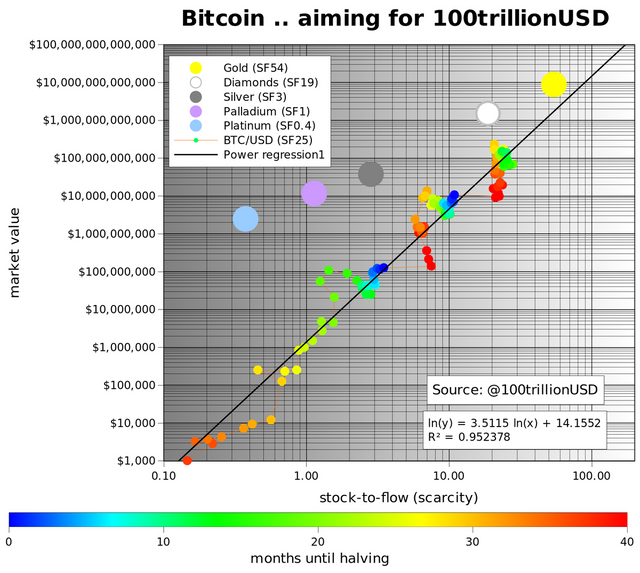

@PlanB’s stock-to-flows (S/F) model stocks market capitalization valuation equation is driven solely by the opportunity cost to produce (aka mine) new units of the monetary resource — otherwise the resource is not monetary. The S/F model predicts the market capitalization will increase ≈10X for every halving of the annual production of the resource:

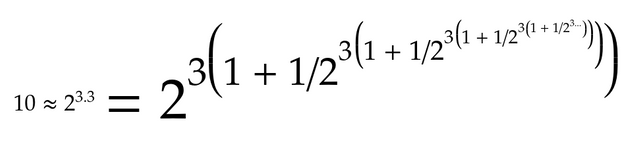

Why 10X increase for only a doubling of the S/F ratio? I visualized this quantitatively on a Matryoshka doll manifold of three fractal, recursive, relativistic dimensions:

The base 3 orthogonal factors of 2 (i.e. 2 × 2 × 2 = 2³) are due to following increases in opportunity cost (i.e. time has a cost):

- Doubling of the cost to produce a proportional unit of the stock.

- Doubling of the time to produce a proportional unit of the stock.

- Doubling of the time to debase the stock.

I posit these combine to produce a commensurate increase in energy consumption every 4 years, depending on whether energy remains a constant proportion of mining costs.

https://digiconomist.net/bitcoin-electricity-consumption

Each factor is an orthogonal dimension because each contributes to valuation. For example, although flow and stock determine both of that latter two factors, each factor independently contributes to valuation. Increased stock is an increased mass and inertia for public confidence, which is separate from the Quantity Theory of Money valuation benefit from decreased rate of debasement.

A “proportional unit of the stock” means for example 1 non-proportional unit in 100 units of stock is equivalent to 2 non-proportional units in 200 units of stock.

The base factors are fractal and infinitely recursive as shown in the above equation, because the factors are increasing over time (acceleration, but with decelerating acceleration) without any change to the rate of the flow. They’re relativistic because they’re relative to the stock, which is mutually relative to the base factors.

The fractal, recursive, relativistic part of the equation above provides the .3 of the exponent. One way of visualizing it is the analogy of walking on an escalator. The speed of walking is supplemented by the speed of the escalator. So thus analogously the flow of mining is changing while the ratio of the flow to the stocks is also changing. These are like relativistic mirrors facing each other, so there’s an infinite recursion of the fractal pattern (aka self-similarity at different scales).

Do gullible readers contemplate whether I might be Satoshi? I hope not. 😨

“Unforgeable Costliness” for Cryptocurrency in the S/F Model

So it’s the friction of the work of the all miners that is required to produce a (non-proportional) unit of the resource which determines the flow and thus the market capitalization.

Remember from Economics 101 that supply and demand curves meet at the price of the marginal (i.e. highest cost) producer.

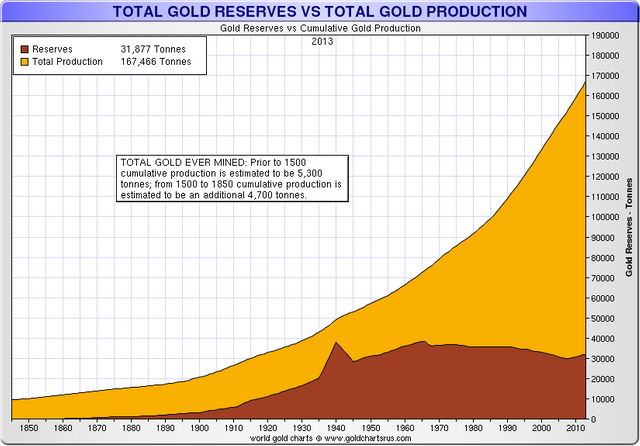

The flow of intangible tokens is dictated by the protocol of decentralized cryptocurrencies, instead of the interaction of the marginal cost of production and valuation of the monetary resource. The marginal cost of production for monetary physical resources (e.g. gold), by definition of being monetary, must evolve slowly with incremental technological innovation:

This work required to mine a (non-proportional) unit of a physical resource is set by factors in nature and laws of physics. Whereas, the work applied to produce a (non-proportional) unit of an intangible, token resource is set by the interaction of the valuation of the intangible monetary resource and the flow dictated by the protocol.

This distinction is diametric:

To rapidly decrease the (supply of) flow of a physical resource, the valuation (and thus price) must decline. But a decrease in the flow increases the S/F valuation. And vice versa. Thus only technological evolution via periodic phase transitions and the interim slow accumulation of mined flow can sustain changes in flow and (inflation-adjusted) valuation.

A rapid, protocol-dictated decrease of the supply of flow of an intangible, token resource reduces the work applied for mining to that of all the miners remaining up to and including marginal (i.e. highest cost) miner.

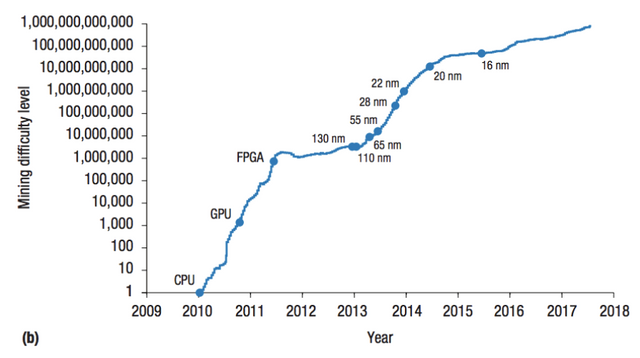

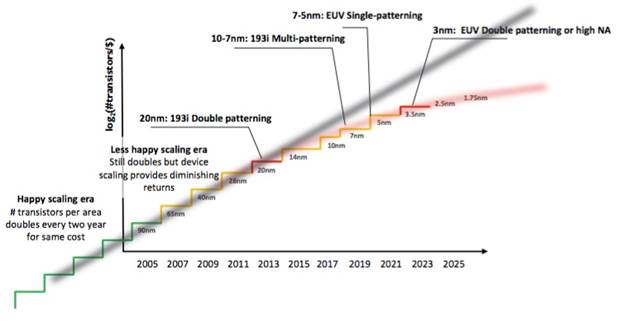

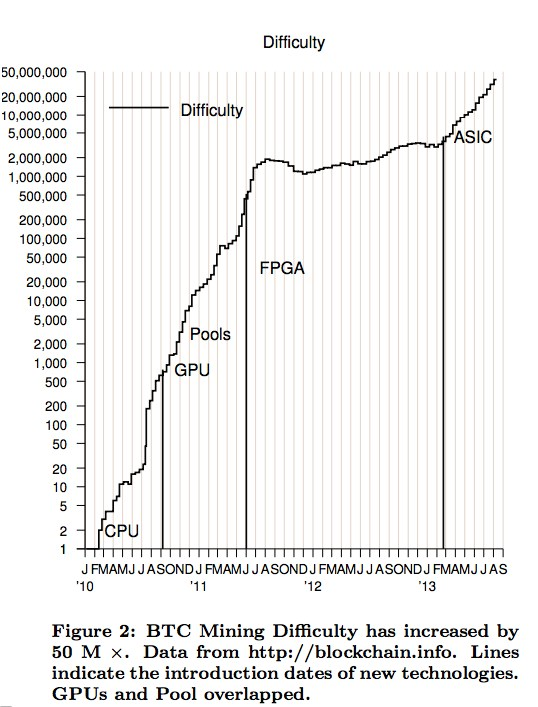

Thus given that all fungible resources are power-law distributed, the hashrate-weighted work costs of the miners are presumably power-law distributed. Thus a protocol-dictated halving of the flow which is the miner’s reward, only causes a negligible fraction of the systemic hashrate to stop mining at the same valuation, i.e. the work applied to mining is nearly inelastic to income greater than or equal to half of the marginal cost of production — also because special purpose ASICs can’t be repurposed. The ≈4 years between halvings allows for two doublings of Moore’s law for the electrical efficiency of the ASIC mining hardware, so that cost of production for most of the systemic hashrate is much lower than the marginal miners.

Thus after the halving the systemic hashrate (but not the work) being applied per (non-proportional) unit of production is nearly double (at the same valuation). The halving of the flow (i.e. a doubling in time cost in two orthogonal dimensions) along with this doubling of cost per minted token causes the valuation to increase by a factor of 10. The increase in valuation restores the profitability of some of the marginal miners which would have been lost by the halving. The key here is that the work applied recovers (as efficiency of mining hardware is improved) at the new level of electrical efficiency after the halving. Since systemic hashrate (or analogously mining difficulty) is a directional proxy for the work that will be consumed, the halving doesn’t cause any reduction in “work” for valuation. This seems to indicate that the S/F valuation of Bitcoin will peak either when Moore’s law for ASICs stops or more likely when Bitcoin soon consumes most of the world’s electricity! Or possibly go to 0 valuation if quantum computers are invented.

Uh oh, some of you may now really be contemplating if I’m Satoshi. 😲

So now we know why cryptocurrency scales so much faster to monetary dominance than the 1000s of years that gold required:

@Philip Barton wrote:

Two pertinent and closely related points emerge from all this:

Gold was accumulated for thousands of years before it was used in the marketplace, which means that,

Gold’s stability of value was formed before it became money.

These points are of the utmost significance to the unveilings of money’s origins. What these overlooked, but indisputable historical facts confirm is that long before its commercial use was understood, Gold was already perceived to be a store of stable value. The primary function of money was formed independent of the exchange of goods. This was the first Eureka moment in the tracking down of money’s origins.

UPDATE 10 Months Later

The analytical explanation for the ratcheting I had alluded to above is in my latest blog Bitcoin’s Pivotal, Religious Moment of Transformative Truth Has Likely Arrived (Tomorrow):

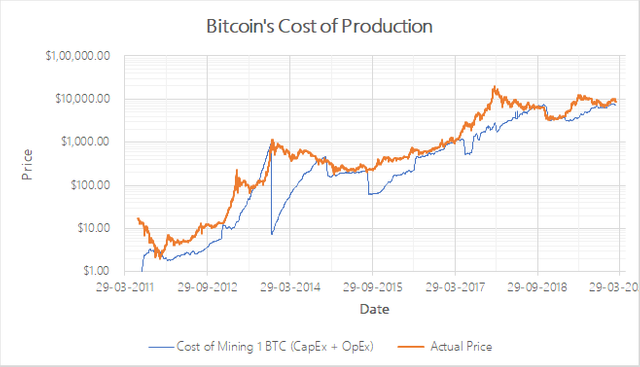

Bitcoin’s Cost of Production — A Model for Bitcoin ValuationEssentially the CoP model predicts that more efficient mining hardware drives up the CoP for the weighted average miner.

Note the metrics and methodology employed to make the chart above are inexact and don’t account for all possibilities for a precipitous decline in the CoP.

I commented on the CoP blog as follows (but note Medium has censored all my posts, lol):

Excellent, but ostensibly the reason your model isn’t predicting the peak highs and also the reason it didn’t predict the current spike low to$4k is because you haven’t factored the CoP of the marginal miner into your analysis, c.f. also section Naive S/F Model Neglects Transaction Fees. Thus you have missed the causal correlation that ratchets the price higher. Your regression fit gives you a predictive fit but doesn’t explain the causative economics. Let me help you on that.

I wrote the following on my recent blog Bitcoin’s Pivotal, Religious Moment of Transformative Truth Has Likely Arrived (Tomorrow) in the section “Filbfilb Citing Possible 61.8% Retracement”:Note according to Economics 101 the price of Bitcoin (where supply and demand curves meet) — would be set by the CoP of the highest cost marginal miner — which would be higher than a price based on the weighted average miner CoP but also subject to more precipitous drops when for example Bitmain S9s are taken offline during a price drop (which I have confirmed is happening in a panic). When the price rose above ~$

8.5kthe S9s became profitable in January, but then the hashrate moved up considerably because of all the S17s and s19s coming out of production. Also recently Whatsminer is ramping up massive production of efficient miners via Samsung’s fab to compete with Bitmain and TMSC. So the price moved up to where any drop in the price would render S9s uneconomic. So then it was a self-feeding spiral in CoP down to$4kwherein the S9s are very much profitable again. If the price can accelerate upwards, the S9s remain profitable. This plunge is the SLINGSHOT to gather the energy for my posited moonshot price rise.Hope you write a second blog and incorporate my suggestion. This is your baby, I prefer for you to get the credit for it. Please just mention I made a suggestion.

UPDATE Elaborated 12 Months Later

Precisely Why Bitcoin Is Re-accelerating:

The phase transition rises in the Bitcoin price are due to phase transition increases in the proof-of-work difficulty level and the effect on Cost of Production (COP). In the past that was due to onboarding more efficient mining technologies. In 2020, the surge in difficulty will be due to massive funding from SegWit booty.

[…]

A comment I’m blocked from publishing on Medium:

@Batman wrote:

There is no consumption of bitcoin supply, and assuming coins are “lost” and believing that’s a “consumption” is naive at best, and extremely ignorant at worst.

Most of the supply has been (intentionally) tainted and will be "stolen" back as miner donations ultimately rendering most tokens verboten (at least for the public-at-large).

The posited orders-of-magnitude increase in the quantity of the block reward will result in a phase transition in the valuation because of the effect of those donations on the acceleration of the difficulty level and then the per unit Cost of Production (COP) model. First the block reward will suddenly increase by orders-of-magnitude raising the difficulty level by an order-of-magnitude (or more) and subsequently the block reward suddenly decreases back to

6.5 BTCper block as all of the supply of tainted Core tokens yet to be "donated" to miners is depleted. This instantaneous reduction will have the analogous effect[1] on valuation as a halving but as if on steroids because the decrease in block reward will be orders-of-magnitude not just half —while the difficulty level will not decrease instantaneously thus radically increasing the COP of the marginal miners. Due to this suddenly decrease in profitability for miners, the production of blocks will slow down consequently delaying the readjustment of the difficulty (which will also increase mempool backlog thus mitigating somewhat the decline in COP via rising transaction fees) until the price rises to some equilibrium with the new radically higher COP. Also other non-linear market effects will instigated from the radical contraction of the supply held by stronger hands with no need to sell quickly.[2][1] The COP per unit sets the opportunity cost for the buying demand for a unit of the asset —why mine if can be obtained for lower cost on the open market. For Bitcoin the COP per unit for the marginal miners adjusts to the value on the open market.

Buying demand (and thus market price) doesn't decrease when the block reward is halvedandBitcoin ASICs are a special purpose sunk cost that can’t be repurposedso COP per unit increases which instigates non-linear effects of markets, e.g. marginal miner versus lowest-cost miner COP, flow of new supply to the market, FOMO greed psychology and increased COP opportunity cost raises the market price which raises the COP which raises market price…terminating at possibly some phase transition level higher equilibrium. The plausibility and sustainability of the phase transitions (as opposed to Tulip bubbles and altcoin pump & dumps) require that other facets (e.g. the properties of money) of the asset are amenable and ripened for market acceptance.[2] They may need to sell before those "stolen" tokens become verboten which would plausibly explain any future correction in the price after the phase transition equilibrium has been firmly established. That is unless they whitelist themselves from the verboten effect in a two-tiered global monetary reset, because they don't intend to trade with the public-at-large.

The Scalar Factor of the S/F Model

Note the model I described above explains the SF³.³ exponent in @PlanB’s S/F model, but it doesn’t explain why the scalar factor e¹⁴.⁶ so that Bitcoin is aligning with gold’s and silver’s valuations at the same S/F ratios.

Cryptocurrency has a difficulty adjustment which maintains a protocol-dictated flow regardless of the work applied. Thus for cryptocurrency the scalar factor is determined by the inertia of the history of the work being applied. I posit that this inertia is a public confidence, self-fulfilling driven phenomenon.

The total work applied to mining a cryptocurrency can be precisely and objectively estimated ex post facto by summing all the zeros in the proofs-of-work of all mined blocks, because these comprise a history of the mining difficulty and systemic hashrate that was applied.

Other than if there’s some additional ramifications (which don’t meet Szabo’s criteria) in the mining subsequent to the premine, I contemplate that the main issues with a large premine are:

The lower levels of work inertia both in terms of less duration of history and lower starting point for future halvings.

The centralization of risk of dumping that can bloat the float concomitant, which presumably would weigh on the confidence and thus on the valuation as a reliable store-of-value which is correlated with the level of applied mining work.

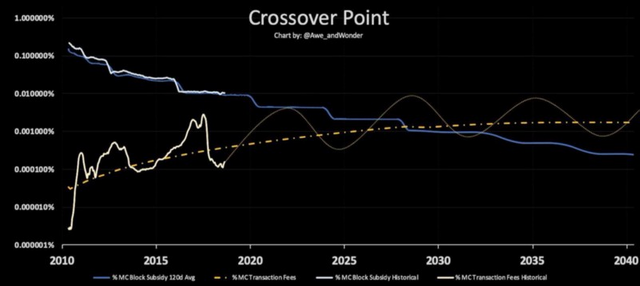

Naive S/F Model Neglects Transaction Fees

The mined value is not the same as the mined cost, both because of transaction fees in the block subsidy and because only the marginal miners have a cost which is near to the price. The latter can be ignored (except for its interaction with the former) for the reasons I provided when I described the model — the effect of the marginal miners is essential to, integral with, and won’t alter the trajectory of, the S/F model applied to cryptocurrency.

However the former if not incorporated into the model could potentially cause the a divergence from an otherwise naive projection of the S/F model. The transaction fees rewarded to the miners must be subtracted from the hashrate-weighted average miners’ presumably power-law distributed production costs. Miners can thus increase their hashrate (and applied work) proportional to the implied ratio. Thus the applied work and valuation should increase compared to @PlanB’s naive S/F model. The result should be an acceleration of the Bitcoin price compared to @PlanB’s naive S/F model. IOW, the amount of work required to mine a token increases by the aforementioned implied ratio of the transaction fee subsidy.

Thus the spiking of transaction fees may explain valuation spikes.

The transaction fees for gold and silver are not conveyed to miners. For physical resources, we might view transaction fees (including the bid/ask spread) as necessary for sustaining the ecosystem and thus being part of the “unforgeable costliness”.

One might attempt to reason that if the wealthy, who will be able to afford to transact on Satoshi’s immutable 1 MB blocksize (Bitco[i]n Core and SegWit are altcoins, c.f. also my blogs), are also the miners then the transaction fees are paid to themselves when they transact and thus are not recouped from cost of mining. However miners can’t only mine at the instant they want to transact unless they have huge percentage of the network hashrate, in which case they wouldn’t likely be the marginal miners.

Projecting Bitcoin’s Transaction Fees

The left axis on the chart below is daily (144 blocks per day) subsidy:

Note the orange projection of the future transaction fees might be modeled too low. However, unlike the BTC price, the lows are not progressing significantly higher (which might be due to the previously very high minimum fee cited below). Perhaps either this is indicative that lulls in the transaction demand will persist, or that as BTC transistions from a purely speculation driven, high pricing volatility asset to a lower volatility international settlement asset in a two-tiered monetary system, then the lows will increase and/or the highs will decrease. The highs are ostensibly increasing non-linearly up to now and again I posit the possibility that the plotted regression fit is too low for the analogous reasoning that the regression fits of the price have been, but…

It seems impossible to reliably project any trend from the history of transaction fees thus far because there was a recommended minimum fee before 2016, some pools enforced small block sizes (c.f. also) before 2015, and 1 MB blocks weren’t even full until the peak 2017.

The best data point in the transaction fee history thus far seems to be a comparison of the peaks in 2013 and 2017. Roughly there’s a doubling of fees to 0.0036 BTCper KB and the consumed block size increased from less than 200 KB to approximately 1000 KB. So that’s ≈10X increase, which seems to correlate with the S/F valuation model but we don’t have enough reliable history to gain confidence in the correlation.

I intuitively want to disregard the ≈10X compounding increase scenario for transaction fees as it seems ludicrous and the ramifications would be catastrophic. But I can’t because actually it seems like what should happen if the S/F valuation model is correct. However, the uber wealthy transact exponentially less, so perhaps as most of humanity is kicked off-chain by rising transactions fees (and the previously posited “SegWit donations” restoration), the uber wealthy will spend a much lower percentage for transaction fees (which seems to make sense). But this wouldn’t stop the transaction fees as priced in dollars from rising to extreme levels.

Bitcoin Maximalism?

My intuition is that the quantitative stocks-to-flows model is qualitatively indicative of the public confidence that the token supply won’t be debased and in the “unforgeable costliness” being sui generis. Otherwise there’s no value if there can be competing variants of the same store-of-value market capitalization in the stocks-to-flows model. The aforementioned Scalar Factor distinguishes the sui generis from the copy coins.

However, it’s quite unsettling to contemplate an unrelenting rise in the Bitcoin market capitalization and what this might mean for the world’s well being.

And it’s the Schelling point of the immutable 1 MB blocksize which gives Bitcoin the sui generis throne. There can be no other altcoin which will ever have the same duration of history of being immutable. And obviously immutability is crucial to the confidence of avoiding debasement.

The next closest is Litecoin, but it was launched 2.75 years after Bitcoin and so it can only achieve a “silver” to Bitcoin’s “gold” stock-to-flows valuation.

I wrote:

LTC’s current S/F of

11.29and≈25for BTC computes to a relative market capitalization of(11.29^3.3) ÷ (25^3.3) ≈ 0.0725in the S/F model. But there are 61,892,225 LTC versus 17,713,300 BTC tokens in circulation. Thus the S/F modeled LTC/BTC price ratio is currently0.0725 × 17713300 ÷ 61892225 ≈ 0.021. This is asymptotically approaching the modeled ratio0.025.

Litcoin achieved the 0.021 BTC price recently.

Charlie Lee set the parameters of Litecoin such that the stock-to-flows ratio will always be less than half of Bitcoin (thus the market capitalization less than one-tenth and given 4X greater supply thus 0.025 token price). Did someone who designed Bitcoin advise Charlie? How did he know or did he just make a lucky guess? Perhaps if a higher the stock-to-flows ratio had been targeted (i.e. with a faster rate of halving), Litecoin would either have failed due to insufficient security (perhaps due to insufficient confidence in the security, thus collapsing price that pays for the security) or its price would presumably have deviated lower (i.e. a lower Scalar Factor) than the model price due to perceived insufficient security.

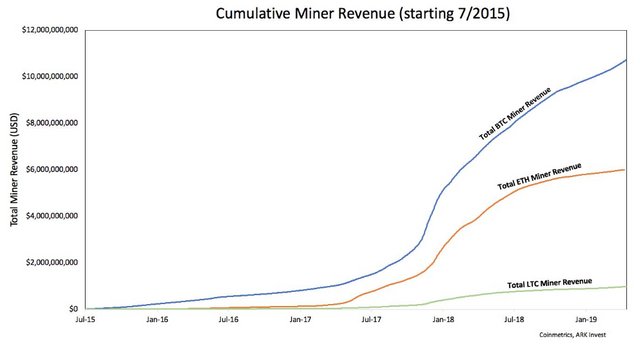

Perhaps the only plausible way to finance a higher stocks-to-flows ratio earlier is to have much greater transaction volume. At the peak at the end of 2017, the relative market capitalizations of Ethereum, Litecoin and Monero were roughly proportional to their respective daily transaction fee volume. Ethereum had a huge gain due to constrained block size given the ICO mania mostly consisting of ERC-20 token smart contracts. Note though that live by the sword, die by the sword, and these transaction volume peaks are more volatile. So priced weighted by volatility then Bitcoin maintained its sui generis lead.

Monero (XMR) was launched 5.25 years after Bitcoin with an accelerated halving schedule. On the peak Jan 2018 the market cap nearly attained $8 billion, while the S/F ratio of 13.3 had the modeled market cap of $11 billion. Note Monero has a use case with a significant transaction volume and significant fees to diminish spamming the anonymity mixsets.

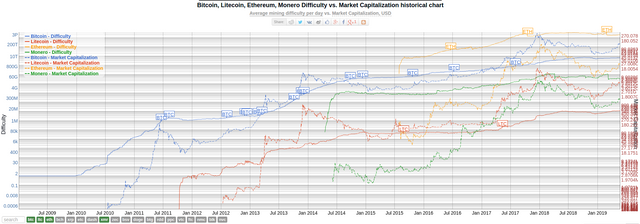

On the following chart only BTC and LTC have a market capitalization that exceeds the mining difficulty. The difficulty displayed is presumably normalized to the presumed relative median electrical efficiency compared to Bitcoin.

So the only possible explanations I can think of for Ethereum (ETH) and XMR are:

Both ETH and XMR have inexorable debasement and not a limit on the number of tokens that will be minted with mining.

If there’s a secret miner who has a much higher efficiency than presumed (thus the difficulty should be displayed much lower). This is plausible given they were designed to be ASIC-resistant.

If the relative duration of accumulated history matters to the Scalar Factor.

If botnets are mining which expend energy but at no cost to the beneficiary, analogous to proof-of-stake having “nothing at stake”.

If Ethereum and Monero are perceived to be centralized, because for example Vitalik forked to remove the DAO attacker, the decision on when the halve the block reward is centralized, and Monero has centralized minimum transaction fee decision to control the adaptive block size algorithm.

XMR has no halvings. ETH has only irregular reductions in block reward at Vitalik’s discretion.

So intuitively for cryptocurrencies, I presume it’s a race to establish a significant Scalar Factor before Bitcoin’s transaction fees Scalepocalypse sends the BTC price to the moon even faster than ≈10X every 4 years. So presumably being first matters.

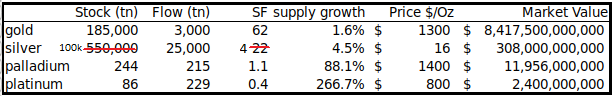

@realr0ach wrote:

This dumb “stock to flow” poster guy Anonymint & Infofront are citing looks like he’s lying about silver and gold to try and make Bitcoin look better. There’s more like 100,000 tons of silver around, NOT 500,000 as he claims. So silver stock to flow is more like 4 instead of 22. Although I didn’t check his “flow” number, so even that might be off too. His gold stock number is also WAY too high. In other words, probably everything in that picture is incorrect.

It’s also not even really possible to have valid flow figures in the first place for numerous reasons I won’t go into. Do you include the ETFs whose only reason for existing is to suppress price? For all intents and purposes, someone trading a paper receipt of ownership for silver around is the same thing as physical flow. The only purpose of the flow metric is to signify transfer of ownership, and that’s what’s occuring (doesn’t matter if the ETF vaults are empty or gold plated tungsten). He probably leaves all of that out solely to try and make Bitcoin look better.

If I am correct in my intuition about the valuation of the stocks-to-flows modeling public confidence, then the arguments about the tinfoil-dunce-cap conspiracies about gold and silver are irrelevant, since the public confidence is presumably based on the “official” data. Presumably if the public believed (or understood the relevance of) the stock-to-flows ratio for silver is 4, then the silver price would be much lower than it is.

Remember money is what ever public confidence believes money is. That is why exponentially increasing hyperinflation can only result when the government can’t even sell its own bonds (c.f. also and also), as it’s indicative that the public has lost all confidence in the government and its currency. For example, QE can never be said HYPERinflation without loss of public confidence in the government. As long as majority of the public is willing to boil like frogs in the pot of fiat malfeasance, then public confidence continues and no hyperinflation results. Saifedean Ammous, Bitcoin economist and author of seminal book, “The Bitcoin Standard” which was the inspiration for the S/F model which we are discussing, has this hyperinflation concept correct, except he thinks hyperinflation (when it occurs) is triggered by an initial burst of inflation. Correlation is not proof of a causal relationship, he should study Armstrong’s blogs which I have linked in this paragraph.

Also how does @realr0ach explain the fact that (regardless of the correlation to gold and silver) the model has backtested the BTC price since inception with the stated high-level of statistical correlation?

As for claimed manipulation which purportedly causes flows to be lower than would be otherwise, that’s all just part of the ecosystem and the stock-to-flows model valuation applies. Also seems @realr0ach may not understand the definition of flows that applies in the model. It’s not transaction flow but rather the annual debasement (i.e. mining production) of the total supply.

EDIT: @PlanB updated his chart with the corrected S/F ratio for silver:

And then he updated it again including diamonds and thinks he sees a trend with Bitcoin headed to $100+ trillion to fill in the gap on the “S/F periodic table”:

So want to upvote but have to wait till I have full voting power. Will upvote at that time. Great breakdown. Thanks.

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very interesting :)

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Can you take a look at much newer solutions: snowblossom (proof of iops of storage with large snow fields &nyzo (proof of diversity) both written from scratch in JAVA, both are working now:

quick intro of the 2 projects online:

Snowblossom https://fx-c.com/cryptocurrencies-that-will-change-the-world/#Snowblossom_SNOW

nyzo https://fx-c.com/cryptocurrencies-that-will-change-the-world/#NYZO

I think they may solve some of the problems, but they are too new tho, newer than most other projects. and almost no one is talking about them now.

I hope you can join their discord to talk with the developers of above projects. They are active on discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

more info about nyzo and snow: https://medium.com/@flashygordy/teamtalks-19-nyzo-aa4a24748aa2 https://medium.com/@flashygordy/teamtalks-24-snowblossom-39aca646815f https://medium.com/@nyzoco/the-nyzo-mesh-time-and-diversity-as-a-currency-85c676631516 Note: None of these were written by the coins developers or team members nyzo developer is anon

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm unclear as to why this is dystopian (unless transaction fees skyrocket to compensate for the successive loss of block reward every 4 years). If bitcoin value skyrockets, wouldn't the transaction fees compensate? I would see a problem if bitcoin value fell which would knock out many miners, then the nonce difficulty could fall every couple of weeks until the network became potentially insecure, forking into infinity.

Addendum: After having read the first link on S/F, it looks like bitcoin will have an S/F ratio somewhere in the same neighborhood as Gold which is at 62. Bitcoin will be at about 50 (?) after the halving of 2020 and by extension about 100 in 2024.

Further addendum: having followed out several of the links, it's becoming clearer. Wondering now if trustless onchain will be for the truly wealthy and the rest of us will be chased off chain. Has anybody studied the pendulum like flow between Austrian and Keynesian models? Seems like 2008 sparked a move back toward the former which hasn't completed yet.

Interesting quote from your medium article...

and this...

This seems to be happening now around the edges of the system. The ossification of the protocol is making updates increasingly difficult (necessary fungibility changes and privacy enhancements are becoming an emergency) and eventually too difficult to adapt to changing circumstances. Authority was always better at such decision making. I think you once mentioned that you thought you had solved this centralization problem if I remember correctly. Have you implemented this yet?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Too lazy to read all this, but it looks pretty cool.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @anonymint! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I wrote on to Jason Hommel on Quora:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit